234. Beat Debt & Inflation Crises With Rules: Government Is The Problem

Join economist Dr. John B. Taylor and me in LPP ep. 88, as we discuss the economic situation, performance of monetary and fiscal policies, importance of policy rules, and lessons in economic freedom.

Hello Friends!

On today’s Let People Prosper episode 88, I am joined by economist Dr. John B. Taylor, the George P. Shultz Senior Fellow in Economics at the Hoover Institution, and the Mary and Robert Raymond Professor of Economics at Stanford University.

Watch the full episode below (shorts under paywall):

We discuss:

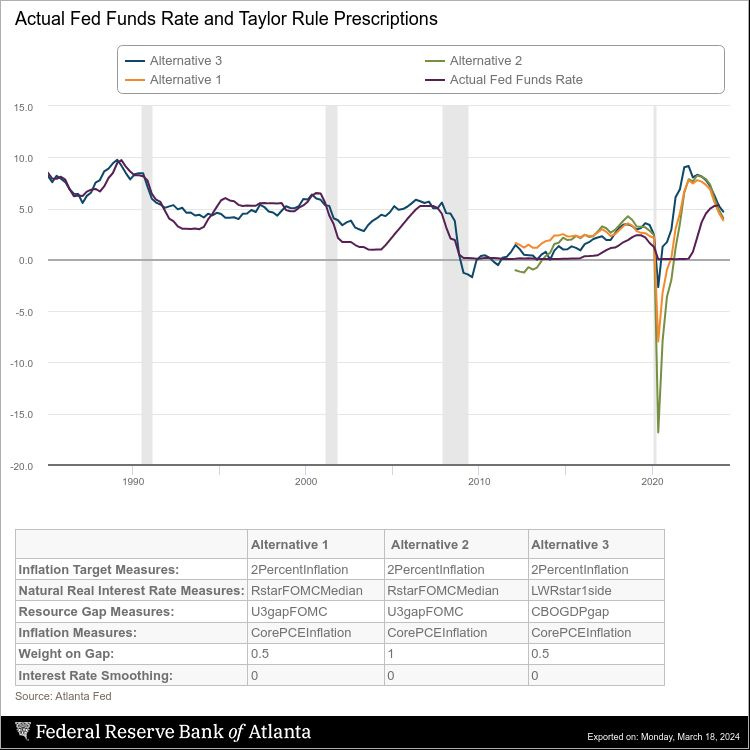

Legacy of the Taylor rule in monetary economics, including how it had its 30th anniversary last year. Here’s what the Atlanta Fed’s Taylor Rule Utility shows should be the Fed’s current federal funds interest rate target (currently 5.25-5.5%):

Importance of economic freedom, especially reducing regulations…don’t miss his book: Choose Economic Freedom: Enduring Policy Lessons from the 1970s and 1980s.

Need for fiscal restraint to solve the debt crisis, read his latest testimony before the U.S. House Committee on the Budget.

Want all the insights? Become a paid subscriber or give it as a gift to someone for just $50 per year to see bonus content in each newsletter!

Don’t have time yet to hear the full episode? Check out these short clips below!

Conclusion from Dr. Taylor’s recent testimony:

“I believe that there are many good fiscal packages that are consistent with these three general principles, and would put the U.S. economy on the road to an improved fiscal state and thereby faster and more inclusive economic growth. I conclude with one fiscal package that is an example of what is needed. It would consist of the following:

A commitment, passed into law, to keep income tax rates were they are now, effectively making current income tax rates permanent. This would be a significant stimulus to the economy and to the financial markets because tax rate increases are now expected on small business income, capital gains income, and dividend income. Committing to keep marginal tax rates from increasing will boost the economy right now. This commitment on tax rates could be reinforced with a pledge not to alter current international trade agreements, which would give additional stimulus to the economy.

Responsible government spending plans that meet reasonable long-term objectives, put the U.S. economy on a credible path to budget balance, and are expedited to the degree possible without causing waste and inefficiency.

An explicit recognition that the “automatic stabilizers” are likely to help stabilize the economy, and should be viewed as part of the overall fiscal package even though they may not require legislation.”