323. Economy Shifts: Fed Cuts, Tax Moves, and TikTok Ban | This Week's Economy Ep. 91

Insights into this week's major economic and policy developments shaping the nation's future.

Hello Friends!

Welcome to This Week’s Economy podcast! In this episode, we explore the Federal Reserve’s interest rate decision, President-elect Trump’s ambitious early agenda, the potential fallout from a looming TikTok ban, and new state tax competitiveness rankings. Join me as I unpack these pivotal developments, their economic implications, and the actions needed to secure prosperity for all Americans. Watch the episode on YouTube below, listen to it on Apple Podcast or Spotify, and visit my website for more information.

1. FEDERAL RESERVE INTEREST RATE DECISION

In the News:

The Federal Reserve is expected to reduce its federal funds interest rates by 25 basis points to a range of 4.25-4.5% at its meeting on Tuesday and Wednesday, signaling a cautious but continued monetary policy easing. Policymakers will likely pause additional cuts in early 2025 to assess the economic trajectory amid persistent inflation and a strong labor market. Source: Reuters

Dr. Ginn’s Take:

The Danger of Premature Easing: Reducing rates while inflation remains above the 2% target reflects the policy mistakes of the late 1970s, when premature monetary easing reignited inflation. This misstep necessitated severe corrective actions to restore economic stability, including aggressive rate hikes and a painful double-dip recession.

Balance Sheet Bloat: The Fed’s $7 trillion balance sheet, inflated by pandemic-era policies, continues to sustain excess liquidity that drives inflation. Prioritizing rate cuts over aggressive balance sheet reduction perpetuates these distortions, undermining long-term economic health.

Mixed Signals to Markets: The Fed's confidence in moderating inflation and premature rate cuts sends mixed messages that mirror past missteps. This approach risks eroding market confidence, reigniting inflation, and necessitating harsher measures. A disciplined focus on reducing excess liquidity and maintaining price stability is crucial to avoiding repeat economic instability.

Related: h/t to Committee to Unleash Prosperity

2. TRUMP’S FIRST 100-DAY PREDICTIONS

In the News:

With President-elect Donald Trump taking office next month, many seek insights into the administration’s early priorities. Several sources share that immigration will be prioritized at the start of the year, while tax reform will be prioritized later in the year. Sources: Politico and Fox News

Dr. Ginn’s Take:

Voters Care About the Economy: If the election showed us anything, American voters deeply care about improving our nation’s economy. A new administration must prioritize decreasing federal spending. The anticipated Department of Government Efficiency (DOGE) will likely address wasteful government spending, but Congress must also prioritize this.

Preserving Tax Cuts: Many of the Tax Cuts and Jobs Act provisions expire next year, and many Trump administration leaders hint that it may expire at the end of the year. Preserving tax cuts should be a priority that doesn’t fall by the wayside. Focusing on permanent tax cuts and broader reforms can create a more robust and fair economic environment that truly benefits all Americans.

Opportunity to Promote Prosperity: Americans elected Trump to reduce government overreach and restore economic freedom. Trump’s second term provides a once-in-a-generation opportunity to shrink the federal government and restore power to the states and the people. He can lead this transformation by championing free-market reforms. His legacy depends on it.

Related: My recent piece at :

3. TIKTOK BAN PROBLEMS

In the News:

On January 20, the day President-elect Donald Trump takes office, a TikTok ban will go into effect unless the platform breaks ties with Chinese parent company ByteDance. The law will require app stores and internet browsers to stop distributing TikTok or face penalties. Source: The Hill

Dr. Ginn’s Take:

Government as Gatekeeper: The ban threatens Americans' right to free expression, guaranteed by the First Amendment. Millions of users rely on these platforms to share ideas, create content, and engage in discussions. This ban will curb individual choice, as people will no longer be free to decide which platforms to use.

Harm to Small Business: Small businesses rely on TikTok to market their products in creative ways that other social media platforms have struggled to match. TikTok Shop has attracted more than 500,000 U.S. sellers. Shutting down the platform disproportionately harms small businesses, removing vital marketing and sales tools and damaging the dynamic competitive spirit that fuels economic growth.

Unleash the Free Market: Social media, artificial intelligence, and data-driven technologies drive a fundamental global transformation. Government bans, however, risk stifling this growth. Instead of restricting platforms and technologies out of fear, we should encourage innovation and competition to allow new technologies to flourish.

Related: See my article at

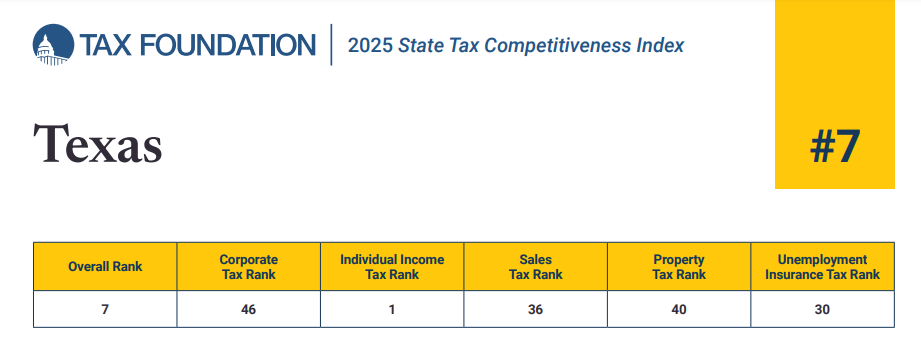

4. State Tax Competitiveness: Texas, Kansas, and Louisiana on the Move

In the News:

The 2025 State Tax Competitiveness Index reveals how well states structure their tax systems. Texas ranks 7th, Kansas holds at 25th, and Louisiana lags at 40th. While each state has made strides in tax reform, challenges remain. Texas benefits from no income tax but struggles with high property taxes and a burdensome corporate tax system. Kansas shows modest improvements but still faces high sales taxes and stagnant income tax policies. Louisiana, though improving with 2024 reforms, continues to grapple with high sales tax burdens and complex tax structures. Source: Tax Foundation

Dr. Ginn’s Take:

Texas: The Opportunity to Lead: Texas can secure the top spot by using surplus revenues to phase out school district M&O property taxes, adopting strong spending limits, and eliminating the burdensome margin tax.

Kansas: Stay Competitive with Bold Moves: To maintain and enhance its tax competitiveness, Kansas must focus on eliminating income taxes and limiting government spending growth.

Louisiana: Build on Momentum: Louisiana’s 2024 reforms are a good start, but to fully unlock its economic potential, it needs stronger spending caps, simplified sales taxes, and further income tax reductions.

Related:

5. TEXAS PROPERTY TAXES ELIMINATION

In the News:

Over the past 26 years, Texas property taxes have increased by an unsustainable 330%, far outpacing inflation growth of 136%. My new research at Texans for Fiscal Responsibility explains how eliminating property taxes will help Texans prosper.

Dr. Ginn’s Take:

Injustice of Property Taxes: The issue is a question of fairness and freedom as property taxes make homeowners perpetual renters from the government. Families can build lasting economic stability and wealth by eliminating this financial burden.

Strategies for Reform: Two realistic approaches to eliminating property taxes are surplus-driven buydowns, funded by limiting government spending growth, or a redesigned tax system that shifts revenue sources, such as increasing sales taxes. Both options prioritize sustainability and economic prosperity.

Economic Growth Through Tax Reform: Reducing or eliminating property taxes can drive stronger economic growth by lowering barriers to homeownership and encouraging investment. Shifting to a more transparent and predictable tax system would enhance Texas's appeal as a destination for businesses and families.

Related: Findings from the report…

Thanks for joining me in this episode of "This Week's Economy." For more insights, visit vanceginn.com and get a paid subscription to my Substack newsletter at vanceginn.substack.com today so you receive these insights in your inbox. God bless you, and let people prosper.

Keep reading with a 7-day free trial

Subscribe to Let People Prosper to keep reading this post and get 7 days of free access to the full post archives.