285. Presidential Candidates Ignore How Nothing is Free | This Week's Economy Ep. 77 📈

My take on the latest 7 top news items without the noise.

Hello Friends!

Welcome back! Thank you for being a dedicated subscriber. Today, I discuss the key news from a free-market perspective that you don’t want to miss. Watch the episode on YouTube below or listen to it on Apple Podcast or Spotify.

1. AI LEGISLATION AND INNOVATION

News: States are discussing various proposed legislation addressing Artificial Intelligence (AI) and its safety. In California, SB 1047 would require AI developers to comply with certain rules before developing their models. In Texas, a recent Senate committee meeting discussed the potential pitfalls of AI and the dangers of overregulating it.

My Take:

While ensuring AI safety is important, we must carefully assess how these regulations will impact economic progress. Overregulation could stifle innovation promised by new technology, hindering our competitive edge.

The rise of AI presents a unique opportunity for society to better adapt to challenges and capitalize on new opportunities. The future belongs to those who can adapt and innovate, and AI should be embraced rather than feared.

To maintain leadership in the AI landscape, the U.S. must welcome disruptive changes and cultivate an environment encouraging competitiveness. Attempting to pause AI innovation is impractical in the face of rapid advancements by other nations. Our big tech competitors like China and elsewhere are advancing rapidly with often less excessive red tape, and we must not fall behind.

2. HARRIS AND TRUMP ON TAXES

News: CBS News compared the tax plans of the presidential nominees and the potential impacts on individuals’ paychecks. Trump's plan includes extending the 2017 Tax Cuts and Jobs Act, lowering the corporate tax rate, and exempting tips and Social Security income from federal taxation. Harris’s plan emphasizes increasing tax credits like the child tax credit and hiking corporate taxes, particularly taxing unrealized stock gains for individuals earning over $100 million.

My Take:

Trump’s plans to extend his tax cuts and lower corporate tax rates would benefit the American public and the economy. A broad tax base with low rates is essential for minimizing economic distortions and spreading the tax burden fairly. If coupled with decreased government spending, these policies could help fuel economic growth.

However, Trump’s proposals to exempt certain income types, like tips or Social Security, narrow the tax base. This could lead to potential hikes in overall tax rates to compensate for deficit spending, shifting the burden to non-exempt income earners and creating an uneven playing field, violating sound tax policy.

Harris’s proposal to tax unrealized gains would disincentivize savings, long-term investment, and innovation. Taxing unrealized gains undermines the promise of future benefits, which are crucial motivators for investment. This approach also stifles innovation, as entrepreneurs and startups often rely on the potential future value of their equity as a form of compensation and capital.

3. HARRIS ON FRACKING

News: Kamala Harris recently stated she would not ban fracking as president, a departure from her previous comments during the Democratic presidential primary in 2019.

My Take:

Fracking has positioned the United States as a global oil and gas production leader, with daily output exceeding 13 million barrels. Much of this expansion has occurred in Texas, which has produced record amounts of oil and natural gas.

The U.S., particularly Texas, Louisiana, Oklahoma, and other states, is rich in natural resources and capable of meeting the energy demands of a growing population if managed wisely. Our nation must refine its energy strategies, emphasizing market-driven solutions rather than increased government intervention.

The push to ditch reliable energy is misguided. Politicians distort the energy market through subsidies, tax breaks, and ESG initiatives in regulations and government pensions. A more market-driven approach is needed to ensure energy security and economic growth.

4. Does Protectionism Work?

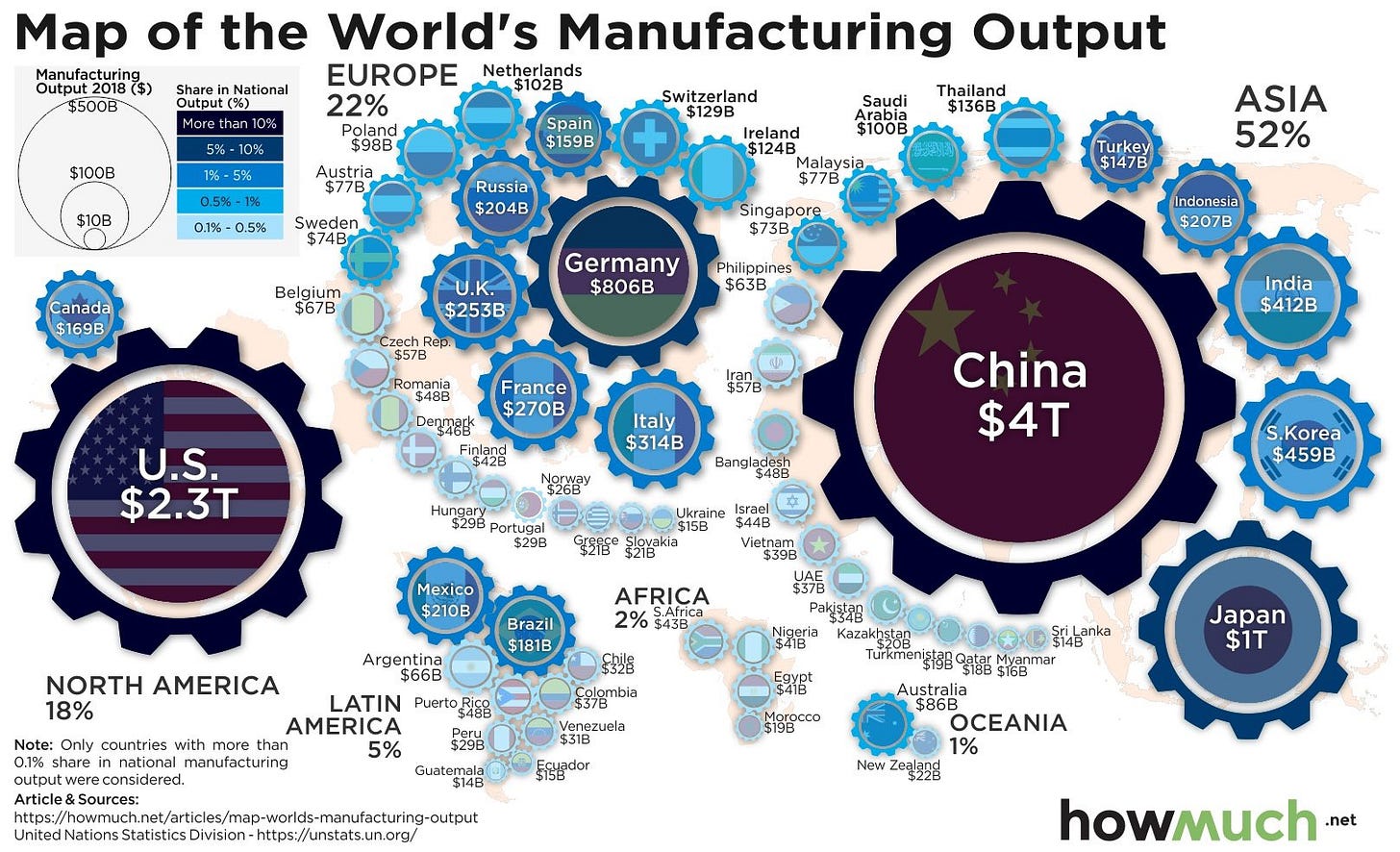

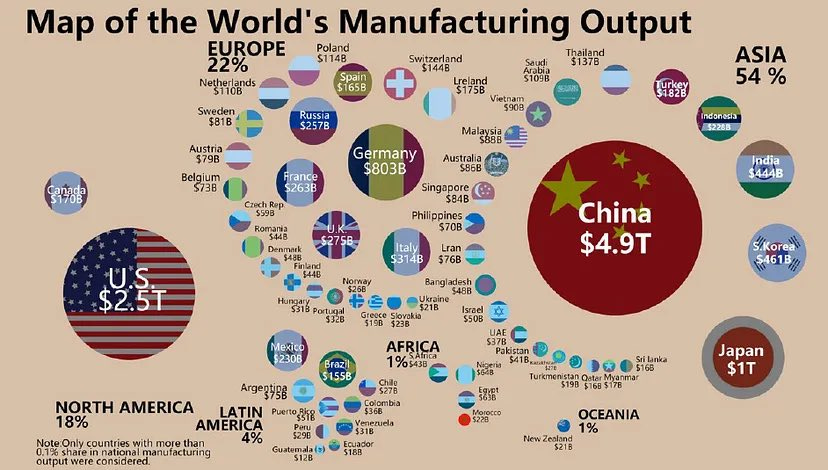

News: The trade data from 2016 and 2021 highlight the impact of protectionist policies, including raising tariffs, which began in 2017. Global manufacturing output was $14.1 trillion, with China leading at $4 trillion and the U.S. following at $2.3 trillion in 2016. Global manufacturing output rose to $16 trillion, with China’s share increasing to $4.9 trillion and the U.S.’s to $2.5 trillion in 2021.

My Take:

Between 2016 and 2021, global manufacturing output grew by 13.5%. China’s manufacturing surged by 22.5%, while the U.S. saw a more modest increase of 8.7%. This period was marked by significant tax hikes on consumers and producers purchasing imports, particularly in the U.S. and China.

Since 2017, the Trump and Biden administrations have imposed $79 billion in tariffs as part of protectionist policies meant to shield domestic industries. Despite these efforts, global manufacturing continued to grow, and the economic pie expanded—but China captured a larger slice, increasing its share from 28.3% to 30%. The U.S. trade deficit with China continued to widen during this period, undermining the goals of protectionism. Focusing solely on the goods trade deficit is misleading because it equals the capital account surplus. A better metric is total trade volume, which reflects the mutual benefits of exchange.

These protectionist policies have failed, stifling economic growth and exacerbating the trade deficit. Rather than insulating the U.S. economy, they have hindered its potential. To truly prosper, we must end protectionism and embrace free trade, allowing the market to allocate resources efficiently and drive economic growth.

2017

2021

5. FREE IVF FROM TRUMP

News: In an interview with NBC News, Trump said if elected his administration would support in-vitro fertilization (IVF) and have either the government or insurance companies cover the cost of the service for American women who need it.

My Take:

IVF is a great hope for families wishing for children. As someone who is pro-life with IVF and has used it for two of our beautiful kids, I recognize its value. However, nothing is truly “free.”

IVF is an elective procedure, and taxpayers shouldn’t be asked to foot the bill for it. This is especially critical when the country is running $2 trillion deficits.

Candidates need to stop handing out entitlements like candy to win votes, especially when such promises are not aligned with the limited roles outlined in the U.S. Constitution.

6. TESTIMONY TO ELIMINATE PROPERTY TAXES IN TEXAS

News: “On Wednesday, a panel of Texas lawmakers will look at expanding or perhaps eliminating property taxes in the Lone Star State. It's a lofty goal right now, but state senators want to explore the possibilities.”

My Take:

Over the last decade, the Texas Legislature has made progress in property tax relief, but the affordability crisis demands more action.

Property taxes are not just a financial burden—they are fundamentally immoral. They force Texans to perpetually rent from the government, functioning as unrealized capital gains and wealth taxes paid annually. This system makes it difficult for families with low or fixed incomes to build and pass on a legacy.

The path forward is clear: spend less and reduce property tax rates rather than complicating the housing market with homestead exemptions, discounts, and abatements that make elimination more difficult.

Read my full testimony or watch it below.

7. Weak Jobs Report Misses Expectations

News: The August jobs report showed only 142,000 new jobs, missing expectations of 160,000. Major revisions for June and July dropped previous totals by 86,000 jobs. The unemployment rate was 4.2%, and average weekly earnings increased by 3.7%, but real wages have declined since January 2021.

My Take:

This report shows clear signs of a slowing economy. The Federal Reserve should resist cutting interest rates too soon to avoid a 1970s-style inflation resurgence.

Congress should focus on spending less, regulating less, and taxing less to promote real, sustainable growth. Both Trump and Harris must prioritize pro-growth policies instead of more government handouts and picking winners and losers.

Let’s push for policies that truly let people prosper by trusting in the power of the free market.

Conclusion

Thanks for joining me in Episode 77 of "This Week's Economy." For more insights, visit vanceginn.com and get a paid subscription to my Substack newsletter at vanceginn.substack.com today so you receive these insights in your inbox. God bless you, and let people prosper.

Keep reading with a 7-day free trial

Subscribe to Let People Prosper to keep reading this post and get 7 days of free access to the full post archives.