303. Emerging Election Debates, Newsom's Gas Controls, & Nobel Prize Winners | This Week's Economy Ep. 83

Election, Education, Nobel Prize, and more! Don't miss it!

Hello Friends!

This week’s episode tackles some of the most pressing economic issues before the upcoming election. We dive into both presidential candidates' economic proposals and how policies like tariffs, price controls, and intervention in the Federal Reserve are creating concern among economists. We also explore policymakers’ attempts to control prices and quantities of goods, the ongoing debate over school choice, and how the Nobel Prize in Economics brings new perspectives on prosperity and immigration. Watch the episode on YouTube below, listen to it on Apple Podcast or Spotify, and visit my website for more information.

1. UPCOMING ELECTION CONCERNS

In the News: As the economy struggles, economists are raising concerns about the economic plans of both presidential candidates. Issues such as tariffs, price controls, immigration policy, and proposed interventions in the Federal Reserve are drawing criticism. Voters heading to the polls must understand how these policies could impact the nation's economic health. Source: Associated Press and YahooFinance

Dr. Ginn’s Take:

Recovery from Bidenomics: Americans are experiencing Bidenomics' shortcomings firsthand, leading to widespread dissatisfaction. While many seek a new direction, both candidates’ economic proposals have flaws, containing elements that will worsen the situation.

Solution to Inflation: The answer to inflation won’t come from price controls, targeted handouts, selective tax exemptions, tariffs, or presidential interference in the Federal Reserve. These measures would only intensify the current issues, as they fail to address the fundamental problem: government overspending and the Federal Reserve's swollen balance sheet.

Path Forward: The next president must work with Congress to curb excessive spending and tackle the federal deficit. Addressing the Federal Reserve's over $7 trillion balance sheet is also critical. The focus must shift to pro-growth, pro-market reforms that enable Americans to thrive.

2. GASOLINE CONTROLS IN CALIFORNIA

In the News: California Governor Gavin Newsom recently signed a law tightening fuel refinery storage regulations to prevent gasoline shortages and price spikes. However, just days after the legislation was enacted, a major oil company announced plans to close one of its refineries. Source: The Hill and Politico.

Dr. Ginn’s Take:

Quantity Control: This policy functions like a price control by limiting the quantity of fuel available in the marketplace. Such restrictions will have negative effects.

Results: The outcome will be higher gasoline prices. Businesses have a far better grasp of market and operational needs than politicians and regulators. The immediate impact is already evident, as a major oil refinery in LA is shutting down due to long-term uncertainty created by the law.

Government Intervention: This is a textbook case of government interference distorting market dynamics, ultimately making life more difficult for consumers. The focus should instead be on eliminating regulations and other barriers that constrain supply, allowing the market to better respond to fluctuating demand.

3. NOBEL PRIZE IN ECONOMICS

In the News: The 2024 Nobel Prize in Economics has been awarded to Daron Acemoglu, Simon Johnson, and James A. Robinson for their groundbreaking research on how institutions are formed and how they influence prosperity. Notably, all three economists are immigrants to the United States: Acemoglu hails from Turkey, while Johnson and Robinson come from the United Kingdom. Sources: Forbes and CNBC

Dr. Ginn’s Take:

Researching Prosperity: The researchers have illuminated why societies characterized by poor rule of law and exploitative institutions struggle to achieve meaningful growth. They emphasize that robust institutions are crucial for societal prosperity. While Acemoglu's recent efforts to go after Elon Musk and Acemoglu and Robinson's touting big-government ideas don’t resonate with me, their previous research was in line with my thinking from new institutional economics.

Immigration: These three researchers demonstrate the value of immigration. Legal immigration supports economic growth and brings in high-skilled workers who can contribute significantly to America's intellectual and economic landscape. We need immigration reform policies that foster future success stories like theirs.

What Brings Prosperity: While their research provides valuable insights into the economic dynamics of nations, we also recognize that pro-market policies and reduced government interference are key to fostering prosperity. It’s imperative for our leaders to champion these policies.

4. SCHOOL CHOICE EFFORTS

In the News: The upcoming election could significantly influence education policy in the U.S. Many states are contemplating school choice legislation, with Colorado, Kansas, and Florida placing school choice measures on their ballots. Texas should advance school choice legislation in the next legislative session. Sources: ABC and National Review

Dr. Ginn’s Take:

Proven Benefits: School choice programs have demonstrated positive outcomes, including improved student performance, higher graduation rates, and greater overall satisfaction. More than 30 states have implemented school choice initiatives, with 12 states offering universal or nearly universal education savings account (ESA) programs.

Quality Education Access: States can guarantee that all children have access to quality education, regardless of their socioeconomic background, by empowering families to choose schools that best meet their needs through universal savings accounts.

Better Public Schools: Counter to the progressive narrative, school choice enhances public education. Increased competition leads to improved quality, and universal ESAs could significantly boost teacher salaries. Some teachers might experience salary increases of up to $28,000 per year, reflecting the value of their profession.

5. DYNAMIC PRICING AT GROCERY STORES

In the News: Congresswoman Rashida Tlaib has accused Kroger grocery stores of discriminatory pricing practices, alleging that using digital price tags and facial recognition software constitutes price gouging, particularly as grocery prices reach an all-time high. Sources: Newsweek and USA Today.

Dr. Ginn’s Take:

Inflation Raising Prices: Inflation is the primary driver of higher grocery prices, affecting the cost of goods and services across the board. Like other businesses, grocery stores respond to market signals and adjust prices accordingly.

Inflation Causes: Excessive federal spending and the Federal Reserve's inflated balance sheet are factors contributing to inflation. The issue lies not with individual businesses but with broader economic policies. Technologies like dynamic pricing, similar to Uber’s surge pricing, are designed to respond to market demands and help ensure the availability of goods.

Solution: Instead of targeting businesses to adapt to market conditions, Congress should thoroughly review the underlying issue: federal overspending. When the government overspends and runs deficits, the Federal Reserve compensates by printing more money to purchase Treasury securities, which devalues the dollar and drives up prices. Breaking this cycle is essential for improving economic conditions.

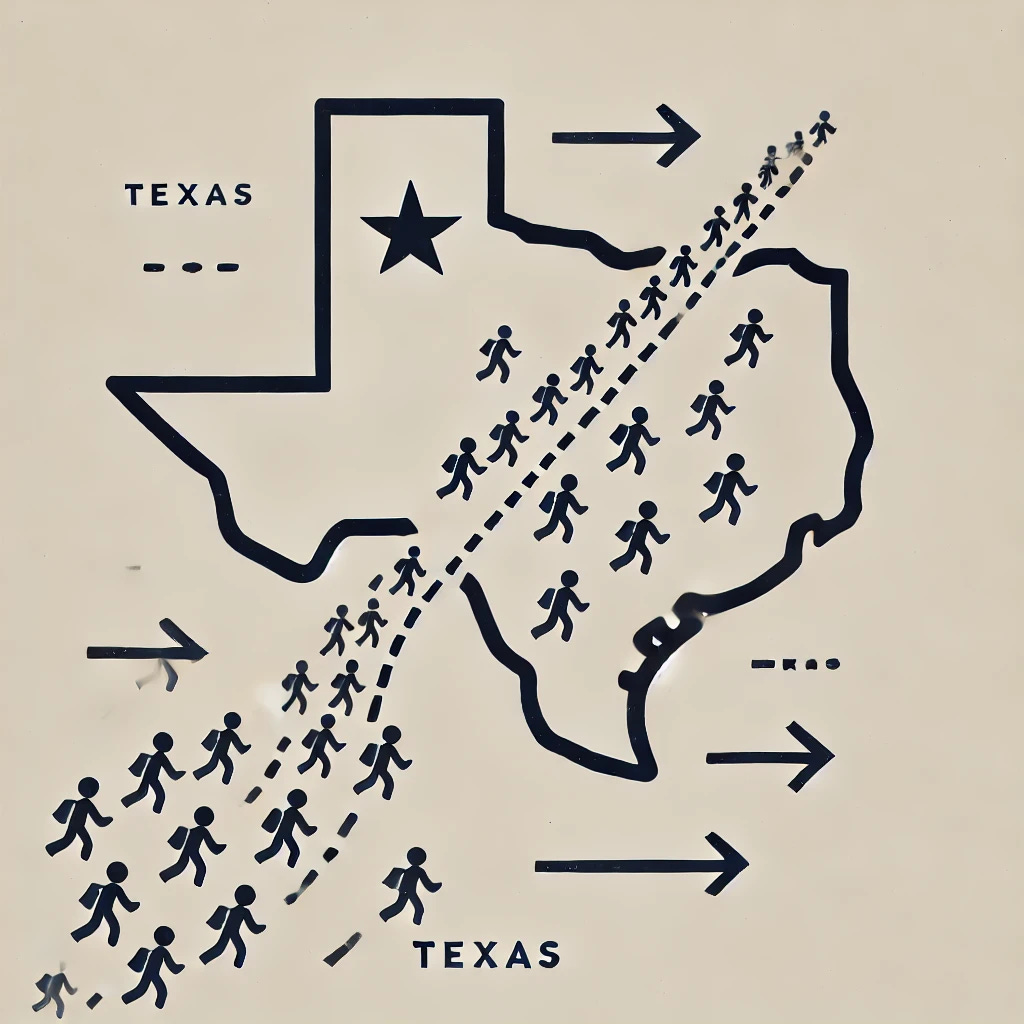

6. ILLEGAL IMMIGRATION TO TEXAS

In the News: Texas, sharing a border with Mexico, serves as a primary entry point for many illegal immigrants and is home to about 1.6 million undocumented individuals. Despite significant resources aimed at preventing illegal immigration, the issue continues. Texas is experiencing labor shortages, particularly in specific industries, such as construction, which tend to attract undocumented workers. Source: Texas Monthly

Dr. Ginn’s Take:

Economic Impacts of Immigration: America has always been a nation of immigrants, and these individuals make substantial contributions to our economy. Texas is currently grappling with a labor shortage, especially in industries that require a large workforce, like construction. While state policy is strict regarding border security, it is more lenient regarding undocumented workers.

Immigration Reform: This situation underscores the urgent need for comprehensive immigration reform. We need immigrants to fill essential jobs and support economic growth, but increasing the number of legal immigrants is crucial.

Better Immigration Policy: A more effective approach to immigration reform would be a market-based visa system, especially for higher-skilled, younger workers.

7. TAX CUTS & JOBS ACT EXPIRATION

In the News: The Tax Cuts and Jobs Act (TCJA) of 2017 is set to expire next year unless Congress takes action. If allowed to expire, trillions in tax breaks would end for individuals, leading to higher tax bills for 62% of taxpayers. A key question is how these tax cuts have impacted the federal deficit. Sources: FactCheck.org and CNBC

Dr. Ginn’s Take:

Tax Cut Benefits: Since its implementation, the Tax Cuts and Jobs Act has significantly benefited American taxpayers. By reducing tax rates for individuals and businesses, it spurred economic growth, increased disposable income for families, and incentivized corporate investment. However, with its expiration approaching, the potential for tax increases looms large, threatening the financial relief millions of Americans have experienced under the TCJA.

Impact on Federal Deficit: Contrary to some criticisms, the TCJA did not cause the dramatic rise in the federal deficit that many predicted. According to the Congressional Budget Office (CBO) estimate, corporate tax receipts have outperformed expectations, reaching $529 billion, exceeding the CBO’s original $425 billion estimate after the TCJA's passage. Additionally, data from the Federal Reserve demonstrates that the federal deficit has more to do with unchecked government spending than with the tax cuts themselves.

TCJA Should Be Extended: In today’s uncertain economic climate, Congress should prioritize extending the Tax Cuts and Jobs Act. It has proven to be a valuable tool for giving taxpayers relief, driving economic growth, and ensuring that both individuals and businesses can continue to thrive. Extending these tax cuts would be far more equitable and impactful than the narrowly targeted tax exemptions proposed by both presidential candidates, which only benefit select industries rather than the broader public.

Thanks for joining me in this episode of "This Week's Economy." For more insights, visit vanceginn.com and get a paid subscription to my Substack newsletter at vanceginn.substack.com today so you receive these insights in your inbox. God bless you, and let people prosper.

Keep reading with a 7-day free trial

Subscribe to Let People Prosper to keep reading this post and get 7 days of free access to the full post archives.