69. Zombie Economy: Ensuing Recession?

In this newsletter, I highlight the latest info on the June jobs report, inflation, stagflation, zombie firms & workers, bad econ policy, property tax relief in Texas, poverty relief efforts, & more.

Hello Friend,

How are you? Too often this simple question is forgotten these days. We should take an interest in everyone we meet. What easier way to do so than ask: How are you? But apparently, research says that successful people have stopped doing this, which may be a reason there’s such distrust for many in leadership positions. Get back to it.

Speaking of distrust, the distrust in policies out of D.C. continues to grow. Rightfully so given the crushing blow of inflation which is taking a toll on all of us. We’ve got a lot to discuss since my last newsletter, and don’t miss my latest Let People Prosper show with two happy warrior economists, so let’s get to it.

Hot Take: I’m concerned about the state of the economy. And it looks like a major concern in my simple poll on Twitter is rightfully on Big Government.

I’m concerned about inflation due to excessive demand from too much money created by the Fed chasing restricted supply of goods and services by President Biden’s regulatory overreach and Congress’ overspending and handouts. But I have a hypothesis that I’m following regarding the more than 5 million job openings above the total unemployed across the nation. This doesn’t seem legit to me. So, this has me thinking that labor demand by firms (i.e., job openings) and labor supply by workers (i.e., unemployed) aren’t telling the complete story. I don’t have all of the pieces yet so I want to share my theory with you in case you find information on it or have thoughts…please share.

Labor Demand: The theory is that on the labor demand side there are many “zombie firms” which have been paying their bills with PPP loans/grants and low-interest rate loans that propped them up for a while (hence like a zombie) but are on the verge of falling quickly with funds drying up and interest rates rising. There is some evidence of this as small businesses dropped 91,000 jobs in May according to the ADP report. Keep an eye on this moving forward as these firms, especially small businesses, may start filing for bankruptcy and firing workers quickly if this is true and starts to unwind.

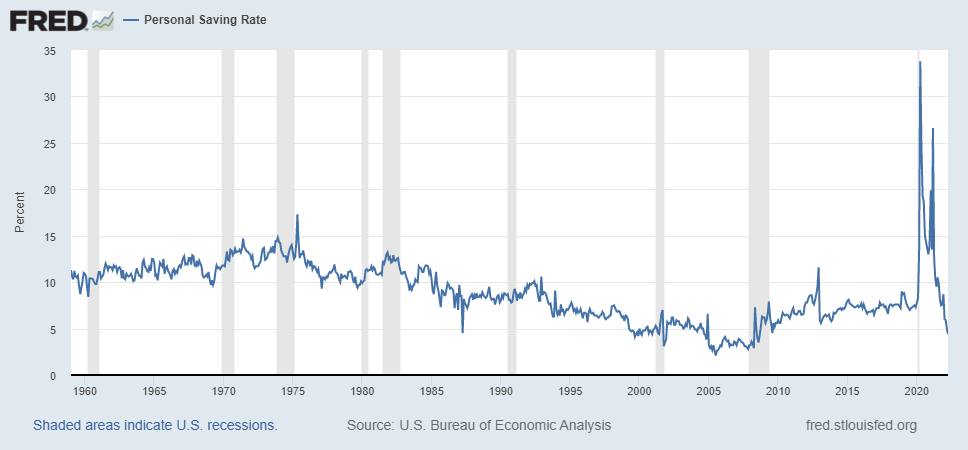

Labor Supply: Regarding labor supply, there are millions, likely at least 3 million, people who remain out of the labor force since the shutdown recession, let’s call them “zombie workers.” Of course, many people who were forced to stay home lost their job if that business closed so they became dependent on three “stimulus checks,” massive unemployment insurance payments, healthcare coverage through Medicaid, and other safety-net measures funded with taxpayer dollars (NO FREE LUNCH). These redistributed handouts contributed to spikes in the nation’s personal savings rate to 33.8% in April 2020 and to 26.6% in March 2021, which the rate remained historically high in that year because many places were closed and many people were mostly forced to stay home by governments (terrible action that did way more harm than help). This had a double-whammy effect of changing people’s desire to get a job as they became frozen at home or found a way to get income without going to work and the savings gave many the means to stay home for a long time. But with high inflation (i.e., 8.3% over the last year per CPI inflation), many government handouts drying up, and savings being depleted (the latest rate is 4.4% in April 2022), many people will have tough choices to make about whether to go back to work. This could mean that they start searching for work again which will drive up the unemployment rate initially, and if they don’t find work quickly, they could fall behind on their bills contributing to major budget problems for them, businesses, and the financial system.

Result: The combination of zombie firms failing and zombie workers arising would mean that the supposed “strong economy” is very fragile and things could unravel quickly. This would make the job openings above the unemployed figure drop quickly, the unemployment rate would rise quickly, the number of jobs created would decline quickly and possibly fall, asset prices like housing and the stock market would deflate quickly, and other markets would begin to correct after this disastrous period of public policy that started in March 2020. We’ve never had a recession or economic situation like this as governments had never shut down businesses or locked people in their homes, and the devastation for people’s lives and livelihoods will continue for a long time (especially kids). More reason this nonsense must never happen again. I hope that I’m wrong. I think it is essential for state and local governments to stop spending so much and provide substantial tax and regulatory relief to withstand the ensuing recession because the Biden administration will likely just make it worse.

Personal Take: I’ll speak at The CFO Leadership Council meeting in Austin this week about the economy.

After a couple of rough months as noted in my previous newsletters, things are getting back to a good routine. We’ve been dealing with our baby girl (8 weeks now) having colic so that’s been a struggle. And I’ve been missing my mom daily so that’s been a struggle. And work has been heating up with research and advancing sound policies so that’s been a struggle. But those struggles keep me striving to let people prosper and God’s grace keeps me going so I have no struggle to tough to not keep smiling and remaining optimistic. God is good!

We celebrated those who paid the ultimate sacrifice while fighting for our freedom in America by going fishing.

And check out this amazing new picture with my beautiful wife and wonderful kids in the bluebonnets in Texas. It doesn’t get better than that!

TEXAS & OTHER STATES ECONOMIES AND POLICIES

I testified before TX Senate Finance Committee on eliminating M&O property taxes while funding critical government provisions. Watch here at 1:56:00.

Nice write-up on my testimony before the Senate Finance Committee.

Texas needs to lower property tax bills for everyone. More here.

Spending restraint based on a fiscal rule is essential. Here’s why:

Without fiscal restraint, there is massive debt.

Texas is doing its part but there’s only so much that producers can do.

Interesting video on an important issue when using taxpayer dollars.

My recent op-ed on the need for a more holistic approach to poverty relief.

Evidence of people moving with their feet.

People keep moving with their feet to lower spending, taxing, regulating states.

U.S. ECONOMY AND POLICIES

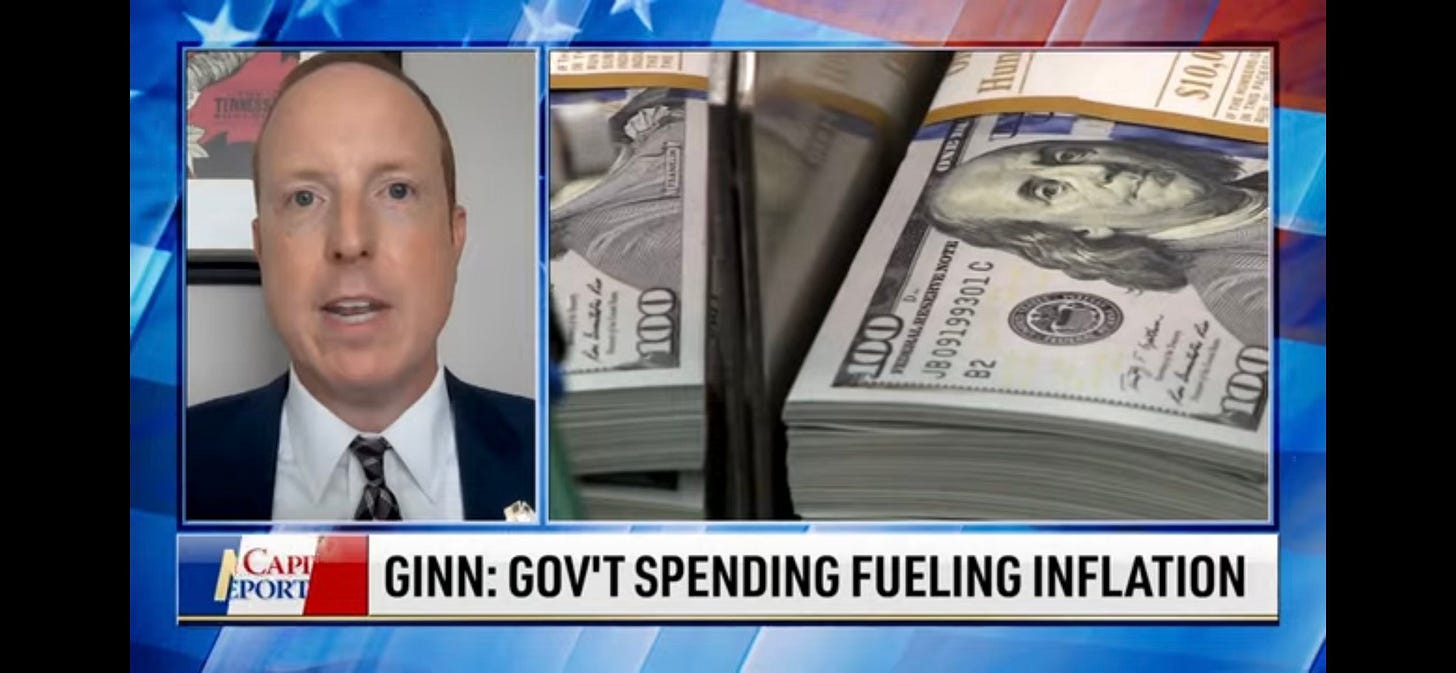

Don’t miss my interview on NTD News Capitol Report show with Steve Lance.

Latest jobs report for May had strengths but also major weaknesses.

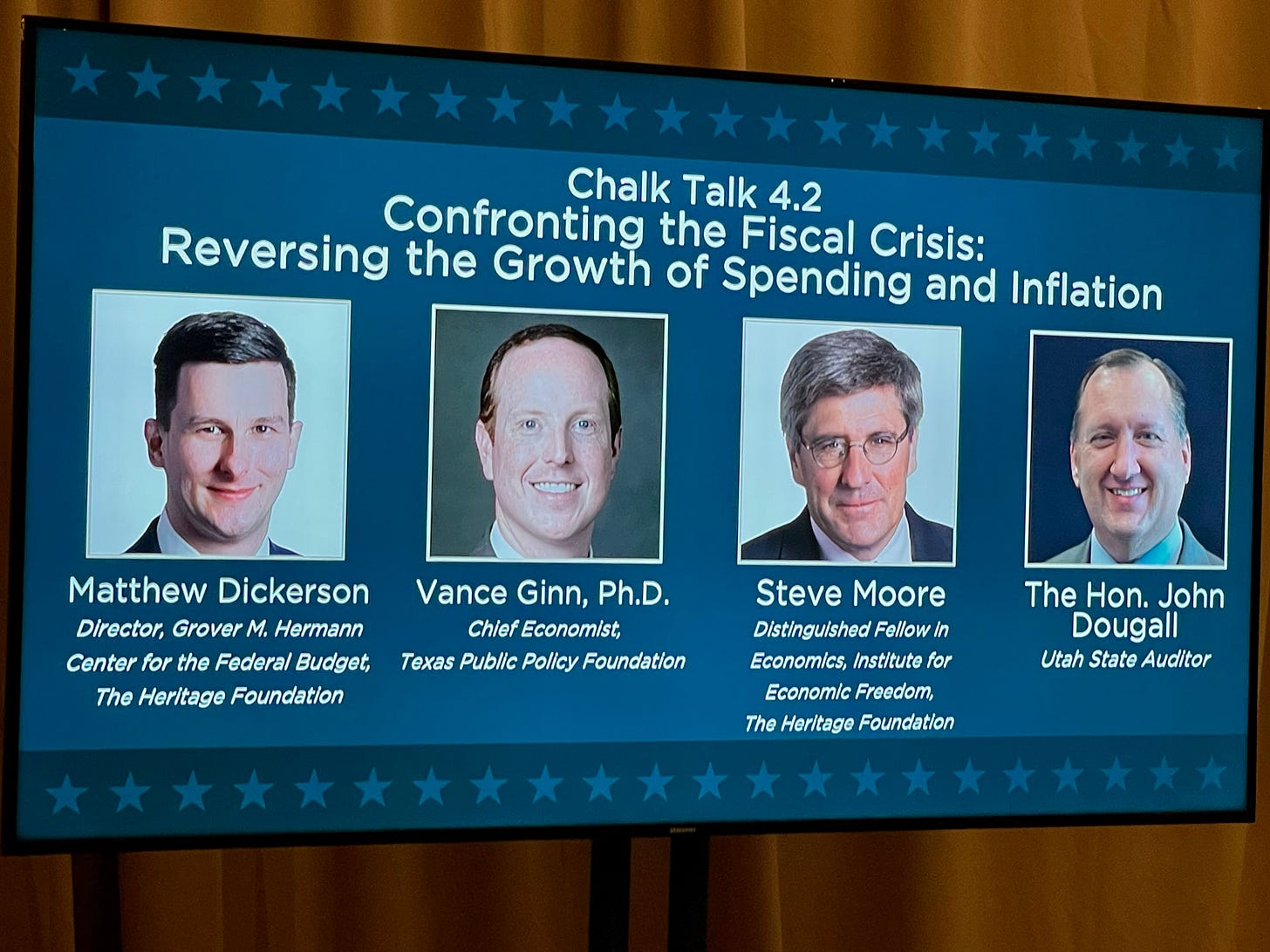

Enjoyed this panel at Heritage’s Resource Bank on spending and inflation.

Spending is the disease, high taxes & debt are just a symptom of the disease.

Stop trying to solve problems with government caused by government.

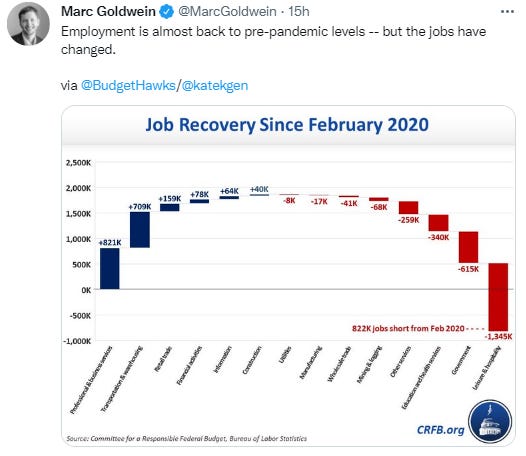

Weaknesses remain in the labor market, note the inequality this creates.

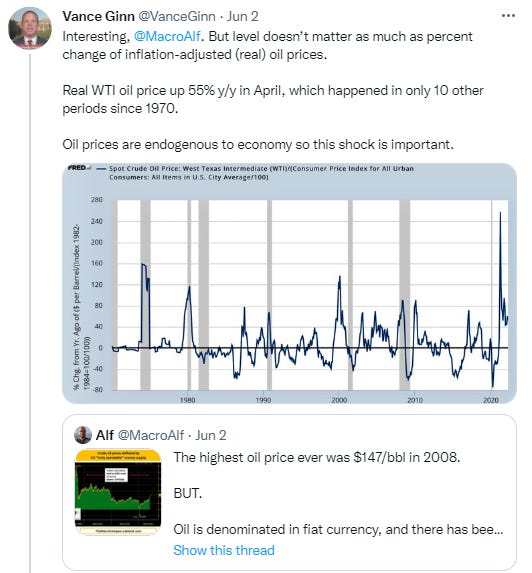

Remember that inflation-adjusted shocks are what matter.

Did I mention there is no tax revenue problem…ever!

It’s starting to seem like they’re not serious about using good policy.

Closing Thoughts

From GOAT#3 Thomas Sowell on the importance of tradeoffs when emotions are hot.

I’m praying that God will give us strength during these trying times. We’ve got this!

Thank you for reading and sharing this newsletter. Many blessings to you and yours!

Overview of the Let People Prosper newsletter: We believe that an inclusive institutional framework with individual liberty, strong families, robust civil society, competitive capitalism, and a constitutional republic best supports abundant opportunities to mitigate poverty and let people prosper. This prosperity isn’t just material but spiritual, psychological, social, etc. that satisfies human desires. Given this understanding and my experience and research as a free-market economist, I provide trusted views on economies and policies across America, especially in Texas where I reside. Please subscribe & share.