70. Start With Why: Rising Energy Prices, Inflation, & Stagflation

In this newsletter, I highlight the latest historically high CPI inflation report, rising stagflationary pressures, need for pro-growth policies, soaring oil and gasoline prices, and more.

Hello Friend,

Do you know why? This is a key question that we should be asking ourselves when we do anything because every decision has a tradeoff (i.e., the best-forgone decision is known as an opportunity cost in economics). Some are minor: Why will you wear that shirt today? But others are major: Why do you work? Understanding each stage of your reasoning to work prepares you for success. For example, my reason to work is to let people prosper, which I believe is my God-given calling. The tool that I’ve been blessed to use is economics, which you’ve likely heard me talk about too much. Ha!

I had always focused on this question but Simon Sinek’s Start With Why: How Great Leaders Inspire Everyone to Take Action made it tangible to me. He provides a nice overview of how successful leaders start with why their organization does what it does. If that's not clearly known and expressed often, then the organization will falter and ultimately fail as the employees and customers will lose track of the ultimate goal. Starting with why is a very good way to determine whether you are heading in the right direction in everything you do. While I think that the what and how that a company or individual accomplishes their why is important, which is often overlooked throughout the book, starting with why is beneficial.

Why do you do what you do? Why do you read this newsletter? I hope reading it helps expand your horizons on why you do what you do.

HOT TAKE

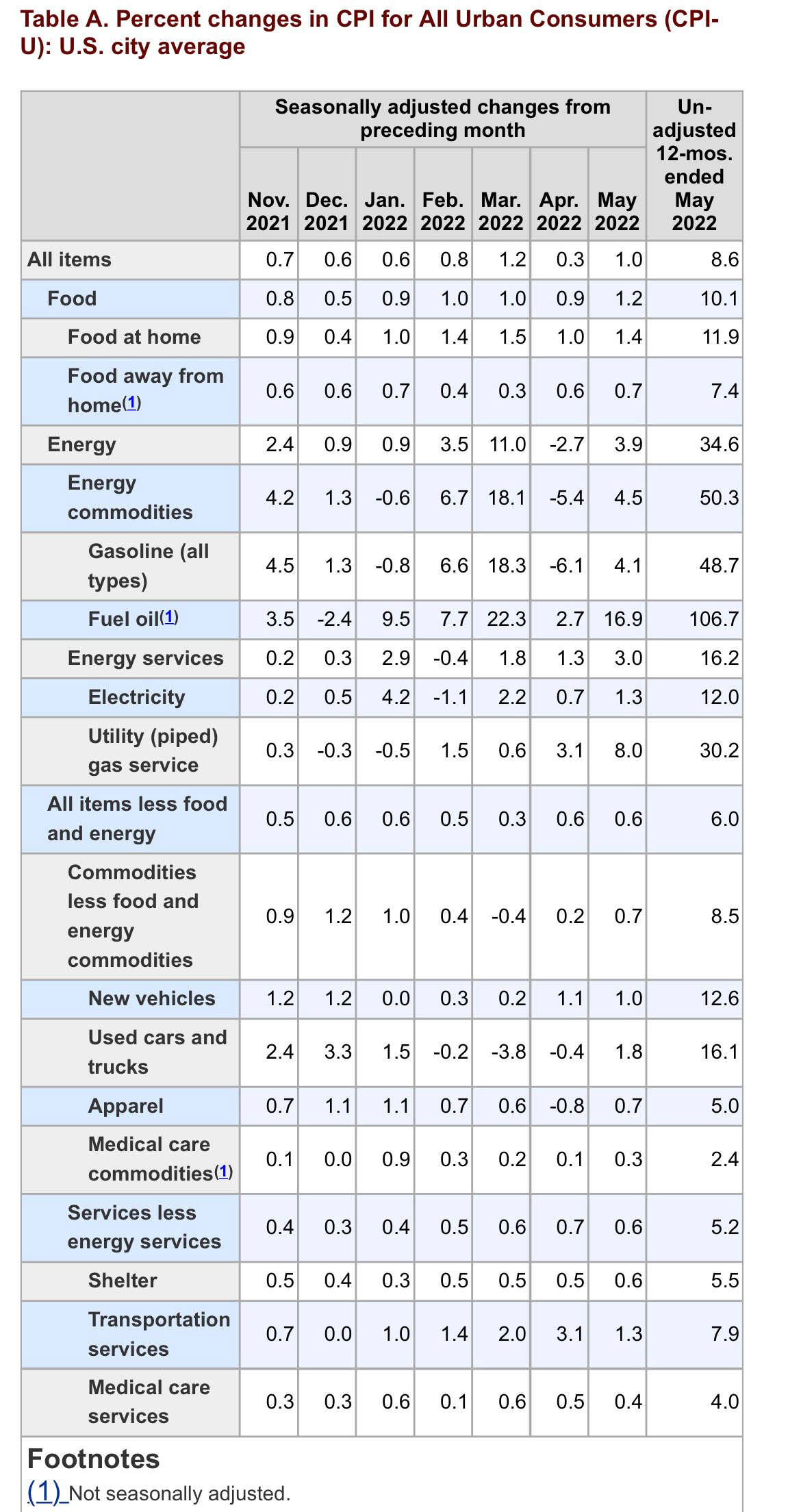

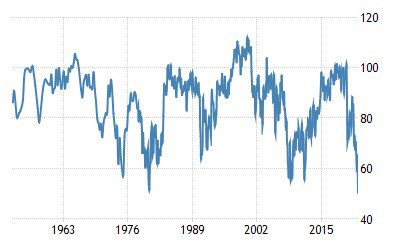

To build on my last newsletter when I introduced my thoughts on the zombie economy, inflation continues to roar higher. Last week, the Bureau of Labor Statistics released a report on the consumer price index, which shows that price inflation was up 8.6% in May 2022 over May 2021. This was the highest recent rate of inflation and the highest since December 1981—one month after the greatest month because I was born. Ha!

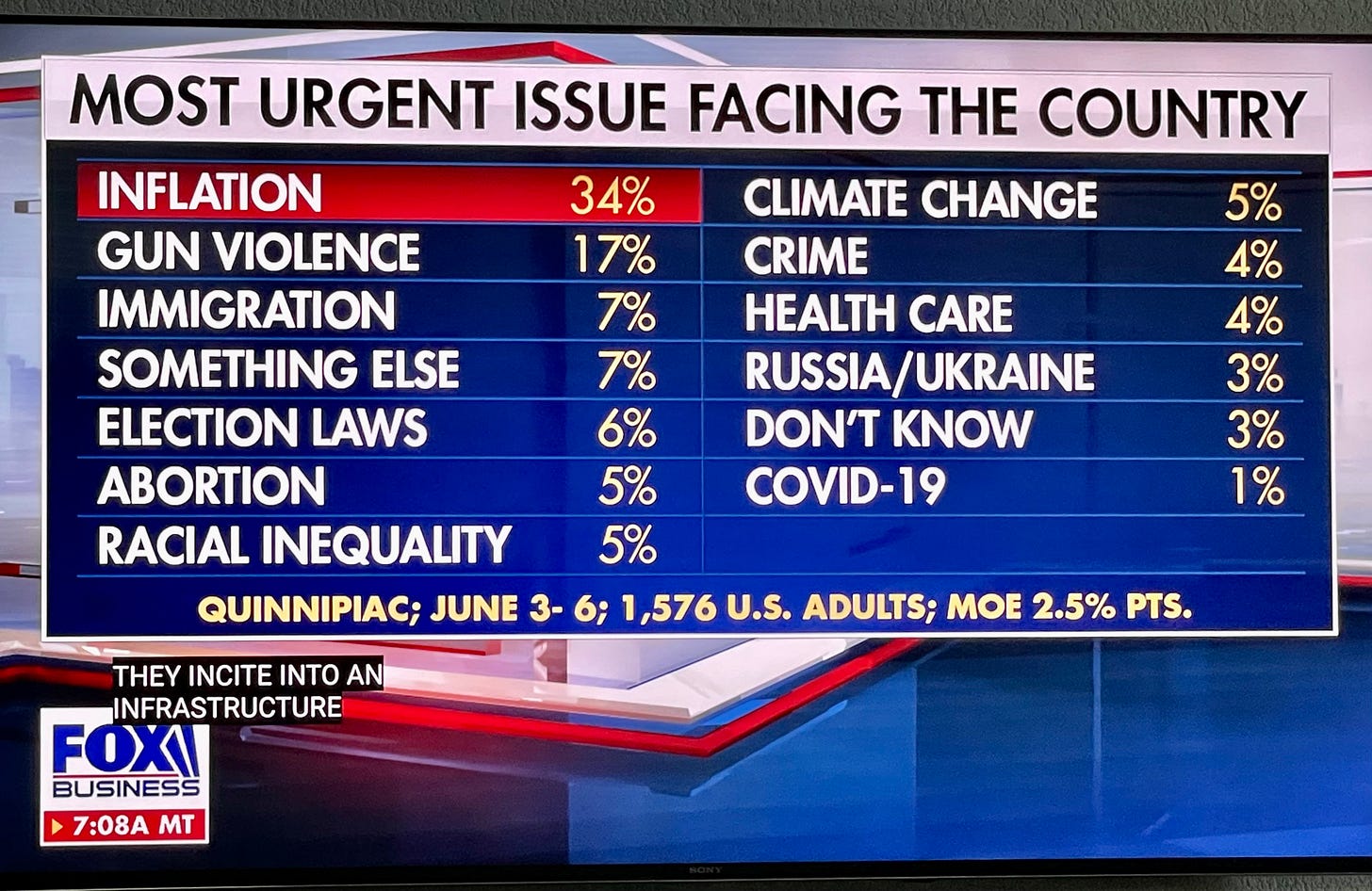

But check out how these charts that were on Maria Bartiromo’s show on Fox Business on Sunday.

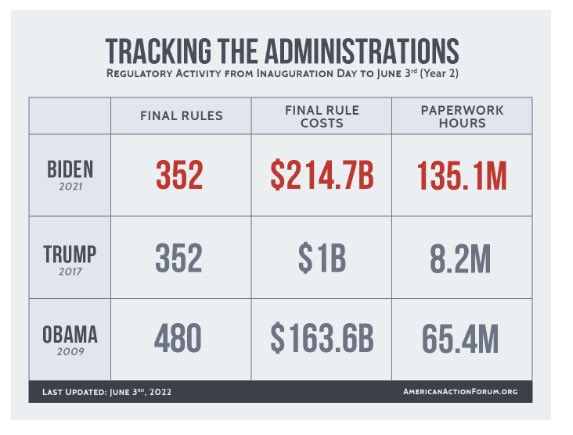

They indicate the major concern of inflation and how it has continued to rise for more than a year now during the Biden administration. But it started rising during the last couple of months of the Trump administration after President Trump, Congress, and the Fed took big actions during the government-imposed shutdowns. President Biden, Congress, and the Fed then doubled down on those initial actions when the economy was already hot.

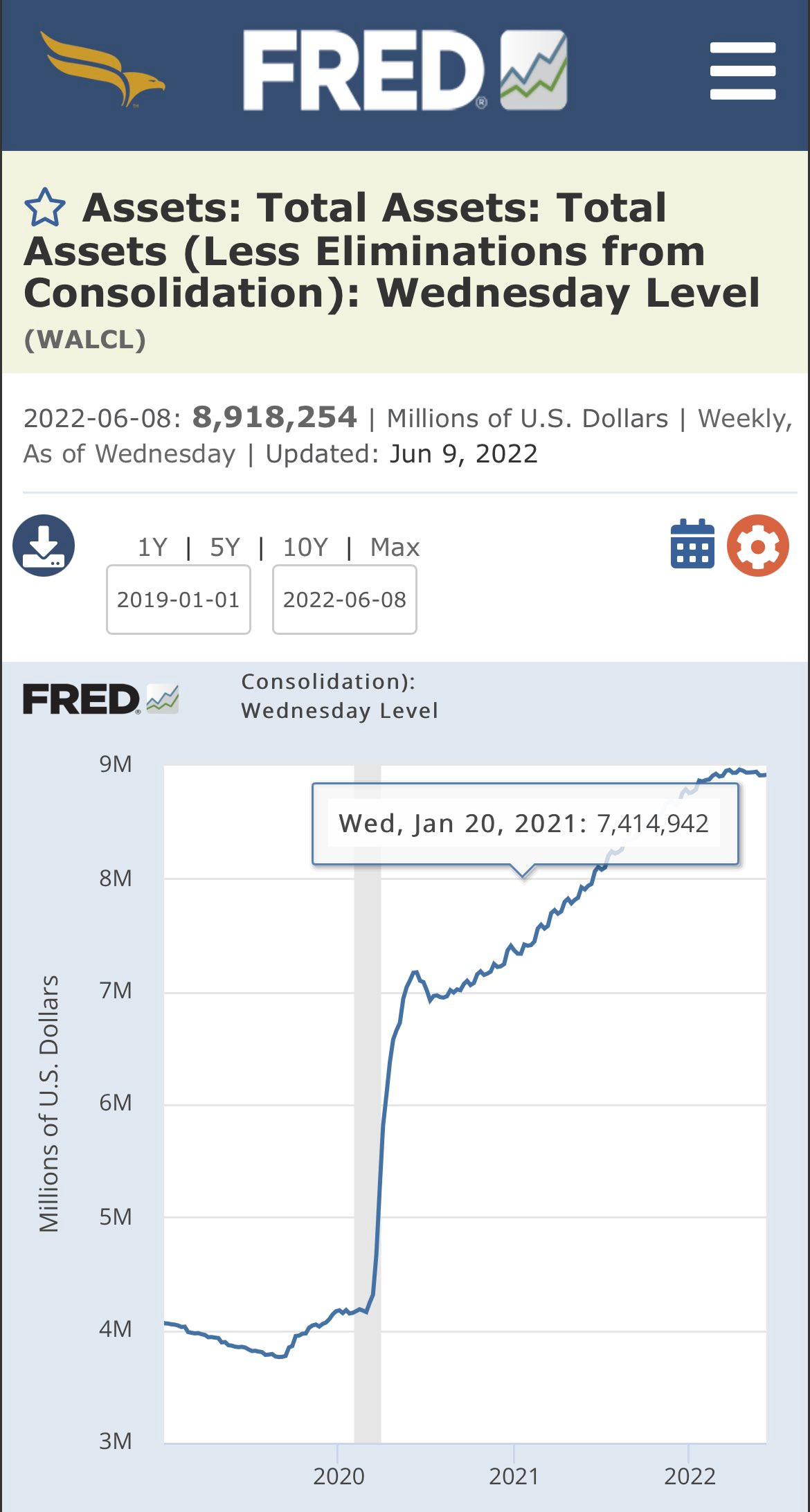

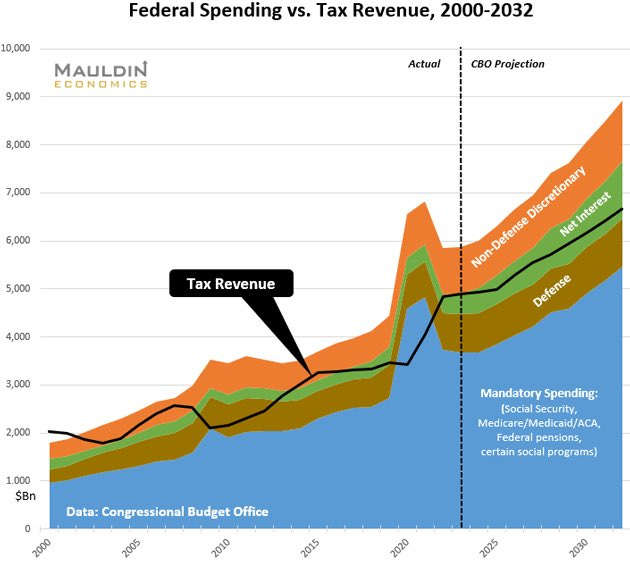

This is important to understand why this was not going to be “transitory” inflation, whereby the inflation rate will go up but when supply chains and other factors normalize there will be a quick slowdown in the rate. In addition to watching the supply chains and other potential transitory factors, I was watching the unprecedented growth of government spending of nearly $7 trillion either spent or appropriated, massive deficits totaling $6 trillion over the last two years, low target federal funds rate of 0-0.25% by the Fed, and extraordinary expansion of the Fed’s balance sheet from $4 trillion to $7 trillion to $9 trillion as it helped hold the target rate low even as the debt growth would ordinarily drive up interest rates.

There were the typical subsequent increases in asset price (e.g., stocks, bonds, real estate, etc.) as the new money created first goes to those with high credit. This policy approach then trickled down (the true trickle-down economics) to consumer goods over time from the increased money supply and higher asset prices (along with supply chain factors). But there is more inflation to come before this process reverses, with higher food prices being a key factor.

The result will be even slower economic growth, and a likely deep recession, because the Fed will have to tighten fast and for a while to rein in out-of-control inflation and there is little reason to believe that President Biden and Congress will pass pro-growth policies that remove barriers for the supply side to grow.

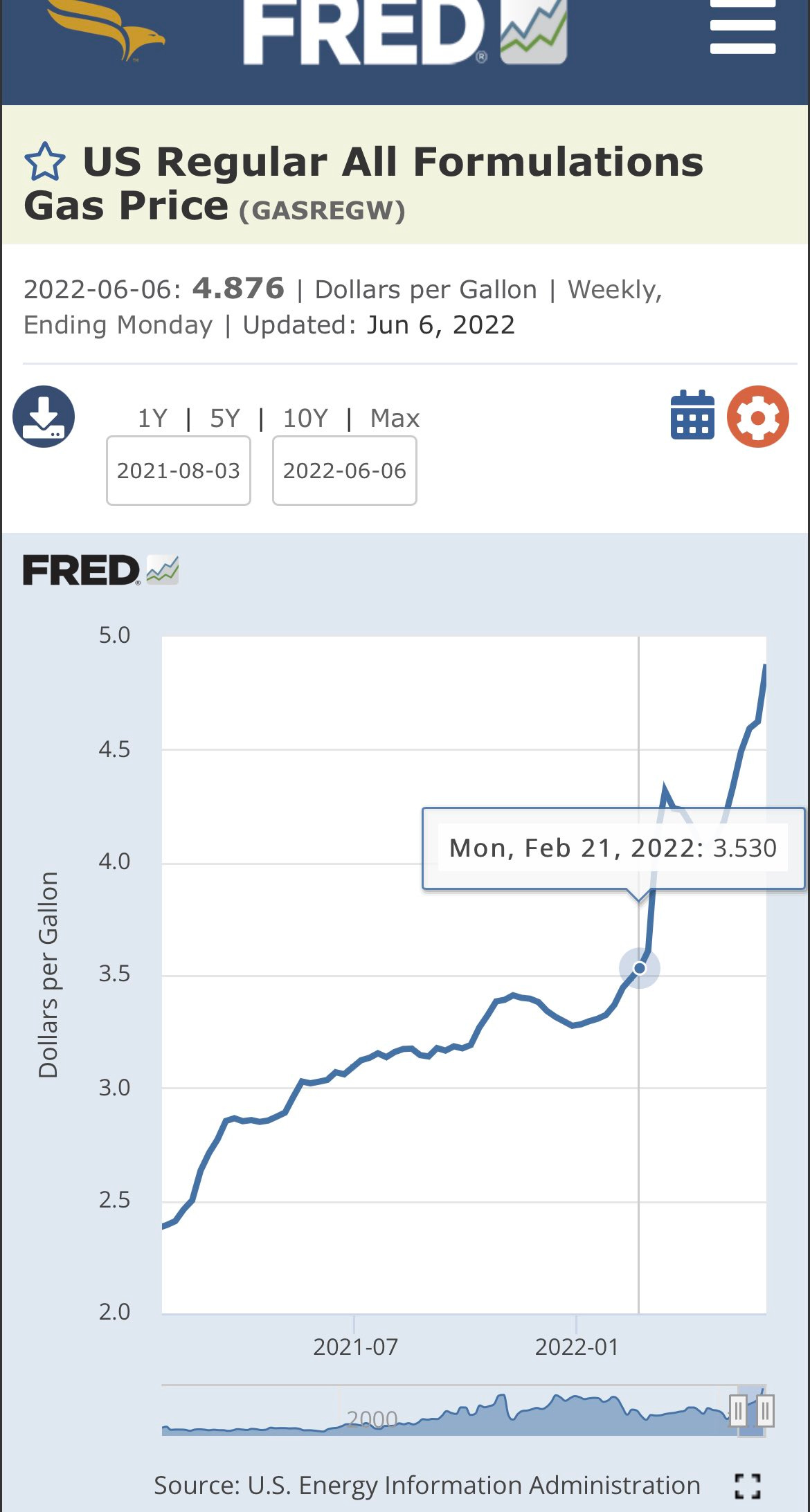

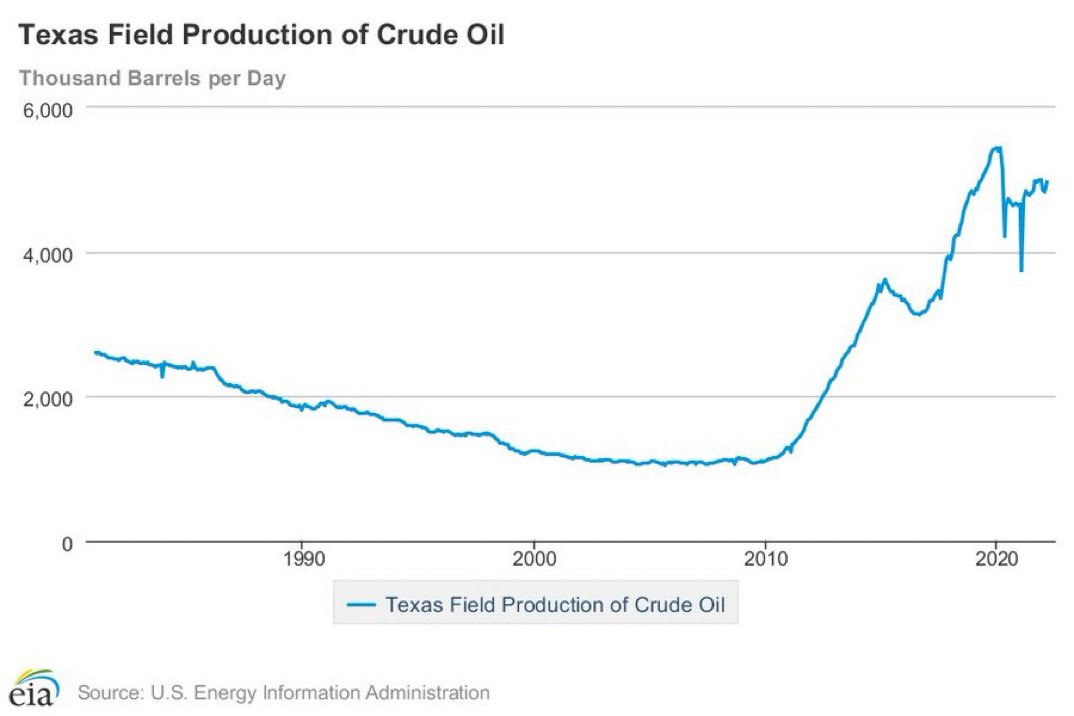

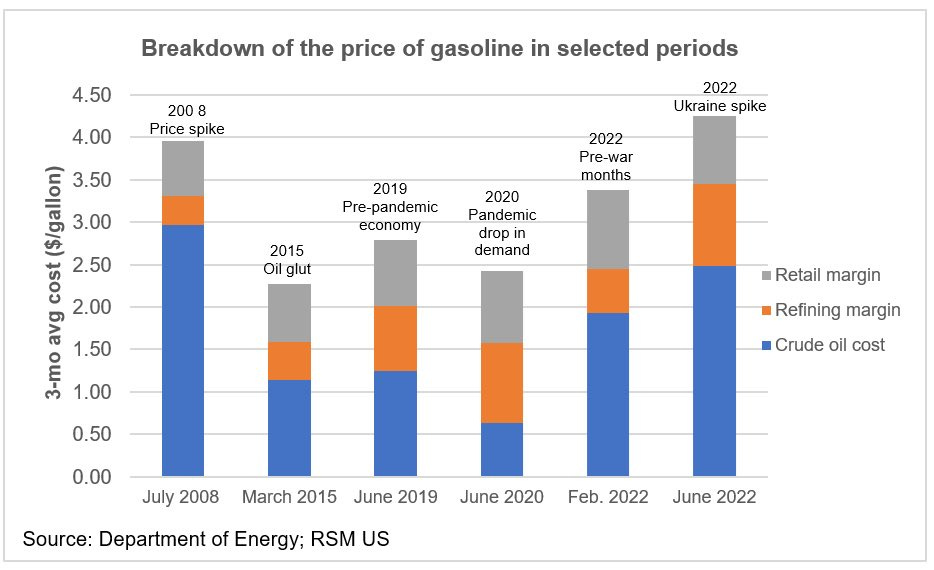

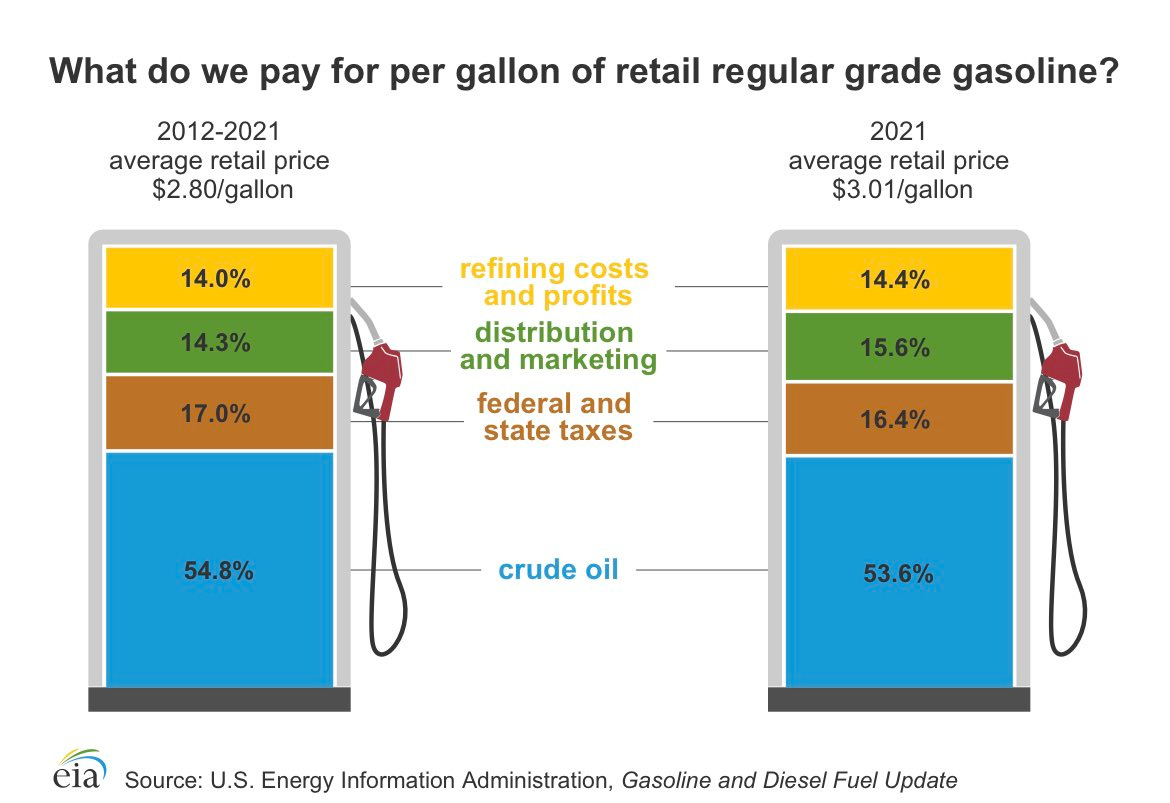

If we add into this story how oil and gasoline prices are soaring mostly because of bad policies out of the White House, then you get even higher prices in the energy market to go along with the broader inflationary pressure from the Fed’s poor actions.

Here’s my 3-part tweet in response to the White House’s press secretary (ridiculous) tweet.

Therefore, I believe we’re in a period of stagflation that will last for a while even when the recession hits. In fact, the first quarter of 2022 had a decline in economic output by an estimated -1.5% and the Atlanta Fed’s GDPNow for the second quarter is only +0.9%, which would result in negative growth in the first half of 2022.

And if my theory of a zombie economy that I laid out in my last newsletter is correct, the collapse of the economy along with higher prices could happen very quickly. We should prepare ourselves in our personal budgets but also in government budgets by removing barriers at every level of government because the resources are best used by families, businesses, and non-profits in the private sector. And be praying for our country, leaders, and people here and around the world. We all need it.

TAKE ON ECONOMIES & POLICIES IN STATES

Skyrocketing housing costs prove the need for lower property tax bills in Texas.

Real Clear Policy piece on why sound budget and tax policy matter.

End taxpayer-funded payments to chosen businesses at expense of all others.

Government failure caused the baby formula shortage and price spikes.

Watch as local governments decide their budgets and then tax rates.

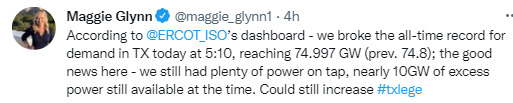

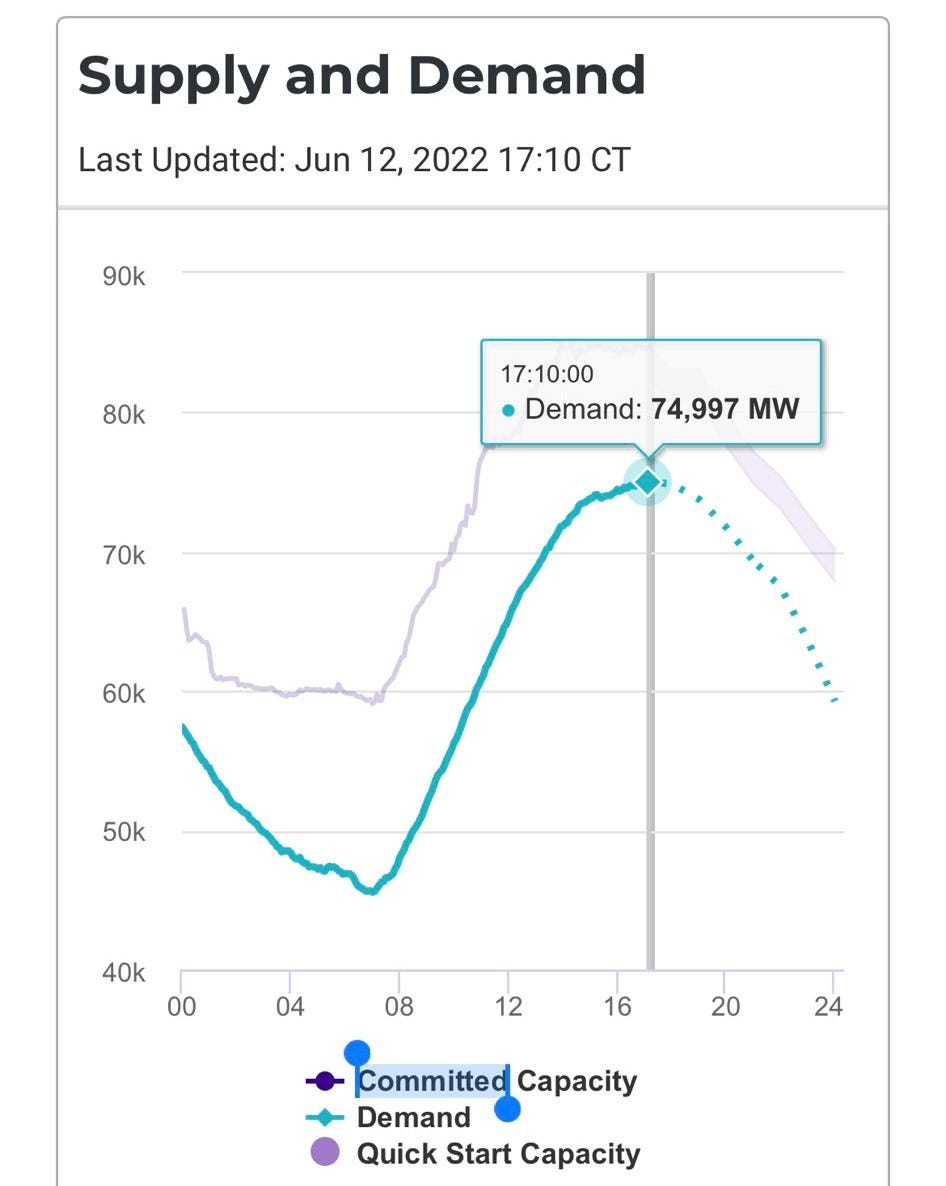

Texas’ electrical grid is running well now as the wind blows, but is it hot air?

Check out my interview with Terry Lowry on poverty relief.

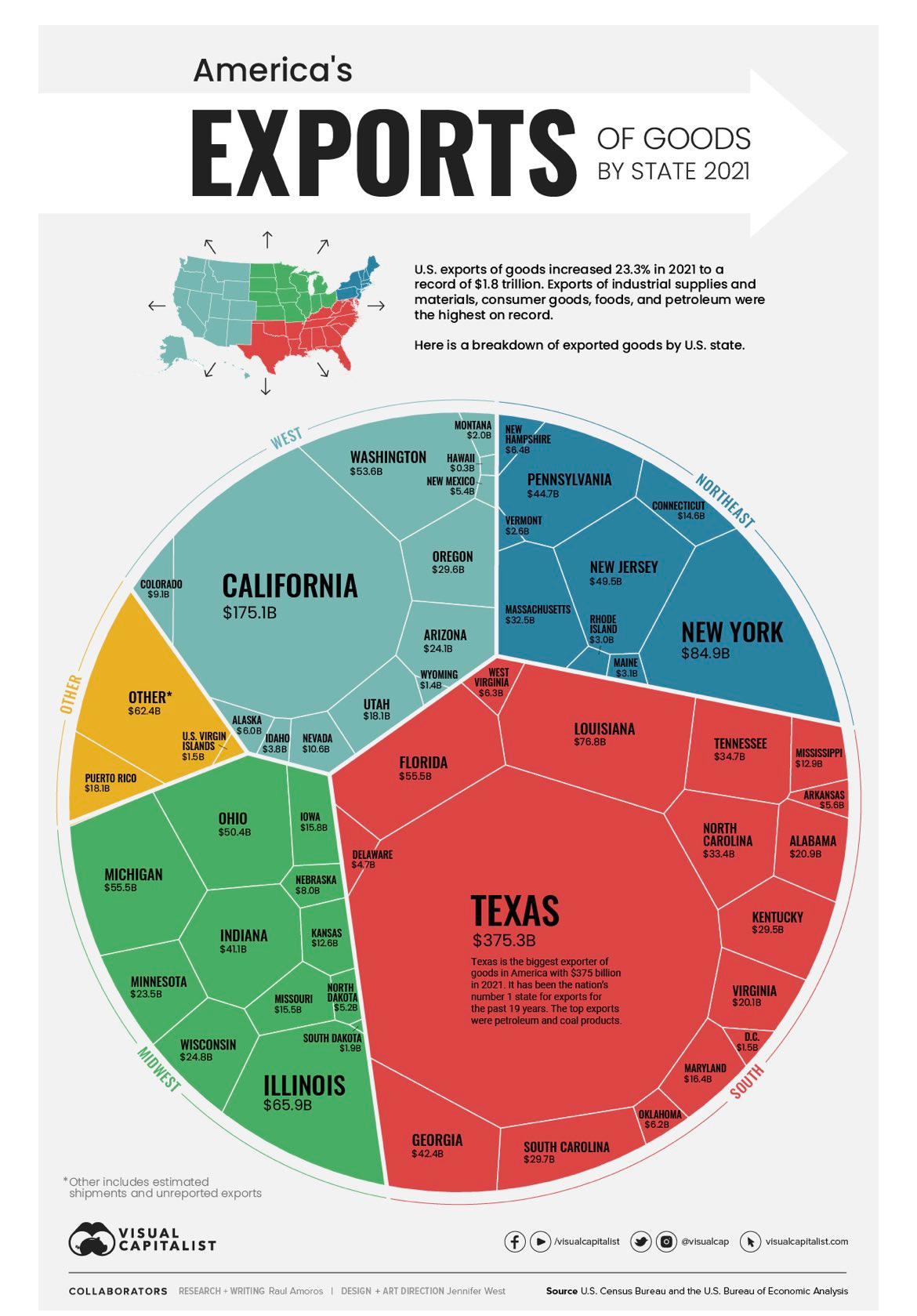

International trade is important to human flourishing. We need more free trade!

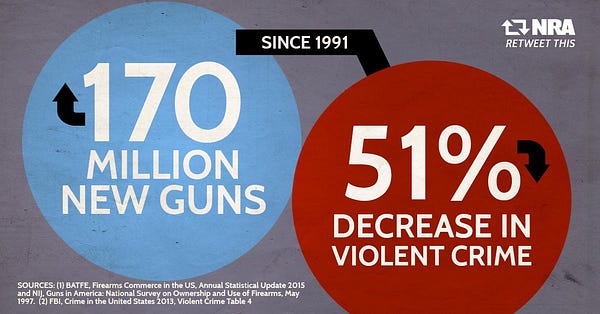

A nice short piece by Dan Mitchell on the case against gun control.

Opportunity for folks across the ideological spectrum to mitigate poverty.

TAKE ON ECONOMIES & POLICIES IN COUNTRIES

Fiscal sanity must start now in D.C. before it’s too late (if not already).

The misery index has been this high in only 8 other periods since the 1940s.

There must be a pro-growth policy approach to turn things around.

An approach was provided by the conservative Republican Study Committee.

Another sound approach is Senator Rand Paul’s Six Penny Plan.

Recession fears start to mount…and they’re not wrong.

The period of high energy prices is a reason we must say NO to a carbon tax.

The real estate market that has booming may be ready for a bust…

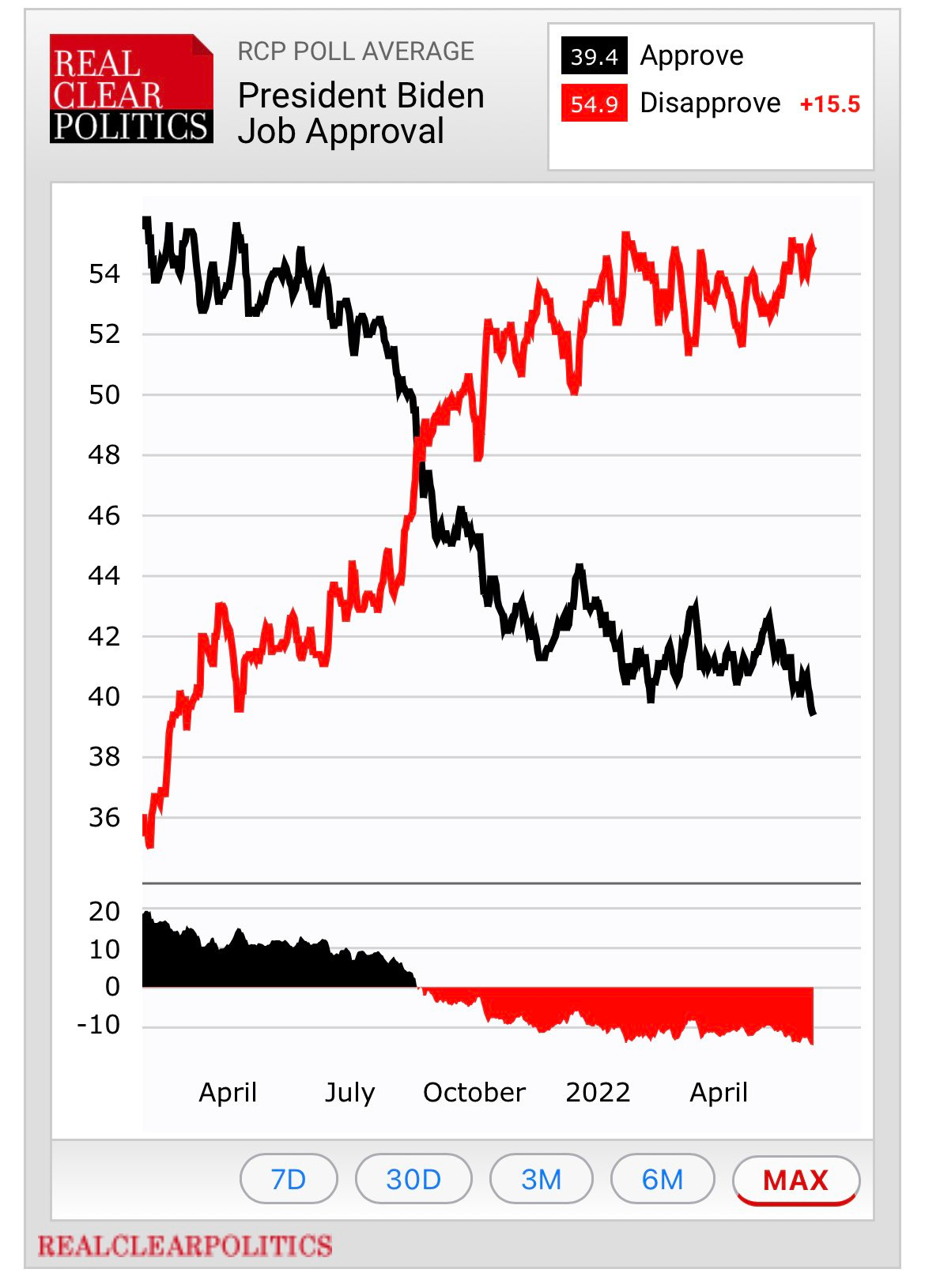

Consumers’ mood and President Biden’s polls hit record lows.

This sort of comparison is weak from selection bias and omitted variable bias.

PERSONAL TAKE

The family is doing pretty well. We’ve had some ups and downs over the last week but I truly believe we are building toward something big. The baby is almost 10 weeks old and is still dealing with colic but much less than before. We’re also stocked up on baby formula, thanks to our church family. I’ve appreciated the time home more with the family even though it wasn’t the best of circumstances with the loss of my mom. Each day is new and another day to be blessed and flourish more. As I focus on my “why,” I’m always looking for ways to expand my work to let people prosper. Please share your thoughts if you have them. I hope you’re doing well! Reach out any time.

CLOSING TAKE

GOAT#1 Milton Friedman on why we must be careful how we expand government.

I’m praying that God will give help us to remember that we are His masterpiece. YES!

Thank you for reading and sharing this newsletter. Many blessings to you and yours!

Why Let People Prosper: We believe an inclusive institutional framework with individual liberty, intact families, robust civil society, competitive capitalism, and a constitutional republic best supports abundant opportunities to mitigate poverty and let people prosper. This prosperity isn’t just material but spiritual, psychological, social, etc. that satisfies human desires. Given this understanding and my experience and research as a free-market economist, I provide trusted views on economies and policies. Please subscribe & share.