274. Inflation, “New Right,” VP Harris & Texas | This Week's Economy Ep. 72 📈

Check out my take on the latest news!

Hello Friends!

Check out episode 72 of This Week's Economy. Today, I discuss the latest Federal Reserve decision, information on elevated inflation, problems with “New Right” and Harris, the unsustainable Texas Budget, and more. Watch the episode on YouTube below or listen to it on Apple Podcast or Spotify.

1. Fed Leaves Target Rate Unchanged

News: The Federal Reserve, America’s central bank, left its federal funds rate target unchanged at 5.25-5.5%, where it has been since July 2023.

My Take: There was, unfortunately, no change in its statement about more aggressively cutting its bloated $7.2 trillion balance sheet, which is the source of persistently elevated inflation. While inflation has been moderating recently, the Fed’s preferred measure of inflation, the personal consumption expenditures (PCE) index excluding food and energy, remained at 2.6% year-over-year in June, well above the Fed’s average inflation target of 2%. This indicates to me that there will unlikely be a target rate cut in September as some believe and the Fed’s Chairman Jerome Powell hinted. The solution is simple: to cut the Fed’s balance sheet substantially to about 6% of GDP, where it was before the Great Financial Crisis, bringing the balance sheet closer to $2 trillion. Until then, we have a rough time ahead with slower growth and higher inflation.

2. Happy Birthday to Milton Friedman

News: Milton Friedman would have turned 112 on July 31.

My Take: He passed in 2006, so he didn't see the school choice revolution, state flat tax revolution, and sustainable budget revolution, but his work ignited these revolutions and much more! Here's my commentary on his work from 2012, when he would have been 100 years old.

3. Overspending in Texas

News: The Texas Legislative Budget Board recently released the Fiscal Size-Up for the current two-year budget for 2024-25.

My Take: The Texas Legislature passed the LARGEST budget increase in Texas history, with increases of 21.2% in general revenue funds, 32% in state funds (including general revenue, general revenue-dedicated, and other funds), and 21.5% in all funds (including state funds and federal funds) when appropriately comparing initial appropriations in 2022-23 to initial appropriations in 2024-25. This resulted in the second-largest new property tax relief of $12.7 billion, and property taxes increased by $165 million.

2) The Texas Legislature increased its share of spending on public education to about 50% from historic increases in spending on government schools by 33.3% in state funds and by 28.6% in all funds. However, all funds could be slightly less, given the federal COVID-related funding in 2022-23.

Find more details under the paywall.

4. Governments Stockpile Bitcoin

News: There are reports that the federal and state governments may start stockpiling or adding Bitcoin and other cryptocurrencies to their portfolios in public pensions and rainy-day funds.

My Take: I should first note that I prefer governments not get involved in Bitcoin and other cryptos to avoid propping up or devaluing them, as governments should be involved less, if at all, in these and other markets.

However, cryptos could be part of the portfolios of the federal government, state, and local retirement plans, or state rainy day funds.

I wonder how much the government should use taxpayers’ money to do these things and redistribute money from the productive private sector to these government activities. Moreover, governments shouldn’t be stockpiling assets but could use cryptocurrencies to diversify portfolios.

For example, there’s no reason Texas should have an annualized cap of 20% on certain tax revenue on its rainy day, which brings it to $27B in its RDF. Texas could soon have $23B in the RDF. That’s too much money on the sidelines in the hands of the government when unforeseen tax revenue shortfalls should be covered by spending less during recessions or disasters.

The bottom line is most governments across America are spending unsustainably and don’t have “extra funds,” so they should be very cautious with taxpayer money to get into trying to hold assets as stores of value with stockpiles when governments and their holdings have historically not done a good job of that, including the US dollar.

This is more reason to cut government spending and taxes than try to diversify taxpayer money holdings into cryptos, which I hope will soon be part of competitive currencies in the private sector.

5. “New Right” is Old Progressivism

News: As Politico reports, the think tank American Compass is trying to gain a foothold in the GOP by seeing an opening with J.D. Vance as Trump’s pick for VP. This think tank sees itself as part of the New Right, which opposes tax cuts, deregulation, and free trade. It claims these policies have been “disastrous economic policy.”

My Take: The Biden administration left a dire economic situation. Americans face high inflation and historically low savings rates. A fix will not come from more or bigger government like the “New Right” or Democrats support. We need less government that unleashes economic potential for people to flourish. To help ALL Americans, we need leaders who reduce government spending, remove government barriers to work, embrace free trade, and cut taxes. No more picking winners and losers; let’s lift up all Americans.

6. Harris’ Platform Hurts Americans

News: As Kamala Harris rises as the likely presidential nominee for the Democratic party, her platform is beginning to take shape. Predictions such as Harris’ FTC antitrust policy, her tax policy, and the future of financial regulations are hitting the news.

My Take: America’s federal antitrust laws have been based on the consumer welfare standard for more than half of a century, but Harris, Lina Khan, JD Vance, and others across the political spectrum want to change that, hurting consumers and producers. This would double down on the Biden administration’s onslaught on competition through flawed antitrust efforts. This is especially true for “Big Tech” companies that generate substantial consumer welfare and billions of dollars in economic activity. It’s good to see Harris continue to promise not to raise taxes on those making less than $400,00 per year, but that’s unlikely if the 2017 Trump tax cuts expire as she has promised. These tax cuts should be improved and made permanent by stopping picking winners and losers in the tax code, which Trump-Vance has advocated. Harris will likely continue the Biden administration’s legacy of increased regulation and flawed ESG and DEI policies through the FDIC, CFPB, and other banking industry regulators. Increasing transparency, reducing political influence, and providing regulatory relief for banks will enhance competition and improve banking services and affordability instead of trying to achieve harmful objectives based on likely good intentions.

Media Hits and Events:

I’ve published pieces, given quotes, or completed interviews this week at Lars Larson Show, AIER, Kansas Policy Institute, Fox Business with Neil Cavuto, NTD News, and more.

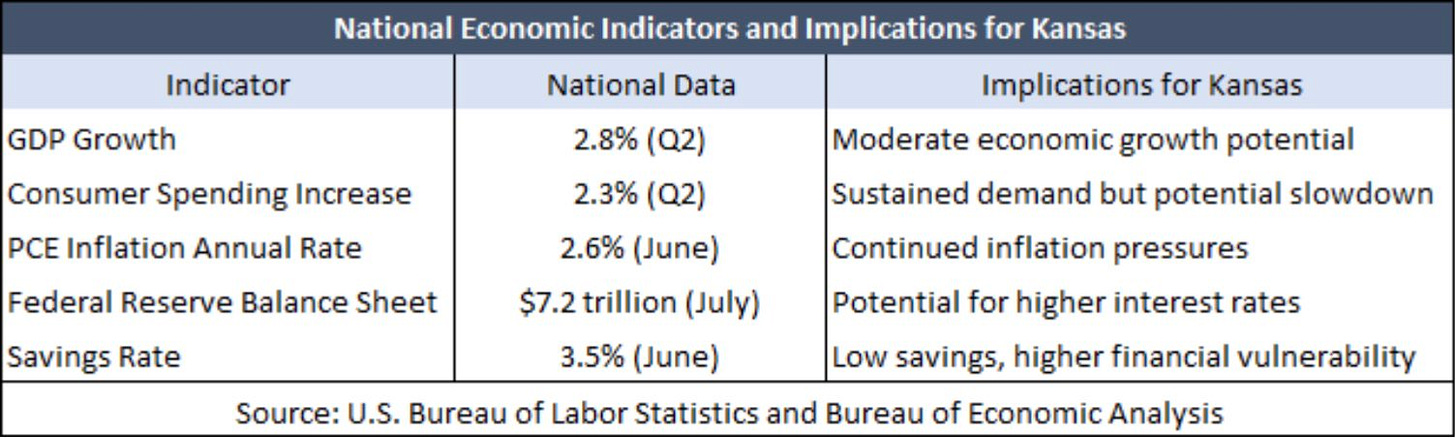

Here’s a chart showing how the national economic indicators influence people across the country, including Kansas.

Let People Prosper Show

Don't miss the latest episode 107 of the Let People Prosper Show highlights the keys to liberty and prosperity with Douglas Carswell, President & CEO of the Mississippi Center for Public Policy and previously a member of the British Parliament. Check it out!

This upcoming Tuesday’s Episode 108 of the Let People Prosper Show digs into how removing government obstacles in the healthcare system can improve patient care with Deane Waldman, MD, MBA, author of Curing the Cancer in U.S. Healthcare and other books, as well as more than 250 articles and monographs. Don’t miss it!

Quote of the Week

Bible Verse of the Week

Conclusion

Thanks for joining me in Episode 72 of "This Week's Economy." For more insights, visit vanceginn.com and get a paid subscription to my Substack newsletter at vanceginn.substack.com today so you receive these insights in your inbox. God bless you, and let people prosper.

Keep reading with a 7-day free trial

Subscribe to Let People Prosper to keep reading this post and get 7 days of free access to the full post archives.