280. Will Trump and Harris Agree to End Price Controls? | This Week's Economy Ep. 75 📈

Get my trusted takes on the top news without the noise.

Hello Friends!

Welcome back! Thank you for being a dedicated subscriber. You don’t want to miss episode 75 of This Week's Economy. Today, I discuss the key highlights from a free-market perspective that you don’t want to miss.

Watch the episode on YouTube below or listen to it on Apple Podcast or Spotify.

1. DNC MEETS THIS WEEK

News: The Democratic National Convention began in Chicago on Monday, culminating in Kamala Harris’s acceptance speech on Thursday night. It was an opportunity to get more clarity on Harris’s economic agenda. The convention was also aimed at Gen Z and younger demographics as they live-streamed the whole convention in vertical video for TikTok, Instagram, and YouTube.

My Take:

This was a major opportunity for VP Harris to clarify her economic agenda, which has taken a lot of heat from her extreme positions. We could learn more about the party’s priorities following the convention as we hear what will be emphasized and downplayed from VP Harris’s presidential candidacy.

The economy was a talking point as it is one of the top concerns for voters. However, so far, we have seen many proposals from Harris aimed at price controls, no taxes on tips, handouts to parents, giving money to homeowners, and other progressive proposals that would worsen the situation.

Many of Harris’ proposals thus far have picked winners and losers and interjected more government interference in the marketplace; this is not helping Americans. We need to allow pro-growth, free-market policies to improve things for Americans.

2. IS GOOGLE A MONOPOLY?

News: Following the recent decision by a federal district court for the District of Columbia saying that Google illegally abused its search monopoly, a federal judge is actively considering breaking up the tech giant. A court-ordered Google breakup would be the U.S.’s most consequential antitrust action in decades. However, figuring out how to split up the company would be challenging.

My Take:

The antitrust crackdown on Google primarily targets the company’s dominance in searching online but overlooks the broader competitive landscape and its innovations, which have contributed positively to the technology sector and consumer welfare.

Aggressive antitrust measures stifle innovation; this regulatory approach will hinder Google's investments in and development of new technologies, slowing overall technological progress, benefiting other countries’ businesses, and hurting consumers.

The consumer welfare standard should remain the cornerstone of antitrust enforcement, ensuring that actions taken against companies are justified by clear evidence of reduced consumer benefits. While antitrust actions like the recent ruling against Google may be intended to foster competition, the actual outcomes undermine this goal.

3. ECONOMY IS MAJOR ELECTION ISSUE

News: With the economy a top concern for voters, Trump and Harris are rolling out their economic agendas. At the end of last week, Harris debuted her economic agenda, which included price caps on groceries, tax breaks for families, and lower health premiums through the ACA. Bernie Sanders says her platform is a “strong, progressive agenda.” Trump is also emphasizing the rising inflation and costs of groceries.

My Take:

If Harris has a list of solutions for our economic environment, why isn’t she enacting them now, as she is already in office? We’ve seen the failures of Bidenomics first-hand, which have helped put us in this situation. And a ringing endorsement from a socialist like Sen. Bernie Sanders is not a great sign.

Implementing price caps distorts the natural marketplace dynamics. By setting artificial limits on prices, these caps lead to shortages and reduce incentives for suppliers to provide goods and services, ultimately harming consumers. For similar reasons, Trump’s proposals for tariffs harm consumers.

Market-based solutions are more effective than price caps and tariffs in addressing inflation caused by the Federal Reserve printing too much money. Allowing prices to fluctuate naturally according to supply and demand better allocates resources and encourages more efficient production and distribution of goods.

4. LOUISIANA TREASURER WANTS TO REMOVE PERSONAL INCOME TAX

News: Louisiana’s Treasurer John Fleming wants to eliminate the personal income tax to attract more opportunities to the state and help the people thrive.

My Take:

Eliminating personal income taxes is the right direction if Louisiana hopes to see more economic growth, but less spending is also needed to help attract businesses and prevent people from fleeing.

Louisiana State Treasurer John Fleming is correct that companies are leaving highly regulated states like New York and California to go South to Texas, Tennessee, and Florida. These states have favorable tax and regulatory environments, and Louisiana should follow their lead.

The state must reform the tax and regulatory environment to attract these opportunities.

5. MORE JOB LOSSES THAN JUST FROM BERYL

News: Unemployment rose in more than half of US states last month, suggesting the weakness in the national jobs report that spooked markets extended beyond Hurricane Beryl.

My Take:

In July, 22 out of 50 states experienced net job losses, indicating that economic weakness is widespread and not merely a localized issue stemming from Hurricane Beryl.

Florida continues to dominate in job creation among the four largest states, while Texas, despite a growing labor force and numerous job openings, faced job losses in June and July. Red states like Florida and Texas excel due to their pro-growth policies—low taxes, fewer regulations, and a favorable environment for entrepreneurs and workers. These strategies consistently outperform the high-tax, heavily regulated environments of blue states like California and New York.

Florida and Texas have been the clear leaders in job creation since the COVID lockdowns, demonstrating the undeniable effectiveness of free-market policies in driving economic recovery and growth. The recent job losses in Texas highlight the need for vigilance, but by continuing to implement strong, pro-growth policies, these states will maintain their leadership and resilience in the face of any challenges.

6. STATES SHOULD LEAD IN FREE-MARKET ENERGY POLICY

News: The Electric Reliability Council of Texas (ERCOT) projections indicate that Texas’ energy demand will nearly double by 2030, increasing from 85 to 150 gigawatts in just six years. This revelation has sparked significant concern among state policymakers and industry leaders.

My Take:

The expansion of cryptocurrency mining, data centers, and the burgeoning artificial intelligence industry drives a significant portion of this anticipated growth. These sectors, often viewed skeptically, are integral to the modern economy and are poised to drive the next economic revolution.

With the right free-market policies, Texas can maintain its leadership in technological advancement and ensure abundant energy for Texans. The state can look forward to a bright future by removing barriers that impede energy production and disincentivizing entrepreneurs from investing in Texas.

The Biden administration’s industrial policy distorts the market. Texas should not fall into the trap of picking another industrial policy and instead provide a level playing field where all forms of energy can compete.

Media Hits and Other:

This week, I’ve published pieces, given quotes, and completed interviews at Fox Business with Varney & Co. on inflation, Austin American-Statesman on free-market energy policy, EdChoice podcast on school choice (see link below), NTD News about Harris’ bad price caps (watch below), Texans for Fiscal Responsibility on the Frozen Texas Budget, Texas Policy Research Institute on occupational licensing, Kansas Policy Institute on state labor market trends, among other topics.

Let People Prosper Show

Don't miss the latest Episode 110 of the Let People Prosper Show for an excellent discussion with Randy Hicks, president of Georgia Center for Opportunity, on how to overcome poverty through community-based solutions rather than top-down government policies.

This upcoming Tuesday’s Episode 111 of the Let People Prosper Show is an excellent discussion with Dr. Paul Tice about energy policy, especially on ESG, reliable power, and climate change. He is an adjunct professor of finance at the Leonard N. Stern School of Business at New York University, where he teaches mainly about the energy, infrastructure, and project finance markets. He also regularly contributes Op-Ed pieces on energy- and finance-related topics to The Wall Street Journal, The Hill, and other news media. He is the author of "The Race to Zero: How ESG Investing Will Crater the Global Financial System."

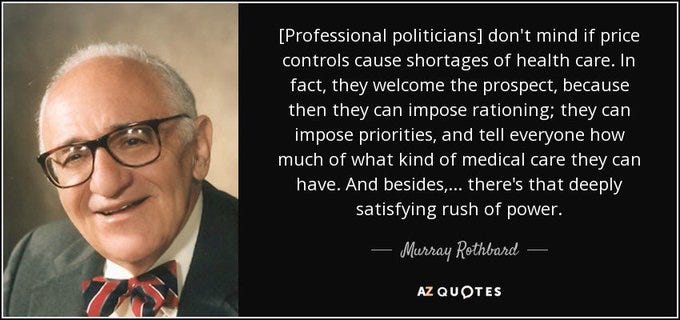

Quote of the Week

Bible Verse of the Week

Conclusion

Thanks for joining me in Episode 75 of "This Week's Economy." For more insights, visit vanceginn.com and get a paid subscription to my Substack newsletter at vanceginn.substack.com today so you receive these insights in your inbox. God bless you, and let people prosper.

Keep reading with a 7-day free trial

Subscribe to Let People Prosper to keep reading this post and get 7 days of free access to the full post archives.