321. Trump’s Tariff Threats and Texas’s New Speaker | This Week's Economy Ep. 90

How Protectionism and Government Expansion Impact You

Hello Friends!

This week’s newsletter dives into the critical issues shaping economic policy, from President-elect Trump’s sweeping tariff proposals to the challenges Texas faces under rising government spending. As Americans brace for potential economic consequences, now is the time for bold reforms to protect taxpayers and ensure economic freedom thrives. Watch the episode on YouTube below, listen to it on Apple Podcast or Spotify, and visit my website for more information.

1. TRUMP TARIFFS HURT TEXANS

In the News:

On the campaign trail and since his election day victory, President-elect Donald Trump has threatened to impose high tariffs on goods entering the United States. Most recently, Trump has announced a 25% tariff on all goods across the border from Mexico and Canada. Economists warn of increased prices of consumer goods and other harmful impacts on American households, especially on the people of Texas. Source: Newsweek (see my quotes) and USA Today

Dr. Ginn’s Take:

Tariffs are a Costly Mistake: Raising taxes through tariffs is a costly mistake that hurts Americans and undermines economic growth. Protectionism through government-imposed tariffs distorts markets, reduces competition, and forces Americans to pay higher prices.

Texas Hurt by Tariffs: A 25% tariff on goods from Mexico and Canada would disproportionately harm Texas, the nation’s top trading state with these countries, by raising costs for businesses and consumers, disrupting supply chains, and reducing economic efficiency. In 2023, Texas exported and imported billions of dollars in goods and services to Mexico and Canada, vital trade that supports many Texas jobs.

Alternative Solution: Instead of relying on these counterproductive measures, President-elect Donald Trump and Texas Gov. Greg Abbott should focus on reducing spending, taxes, and regulations while promoting free markets and trade. When markets function freely, they create greater prosperity, innovation, and opportunity for Texans, Americans, and global trading partners.

Related:

2. INFLATION’S LATEST IMPACTS

In the News:

The Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures (PCE) Price Index, reports a 12-month inflation rate of 2.3%, rising 0.2% since September. If you exclude food and energy prices, the core PCE was up 2.8% over the last year, which is the key inflation measure used by the Fed. This exceeds the Fed’s 2% flexible average inflation target. Speaking at the American Institute for Economic Research Monetary Conference, Federal Reserve Governor Christopher Waller hinted at further rate cuts. Sources: CNBC and National Review

Dr. Ginn’s Take:

The Fed’s Role: Inflation continues to erode purchasing power, with rates still above the Fed’s 2% target. The Federal Reserve’s reactive policies, including ongoing interest rate cuts, are repeating historical mistakes and risk fueling further inflation.

National Debt Worsens the Crisis: With net interest payments on the $36 trillion national debt surging, the Federal Reserve’s hundreds of billions in losses reveal a system that would bankrupt any private business. Meanwhile, Congress shows no fiscal restraint, exacerbating economic instability with excessive spending.

Solutions for Economic Stability: The incoming Trump administration must lead with pro-growth policies to reverse this failure. This includes reducing government overreach, cutting taxes, curbing government spending, expanding free trade, and embracing more paths to legal immigration policies to expand the workforce and drive productivity.

Related:

See my latest article at

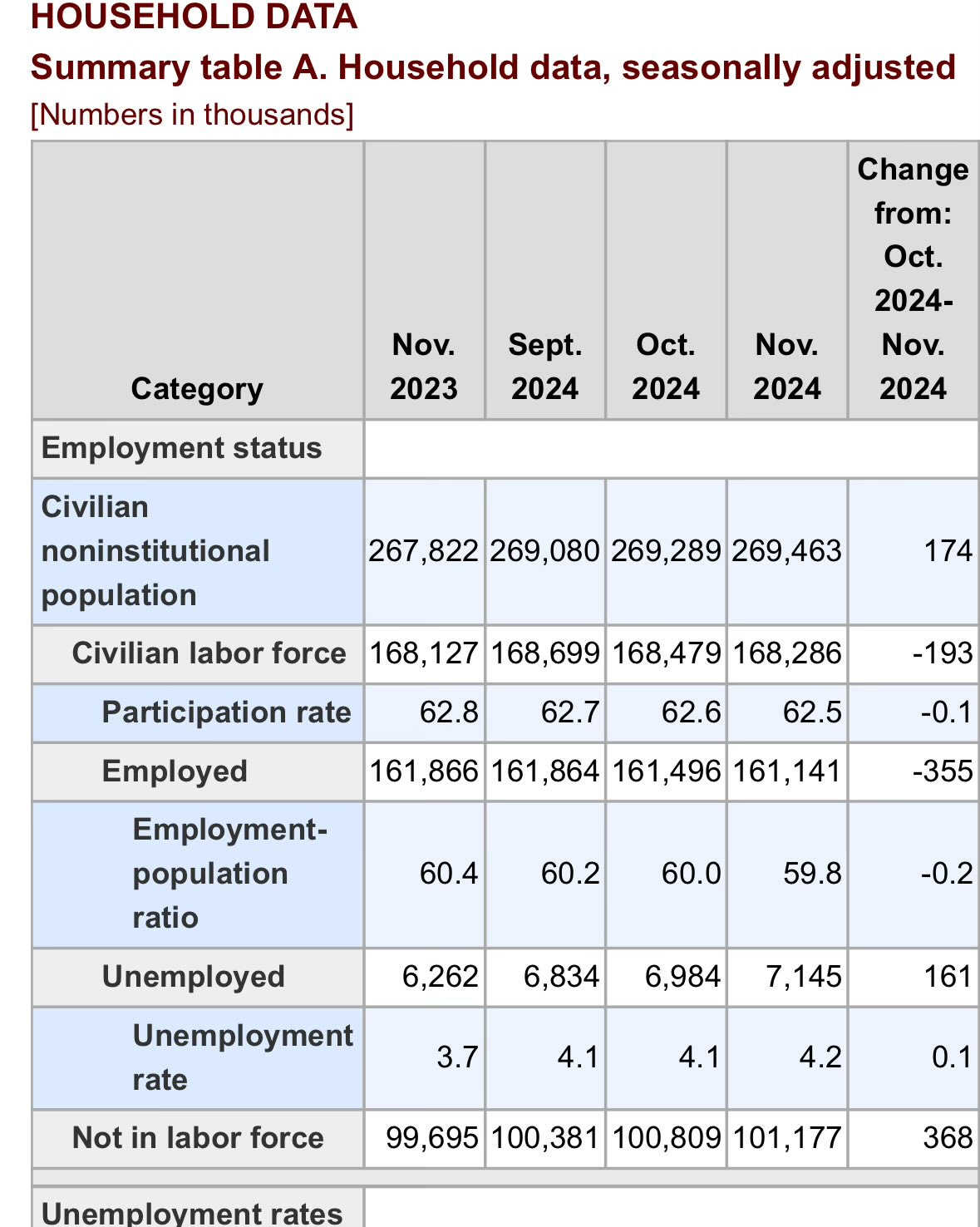

:3. U.S. JOBS REPORT

In the News:

“Nonfarm payrolls rose by 227,000 for the month, compared with an upwardly revised 36,000 in October and the Dow Jones consensus estimate for 214,000. The unemployment rate edged higher to 4.2%, as expected. Traders accelerated their bets on an interest rate cut this month following the payrolls release. Job gains were focused in health care (54,000), leisure and hospitality (53,000), and government (33,000).” Source: CNBC and BLS

My Take:

Private Sector Slows Amid Rising Unemployment:

November’s job growth of 227,000 included 33,000 government jobs, while private sector jobs showed a worrying decline after October’s 2,000-job loss. The household survey indicates a drop in the labor force by 193,000, with employment falling by 355,000 and unemployment rising by 161,000, bringing the unemployment rate to 4.2%, up from 3.7% last year.Earnings Growth Fails to Keep Pace with Inflation:

Average weekly earnings rose by 3.7% over the last year but remain lower than in January 2021 after adjusting for inflation. This indicates that while paychecks are growing nominally, real purchasing power continues to decline, burdening American families.Trump’s Economic Opportunity:

With labor market weaknesses influencing the election, Trump’s renewed presidency offers an opportunity to focus on pro-growth policies. Avoiding the pitfalls of protectionism and excessive government spending while pursuing tax cuts and regulatory reform could drive private sector growth and ensure broader economic prosperity.

Related:

4. CALIFORNIA BUDGET WOES

In the News:

California Governor Gavin Newsom and state lawmakers convened a special legislative session to bolster the state budget and "Trump-proof" California’s Department of Justice. The legislature allocated $25 million for legal fees to defend state policies on civil rights, abortion, immigration, and climate change from potential federal challenges. Sources: Associated Press and Fox News.

Dr. Ginn’s Take:

The Purpose of State Budgets: This is a troubling misuse of state resources. Budgets should prioritize the well-being of residents, not fund political battles with the federal government. Diverting taxpayer money for partisan purposes undermines the trust and interests of the people it serves.

Responsible Spending and Sustainability: States should focus on honoring taxpayers by adopting sustainable budgets and spending limits. A sustainable approach ensures fiscal responsibility, leaving more money in residents’ pockets to foster economic growth and individual prosperity.

Spending That Serves Residents: California should prioritize investments that directly benefit its citizens instead of politicizing the state budget. Responsible and impactful spending—improving quality of life and economic opportunity—will create a more prosperous and thriving state. Prioritizing people over politics is the path to real progress.

Related:

5. FUTURE OF HEALTHCARE UNDER TRUMP ADMINISTRATION

In the News:

The future of Biden’s enhanced Affordable Care Act subsidies, set to expire in 2025, remains uncertain under a potential Trump administration. Trump's cost-cutting agenda and Congressional input will shape the path forward for healthcare policies affecting millions of Americans. Source: Business Insider

Dr. Ginn’s Take:

Tackling Waste and Inefficiency: Trump has signaled a commitment to addressing government inefficiency, and Medicaid is a prime target. The program currently operates with significant dollar inefficiency, spending excessive taxpayer dollars while delivering limited value. Reform is essential to curb waste and improve outcomes.

Reevaluating ACA and Medicaid: The Affordable Care Act exemplifies federal overreach in regulating Medicaid, with Biden’s enhanced subsidies further inflating costs. These subsidies, set to expire in 2025, have contributed to unsustainable spending with limited benefits. Scaling back such measures is crucial to addressing the trillions in deficit spending driving the nation toward fiscal instability.

Shifting Cost and Control to States: Transitioning Medicaid to a block grant model would empower states to manage their programs more effectively. Fixed federal funding would remove incentives for overspending, promoting responsible budgeting while allowing states to design healthcare solutions tailored to local needs. This approach would reduce federal waste and lighten the burden on taxpayers.

Related:

6. CREDIT CARD USERS SEE HIGHER RATES

In the News:

Out of fear of an impending CFPB regulation, some banks have raised credit card interest rates and introduced new fees. But now it is uncertain if this rule to cap late fees at $8 per incident will ever take effect. Source: NBC News

Dr. Ginn’s Take:

Consequences of Price Controls: While the CFPB’s proposed cap on credit card late fees aims to reduce consumer costs, it risks unintended consequences that could make credit more expensive and harder to access. Credit card companies, facing reduced fee revenue, are already increasing interest rates and adding new charges, disproportionately impacting borrowers with lower credit scores who rely on affordable access to credit.

Business and Community Impacts: Small businesses often depend on credit to manage cash flow. Under this rule, they could face tighter lending standards and higher costs as banks adjust to recoup lost fee income. Additionally, vital for local economic growth, small banks and credit unions may be forced to reduce lending, further limiting opportunities for entrepreneurs and local projects.

History's Lesson: Price controls may sound appealing but frequently lead to market distortions that hurt the very people they aim to help. Capping late fees will lead to higher consumer costs and reduced credit access. Protecting consumers should involve thoughtful solutions that preserve market functionality, not restrictive policies that create new challenges.

Related:

7. New Texas Speaker of the House

In the News:

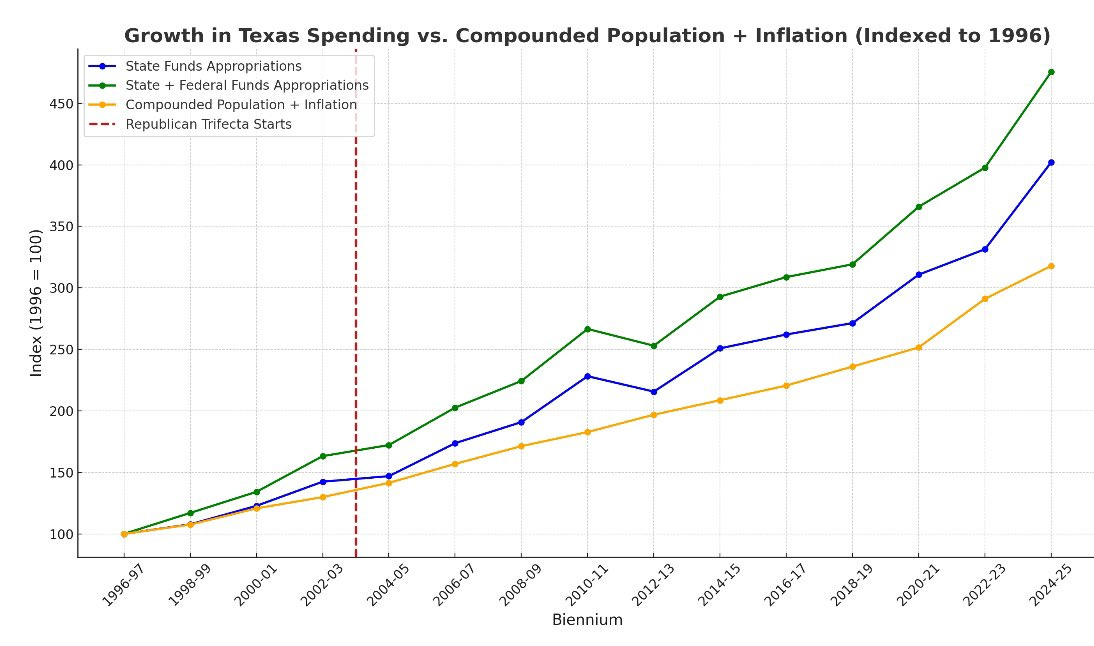

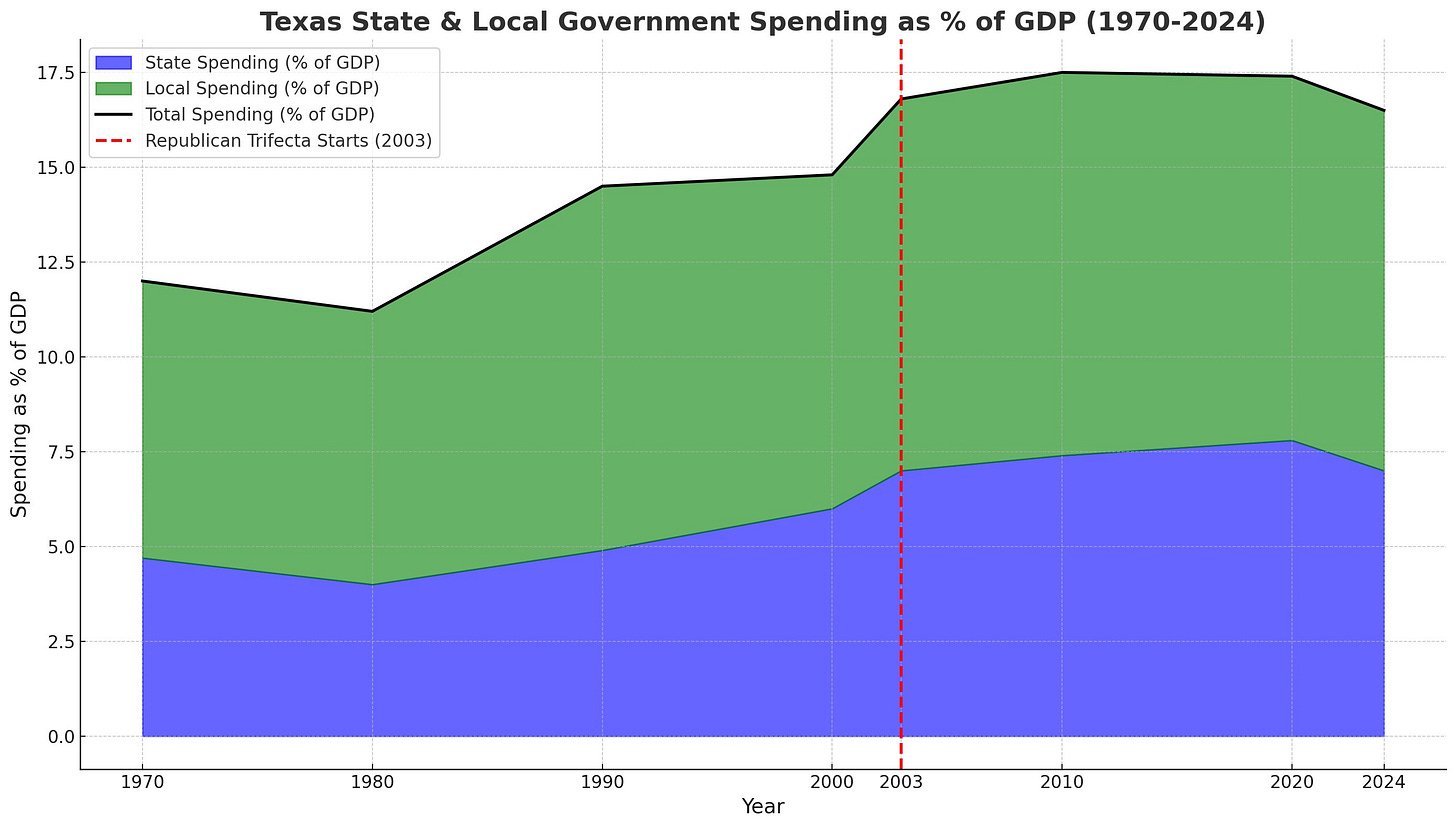

Texas is gearing up for new leadership in the state legislature, with House Representative David Cook expected to assume the role of Speaker after Dade Phelan stepped down from his bid for a third term. As the Lone Star State prepares for the 2025 legislative session, the focus turns to addressing pressing challenges, including skyrocketing government spending. Since 1970, Texas’s state and local government spending as a share of GDP has surged from 12.0% to 16.5%, burdening taxpayers and threatening economic competitiveness. Source: Dallas Morning News

My Take:

Spending Limits Must Be Strengthened:

Texas’s spending as a share of GDP has nearly doubled since 1970, and even under Republican leadership, it reached an alarming 17.5% in 2010. It’s time to adopt a stronger constitutional spending limit that covers all state and local spending, tying growth to a maximum of population growth plus inflation, as advocated by my work at Americans for Tax Reform, Texans for Fiscal Responsibility, and others. This approach ensures fiscal discipline and protects taxpayers from unnecessary government expansion.Tackle the Affordability Crisis:

Excessive spending has driven up taxes and contributed to Texas’s affordability challenges, particularly in housing. Cutting wasteful programs and reforming local regulations are essential to easing the financial burdens on families and businesses, ensuring that economic opportunity is accessible to all Texans.Bold Reforms Needed for Prosperity:

With Rep. Cook as Speaker, the legislature must prioritize free-market solutions. These include gradually phasing out property taxes by using surplus revenue, reducing the size of government, passing universal school choice, empowering parents to deal with kids being online and on social media rather than politicians and bureaucrats, and eliminating barriers to economic growth. Texas can remain a beacon of economic freedom and opportunity by implementing these reforms.

Related:

Thanks for joining me in this episode of "This Week's Economy." For more insights, visit vanceginn.com and get a paid subscription to my Substack newsletter at vanceginn.substack.com today so you receive these insights in your inbox. God bless you, and let people prosper.

Keep reading with a 7-day free trial

Subscribe to Let People Prosper to keep reading this post and get 7 days of free access to the full post archives.