272. Tackling Inflation, Taxes on Tips, and Texas Job Creation | This Week's Economy Ep. 71 📈

Inflation, Austin, Space X, Tip Taxes, Texas, KOSA, Carbon Tax: Navigating Today's Economic Landscape

Hello Friends!

Check out episode 71 of This Week's Economy. Today, I discuss six key items that touch on everything from inflation, Space X, Austin, carbon taxes, KOSA, taxes on tips, and more. Watch the episode on YouTube below or listen to it on Apple Podcast or Spotify.

1. Trump and Harris on Inflation

News: Former President Donald Trump and current Vice President Kamala Harris have promised to tackle inflation if elected. However, many of their proposed policies would exacerbate the issue, which would increase the budget deficit and hinder supply. Critics argue that blaming current economic woes solely on President Biden ignores supply chain disruptions that began during the pandemic under Trump's administration.

My Take: Both Trump and Harris will likely add to reckless deficit spending, risking tough Federal Reserve decisions with more money printing, less economic growth, and higher inflation. While tariffs aim to protect U.S. industries, they often lead to higher consumer prices. Trump's tariffs were misguided, and Biden continued them, compounding the problems. Removing these tariffs would ease costs. Expanding Trump-era tax cuts would benefit American households, especially with federal spending restraint. However, failing to extend these tax cuts could result in a significant middle-class tax hike. The restrictive policies from higher regulations, budget deficits, and other measures under Biden's administration harm the economy. Progressive policies would further deteriorate economic conditions. The best way to strengthen the economy and control inflation is to embrace free trade and pro-growth policies, including cutting government spending, taxes, regulations, and excessive money printing.

2. Austin Ranks 15th in Quality of Life Study

News: Austin, Texas, ranks 15th globally in a new quality of life study by Numbeo, the highest of any U.S. city, while Dallas ranks 28th, San Antonio 44th, and Houston 56th.

My Take: Texas cities outperform many others regarding quality of life due to the state's vibrant, attractive environment. Texas is a business and family hotspot thanks to its pro-growth policies, absence of personal income tax, sustainable budgeting, and limited regulations. The latest Bureau of Labor Statistics report shows Texas leading in job gains, with 267,400 new jobs added over the past year. Emphasizing market-driven solutions is essential for Texas to overcome challenges and maintain its status as an ideal place to live, work, and raise a family. In my recent piece at the Kansas Policy Institute, I discussed the high-tax state exodus from states like Kansas to those with lower taxes, like Texas, attracting businesses and residents and contributing to their improving economic growth and quality of life.

3. SpaceX Moves to Texas

News: Elon Musk plans to move the headquarters of SpaceX and X to Texas, highlighting the state's attractiveness to businesses and newcomers.

View: Texas continues attracting people and businesses, including major companies like SpaceX and X. Infrastructure improvements are necessary to accommodate this influx and meet growing energy demands. Texas should refine energy strategies, focusing on market-driven solutions, including nuclear power, eliminating subsidies to energy companies, and ensuring a level playing field. Reducing government involvement and promoting market activity will bolster Texas's infrastructure, maintaining its status as a beacon of prosperity and freedom. This influx is also part of a broader trend where businesses and individuals move to states with more favorable economic policies, as I noted in my recent piece on the high-tax state exodus.

4. Tax on Tips

News: The New York Times reports on Trump's proposal to exempt tips from federal taxes, calling it "improvisational economic policymaking." Sen. Ted Cruz has introduced similar legislation with the No Tax on Tips Act.

My Take: Exempting tips does not address the root cause of economic issues—government overspending—and could exacerbate the problem by significantly reducing federal revenues. In my recent piece at The Hill, I discussed how high taxes and inflation impact all American workers and why more comprehensive tax cuts, similar to those implemented during the Trump administration, would be more beneficial for all households. Instead of focusing on exempting federal taxes on tips, expanding Trump-era tax cuts by broadening the base and reducing the number of brackets with the lowest rates possible would benefit all American households. Congress must address the fiscal crisis and inflation through spending cuts.

5. Failures of the Kids Online Safety Act

News: The Kids Online Safety Act (KOSA) has faced criticism for empowering politicians and bureaucrats over parents rather than protecting children as intended. The U.S. Senate passed a procedural hurdle for KOSA with a likely vote on it next week.

My Take: Despite its good intentions, KOSA has significant flaws that make it more harmful than beneficial. By giving more power to politicians and unelected bureaucrats, the Act undermines the authority of parents, who are best positioned to make decisions for their children. This top-down approach often leads to overreach and can stifle the freedom and responsibility of families. In my recent work, I highlighted how this legislation risks imposing blanket solutions that do not consider individual family needs and circumstances. Moreover, KOSA could lead to increased surveillance and censorship, infringing on privacy and free speech for everyone. Instead of such heavy-handed regulation, we should focus on empowering parents with the tools and information they need to guide their children's online activity effectively.

6. The Economic Folly of a Carbon Tax

News: A renewed push for implementing a carbon tax to combat climate change exists.

View: A carbon tax is economically flawed and potentially harmful despite its intentions to reduce carbon emissions, which the EPA doesn’t consider a “harmful pollutant.” In my recent article at the American Institute for Economic Research, I discuss how a carbon tax increases the cost of energy, which raises many prices—from manufacturing to transportation to basic consumer goods. This tax disproportionately affects lower and middle-income families who spend more on energy-related expenses. Furthermore, the carbon tax hinders economic growth by increasing operational costs for businesses, leading to higher consumer prices and potentially reducing American industries' competitiveness on the global stage. Instead of a carbon tax, market-driven innovations and technological advancements offer a more effective and less economically damaging path to improving the environment and our livelihoods.

Media Hits and Events:

I was on the Chad Hasty Show talking about my piece in The Hill about the costs of exempting tips from federal taxes and what should be done instead.

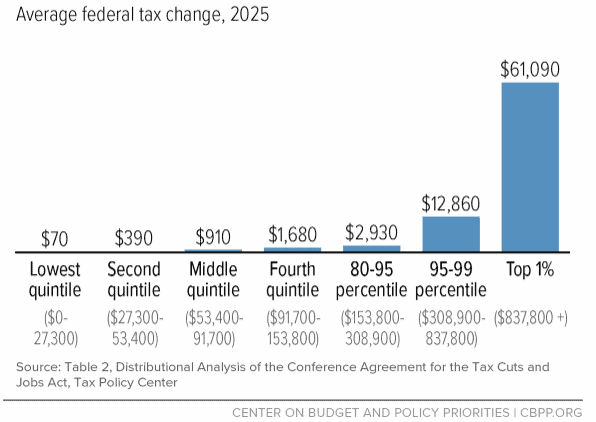

I’ve published pieces, given quotes, or completed interviews this week at AIER, Kansas Policy Institute, The Sentinal, The Hill, NTD News, and more. Here’s a chart showing how nearly everyone would see a tax hike if the Trump tax cuts expire.

Let People Prosper Show

Don't miss the latest Episode 107 of the Let People Prosper Show with Dr. Meg Tuszynski, Managing Director of the Bridwell Institute for Economic Freedom in the Cox School of Business at Southern Methodist University and a Research Assistant Professor at the Cox School. We discuss economic freedom and how it improves the careers of women (and men). Don’t miss it!

This upcoming Monday’s Episode 107 of the Let People Prosper Show highlights the keys to liberty and prosperity with Douglas Carswell, President & CEO of the Mississippi Center for Public Policy and previously a member of the British Parliament. Check it out!

Quote of the Week

Bible Verse of the Week

Conclusion

Thanks for joining me in Episode 71 of "This Week's Economy." For more insights, visit vanceginn.com and get a paid subscription to my Substack newsletter today so you receive these insights in your inbox. God bless you, and let people prosper.

Keep reading with a 7-day free trial

Subscribe to Let People Prosper to keep reading this post and get 7 days of free access to the full post archives.