276. Recession, Big Tech, FDIC, & Harris | This Week's Economy Ep. 73 📈

My latest insights on the top news of the week.

Hello Friends!

Don’t miss episode 73 of This Week's Economy. Today, I discuss the possibility of a recession, Kids Online Safety Act (KOSA), Chevron moving to Texas, Trump not taxing Social Security income, Harris’ connection with Big Tech donations, and more.

Watch the episode on YouTube below or listen to it on Apple Podcast or Spotify.

1. Boom and Bust Economy

News: The last week has been a whirlwind for the global and domestic economies. The S&P 500 lost 3% on Monday and has been down 8.5% since July 15, but it has moved back up a bit since then. Is a recession ahead?

My Take:

Unfortunately, it's time for asset bubbles to correct from government failures across the globe. This outcome was avoidable, with less government spending by Congress and less money being printed by the Fed.

Some of us have been saying this for years, and I won't stop. But Congress or the Fed will unlikely listen. It will get worse before it gets better.

We need less government, not more, to revive the economy, and the Fed shouldn’t cut its interest rate target with elevated inflation that will keep the economy from healing.

2. Tech Rule to Protect Kids

News: The Senate passed two online safety bills for children: the Kids Online Safety Act (KOSA) and the Children and Teens’ Online Privacy Protection Act (COPPA 2.0).

My Take:

While it’s laudable to improve children’s privacy and safety, these bills fail to achieve their goals and would cause greater risk to youth in today’s digital age.

Parents know best for their kids. Not politicians, bureaucrats, CEOs, or anyone else. Sure, many parents don’t make the ‘correct’ choices every time, as I make many mistakes, but the government's one-size-fits-none policies will worsen the situation.

By imposing burdensome restrictions on online platforms, we risk hindering the development of new technologies and services that could benefit families. A better policy approach provides information and fosters competition in the marketplace, allowing consumers to choose the platforms that best align with their values and preferences.

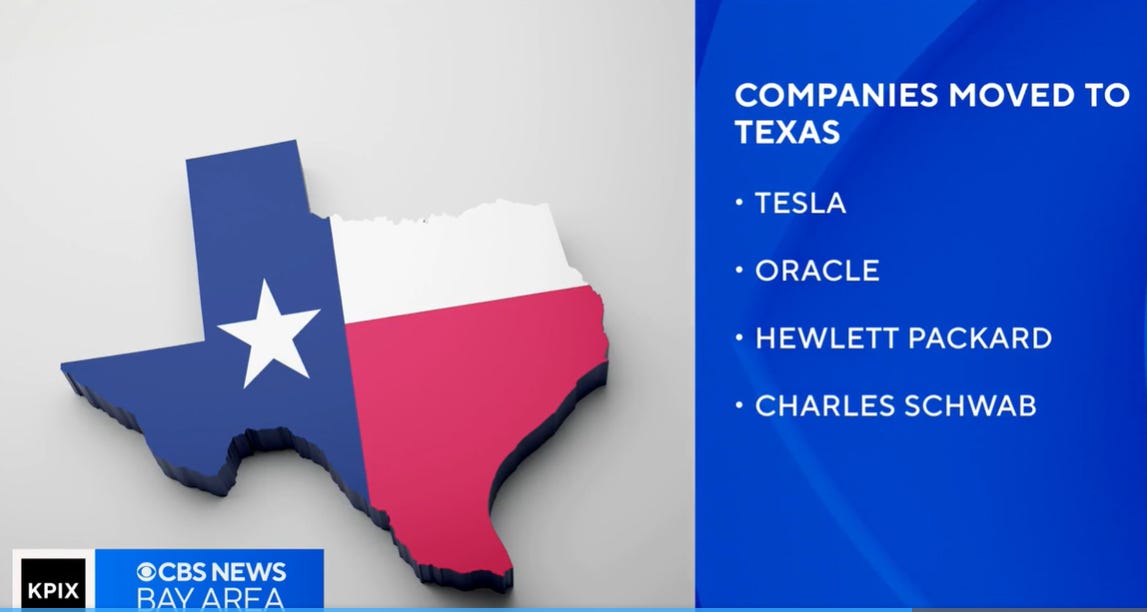

3. Chevron Moves to Texas

News: Chevron has announced moving its headquarters from California to Texas. This is after years of conflict with regulators over fossil fuels and climate change.

My Take:

Texas remains a magnet for people and businesses, attracting more newcomers than most states, including the headquarters of Chevron. To sustain this influx and support a growing economy, we must consider the infrastructure needed to meet expanding energy demands.

This follows Elon Musk’s claim that he will move the X and SpaceX headquarters to Texas from California as well.

By championing policies that reduce government involvement and promote market activity, Texas can strengthen its infrastructure to support its growing population and sustain its status as a beacon of prosperity and freedom.

4. Trump to Cut Income Taxes on Social Security

News: Trump has proposed to eliminate taxes on Social Security. This could be a popular campaign point as poverty among seniors is on the rise.

My Take:

This proposal, like eliminating taxes on tips, is another targeted tax break that only benefits a segment of the American population.

Trump is correct to consider eliminating different taxes. Instead, he should consider broadening the tax base so everyone pays for government spending by eliminating many federal tax deductions, exemptions, and credits and lowering and flattening tax rates.

By pushing for less spending, taxes, and regulations and key reforms to safety-net programs like Social Security and Medicare to help make them solvent, the American Dream can be alive and well again.

5. Harris Attracts Big Tech Donors

News: While many Big Tech leaders rally to support Kamala Harris for president, she has already revealed that she will not go easy in regulating Big Tech. She was key in creating rules around AI under the Biden Administration.

My Take:

AI is a transformative technology that has the potential to revolutionize various industries, from healthcare to finance and beyond. In a free market, competition drives innovation and efficiency, benefiting consumers and businesses. Restricting AI through excessive regulations and government oversight threatens this dynamic.

America’s federal antitrust laws have been based on the consumer welfare standard for over a half-century. Still, Harris and others across the political spectrum want to change that, hurting consumers and producers.

This would double down on the Biden administration’s onslaught on competition through flawed antitrust efforts. This is especially true for “Big Tech” companies that generate substantial consumer welfare and billions of dollars in economic activity.

6. FDIC’s Stance on Index Fund Investing Criticized

News: Criticism has emerged over the FDIC's position on index fund investing, arguing that it undermines sensible investment strategies.

My Take:

The FDIC's intervention in investment practices exemplifies unnecessary regulatory overreach that disrupts market efficiency and undermines the fundamental principles of a free-market economy, where individuals should have the autonomy to make their investment decisions.

Investors should have the freedom to choose index funds without governmental interference. This would ensure a competitive and dynamic market that encourages innovation and offers a wide range of investment options to suit different risk appetites and financial goals.

Market-based solutions and consumer choice are crucial for fostering a healthy investment environment that promotes economic growth, individual liberty, and financial independence while reducing the risk of government-imposed distortions that can lead to inefficiencies and reduced returns for investors.

Media Hits and Other:

Don’t miss my recent appearance on Amanda Head’s podcast, “Furthermore,” where we discussed the economy and pro-growth policies greatly.

I’ve published pieces, given quotes, and completed interviews this week at Rich Valdes Show, Mackinac Center, OCPA, TPRI, TFR, KTRH News, NTD News, and more.

Let People Prosper Show

Don't miss the latest episode 108 of the Let People Prosper Show to understand how removing government obstacles in the healthcare system can improve patient care with Deane Waldman, MD, MBA, author of Curing the Cancer in U.S. Healthcare and other books, as well as more than 250 articles and monographs. Don’t miss it!

This upcoming Tuesday’s Episode 109 of the Let People Prosper Show is a great discussion with Randy Hicks, president of Georgia Center for Opportunity, on how to overcome poverty through community-based solutions rather than top-down government policies.

Quote of the Week

Bible Verse of the Week

Conclusion

Thanks for joining me in Episode 73 of "This Week's Economy." For more insights, visit vanceginn.com and get a paid subscription to my Substack newsletter at vanceginn.substack.com today so you receive these insights in your inbox. God bless you, and let people prosper.

THANK YOU for being a paid subscriber!

Keep reading with a 7-day free trial

Subscribe to Let People Prosper to keep reading this post and get 7 days of free access to the full post archives.