125. This Week's Economy Ep. 4: TRUTH On Inflation, Real Wages, Housing Market, TX Senate Budget, & CBDC

In "This Week's Economy" Ep. 4, I talk about new CPI inflation report, slowing housing market, Texas Senate Budget & tax relief efforts, school choice, & threats of central bank digital currency.

Hello Friends,

Thank you for listening to the fourth episode of "This Week's Economy,” where I briefly share my insights every Friday morning on key economic and policy news at the U.S. and state levels.

Today, I cover:

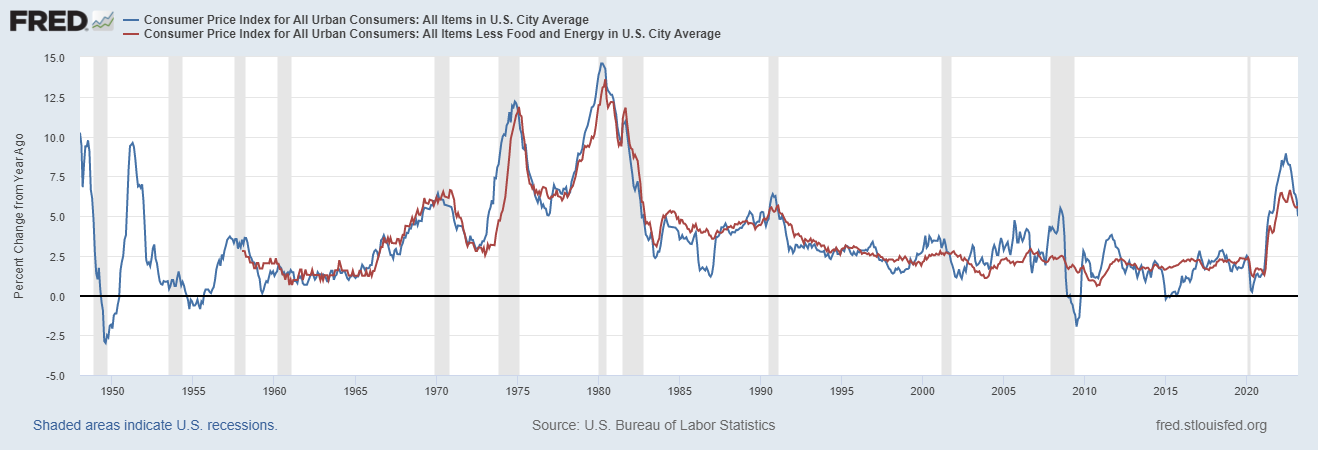

CPI Inflation Report: The Bureau of Labor Statistics recently released its report for the consumer price index (CPI) measure of inflation. The headline is up 5% year-over-year, and core (excluding food and energy) is up 5.6% y/y—both are the highest in 32 years. I cut through the noise to let you know what it means to you and for the housing market, which is slowing across the country and in Texas.

State Actions: The Texas Senate recently released its budget for the upcoming 2024-25 budget, which appropriates too much and provides too little in property tax relief. Find out the details in my policy brief on what’s in the budget and how it could be improved. I also discuss how states nationwide are passing school choice, so it’s important that states like Texas and Louisiana don’t fall behind in education. But more importantly, they should empower parents to do what’s best for their kids’ education.

CBDC + U.S. Dollar Reserve Status: I was recently on the Wake Up America Show with Austin Peterson (watch my interview at 33:35 at YouTube link below) to discuss the failures of a central bank digital currency and the influence this could have on our lives. I also talk about how global factors are influencing the U.S. dollar’s global reserve status and what this means for us (good article by Peter Earle at AIER here).

You can watch this episode on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor (please share, subscribe, like, and leave a 5-star rating).

For show notes, thoughtful economic insights, media interviews, speeches, blog posts, research, and more at my website.