74. WIN: Whip Inflation (& Spending) Now

The latest U.S. jobs report was a mixed bag. The Fed must whip inflation now by aggressively tightening monetary policy. Congress must spend less. States like Texas must lead the way.

Hello Friend,

I hope that you had a fantastic celebration of America’s Independence Day last week on the 246th anniversary of that remarkable day on July 4, 1776. Here’s a quote from one of my favorite presidents:

There’s much to be thankful for even when some things look dire. This includes the fact that I’m proud to be an American.

We want there to be improvements to let people prosper but if you compare the U.S. with many other countries in terms of freedom and prosperity, there are few places that can compare with our flourishing. And although I was on vacation this week, I was busy working to shed light on what was going on in the economy and spending valuable time with my family. Please subscribe and share this newsletter. Thank you!

BOOK TAKE

I’m currently reading a good book Inflation: What It Is, Why It’s Bad, and How to Fix It by Steve Forbes, Nathan Lewis, and Elizabeth Ames.

The “WIN” button from the 1974 presidential campaign by President Gerald Ford was intended to “Whip Inflation Now” but that didn’t happen until the early 1980s when Fed Chairman Paul Volcker cut the money supply and tamed inflation for decades until recently.

President Biden and Chairman Jerome Powell should learn from those lessons, but I’m not holding my breath. The book provides many good insights to help you understand inflation and what should be done about it. There is not enough focus on the monetary factors, but there is a good discussion about the differences between price inflation (e.g., CPI, PCE, chained CPI, etc) and monetary inflation (i.e., Fed printing too much money). While there are certainly supply-side effects to consider as increasing the goods and services in the economy can help tame inflation, those are likely off the table for now and can take longer than the Fed’s actions to reduce demand from its excessive quantitative easing.

Check out the book for yourself, as we need to learn from the current government failures.

HOT TAKE

Let me start by recommending the Pro Vision Macro newsletter on Substack. It provides valuable insights into the economy. Check it out for yourself and consider subscribing. Please share my newsletter in your newsletter and I’ll share yours.

A couple of key points that I wanted to share with you this week.

My economics lens comes from a bias towards free markets and limited government, which is built on my consistent classical liberal view. I’ve built this lens over time with a foundation from different schools of economic thought. In undergrad and graduate school at Texas Tech University, I had the opportunity to learn mostly about the Keynesian view of economics, which mostly assumes that government can solve perceived market failures. This is much of what we see in most countries today with deficit spending through excessive government spending to move the levers of an economy like a machine to a determined outcome.

But my mentor at Texas Tech was Dr. Ronald Gilbert who handed me a copy of Capitalism and Freedom by Milton Friedman in my Junior year, and it made so much sense. In general, the key is to maximize people’s freedom through all institutions so that people have more opportunities to prosper. This school of thought is known as the Chicago School, which includes many other great economists, and is considered a free-market school of economics.

I then attended several events by the Institute for Humane Studies and began to learn a great deal about Friedrich Hayek, Ludwig von Mises, and other economists who are in what’s considered the Austrian School of economics. This is another free-market school of economics with clear principles in its strong foundation for how people behave. While these two free-market schools of economics have a lot of similarities, there are many differences, which I’d recommend reading Vienna & Chicago, Friends or Foes?: A Tale of Two Schools of Free-Market Economics by Mark Skousen. Other schools of economics that have built my lens are the New Institutional Economics (economist Doug North) and Public Choice Economics (economist James Buchanan).

These four schools of economics (e.g., Chicago, Austrian, New Institutional, and Public Choice) tend to have a common thread of explaining how people act and interact within institutions to satisfy their desires given scarce resources. This common thread is different than a lot of other schools that tend to dehumanize economics and turn it into maximization problems of different levers that politicians can use to achieve certain ends. Of course, the problem is that these actions aren’t made in a vacuum so they influence people’s incentives and behavior thereby distorting the outcomes. There are roles for the government but they should be limited to preserving life, liberty, and property, also characterized as the pursuit of happiness.

My lens also derives from lessons learned in history, psychology, philosophy, sociology, political science, mathematics, and other subjects, as humans are complex and dynamic beings created in the image of God. Given my lens has been developed by these different schools of economics, experiences, other subjects, and other factors, I don’t consider myself a follower of one particular school of economics but rather a free-market economist. This lens also provides abundant opportunities to evaluate tradeoffs of decisions, which is the unique ability of many economists compared with those with other training. Of course, there’s much more that I need to learn and do so every day. I hope you do so too and will find that these insights into my view of economics will help you determine yours.

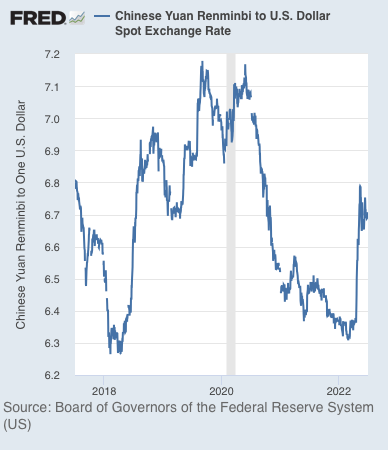

The second thing I want to discuss is of some debate these days by those on the right side of the political spectrum is international trade, particularly the costs or benefits of tariffs, which is a tax placed on an imported good from a foreign country paid by a domestic consumer. There were two good pieces on this recently as a debate between Chuck DeVore at TPPF (read his take here on why rolling back Trump’s China tariffs will sell out the country) and Max Gulker at Reason (read his take on a rollback of Trump’s China tariffs would be a win for American consumers).

My take is that tariffs on Chinese imports that Americans pay reduced some imports. But when the tariffs went into effect in 2018 there were also growing budget deficits and a rising federal funds rate target by the Fed. These factors contributed to an appreciating U.S. dollar that mitigated much if not all of the cost of the tariffs on Americans’, and many businesses also received exclusions from paying the tariffs thereby reducing some of the direct costs and effects of the tariffs.

The tariffs also did little to nothing to reduce the trade deficit, as it remained elevated and tended to increase, or make us stronger against China. Moreover, the trade deficit isn’t a very useful economic indicator as there are many factors that influence it, particularly the fact that Americans tend to want to consume more or different products than what are produced domestically.

There are better ways to try to deal with countries (like China) that don’t play by the rules of trade. The best one is to expand free trade agreements with China’s trading partners, like the Trans-Pacific Partnership would have done, which I wrote about the benefits of it many times. Unfortunately, President Trump rejected TPP when he became president because he thought President Obama negotiated it poorly, which would have been great if Trump would have just renegotiated it if that was the case. From my perspective while working in the Trump White House, the primary people really touting the tariffs were Navarro, Ross, and Lighthizer, who had the ear of the President on this issue. Many of us understood the economics and national security issues of keeping tariffs in place beyond getting China to the trade-talks table, which may have helped, but China was never going to comply with an agreement—even if COVID hadn’t happened. The trade deficit with China didn’t change much, and reducing this trade deficit was a stated goal of the tariffs. The overall trade deficit didn’t budge much because the U.S. just shifted to buying goods from other Asian countries because of the competitive advantages in doing so.

So there’s no free lunch with tariffs and they aren’t a good mechanism in the 21st century (if ever) to influence exchanges by individuals as countries don’t trade. Reagan fell into the trap of import quotas which also made things worse while growing government in the process. Chicago economist Casey Mulligan’s (who was a member of Trump’s CEA) talks about this in his excellent book: You’re Hired!

The deregulation and Tax Cuts and Jobs Act (TCJA) were great policies during the Trump administration’s economic record, but the protectionist trade policy and lack of spending restraint weren’t (at least his budgets were good but Congress didn’t follow them and Trump didn’t veto them). The U.S. could have had much more economic growth, job creation, and national safety without those. Tariffs are also something that Congress should do in most situations instead of a president.

Ultimately, the U.S. should work towards lowering the cost of doing business by cutting excessive spending, taxing, regulating, and protectionist measures. This would be the best way to make America more competitive with foreign countries and improve productivity and prosperity domestically. This was working before the shutdown recession in response to the pandemic as many businesses reshored because it was more profitable to do so, not because of the tariffs. Raising taxes through tariffs and other bad policies of trying to engineer outcomes and fund government distort behaviors and outcomes, making us worse off. These should be avoided.

But that doesn’t mean that nothing should be done to deal with countries like China that don’t play by the same rules of trade. Instead of forcing Americans to pay for tariffs on imported goods to attempt to deal with China’s poor trade and other policies, expanding free trade with China’s trading partners, like TPP, would help keep costs lower domestically from cheaper imports while putting pressure on China to liberalize its trade and economy. This won’t happen overnight, but history has helped show that liberalizing trade and increasing trade partners can help to provide more peace and prosperity. In short, I’m a free-trade, free-market economist who finds that more trade with more countries, just like with more people domestically, is the best path forward. This will also result in more taxes collected which could be used to provide tax relief (prefer a move to a national consumption tax while ending the income tax system and IRS) while funding a strong military and other limited government provisions so there are more opportunities to safely let people prosper.

TAKE ON ECONOMIES & POLICIES IN STATES

My latest co-authored research finds we need local spending limits in Texas.

Nice TV segment in San Antonio on our local spending paper.

Texas has been slowing but looks better than the rest of the nation.

Good discussion with Chad Hasty on our latest spending limit research.

We need school choice to empower parents in every state, especially Texas.

Here are reasons for school choice everywhere to meet kids’ unique needs.

TX looks to get a boost from military installations, though must consider costs.

More info on my recent co-authored research on local spending excesses.

Texas has a historic opportunity to lower property tax bills.

Cash handouts without some connection with work don’t help.

TAKE ON ECONOMIES & POLICIES IN U.S.

U.S. jobs report was a mixed bag, headline strengths but weaknesses remain.

Good overview of the job recovery since 2020.

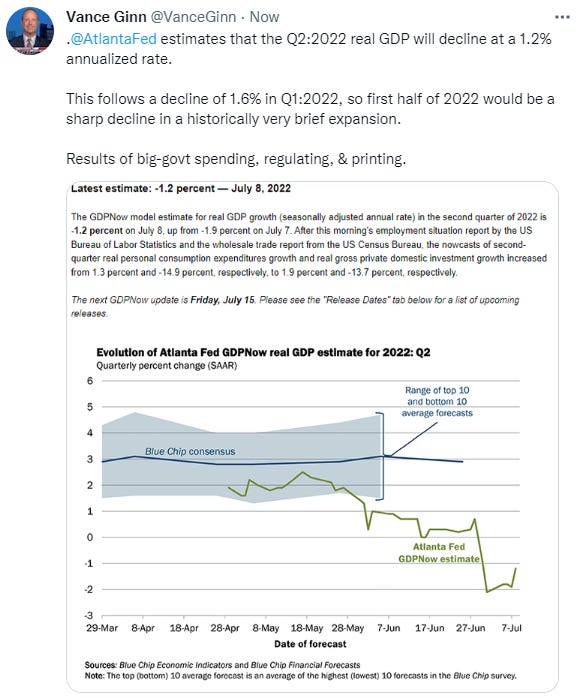

Latest Atlanta Fed GDPNow estimate still indicates recession.

The CBO finds that Biden’s policies are ballooning the deficit.

The Fed must catch up to deal with rampant inflation from its bad policies.

Government failure can be devastating in many ways. We must learn from it.

Persistent inflation should have been understood early on. Not by all.

Monetary tightening and pro-growth fiscal policies are needed ASAP.

There’s a long way for the Fed’s federal funds rate target to rise.

Seriously?

The excessive regulations by the Biden administration are stifling growth.

ESG isn’t good for personal investing or government pensions.

PERSONAL TAKE

I had a great vacation week. We took the kids to the Cameron Park Zoo in Waco, visited a children’s museum called the Thinkery in Austin, enjoyed a trampoline park near Round Rock, played games (Uno and Sorry) at home, and enjoyed each others’ company. There’s nothing like time with family! And here’s a pic of our crew even when it was 100 degrees outside (you can tell our 4-year-old boy was exhausted as we were leaving the zoo and the 3-month-old baby girl wasn’t interested in a picture. ha!).

I noticed that the boys (7 and 4 years old) were watching screens more than usual this week but not necessarily too much, then I ran across this post by economist Emily Oster who noted that we likely worry too much about the amount of time our kids are on screens.

This should be a parental decision, so be sure to do your homework and check with your kids on what’s best for your situation and watch what they’re viewing. There is harm that can be done from social media and other things online, but the way we parent can be a much bigger influence on our kids and others if we prioritize it.

I’ll be on the road some next week speaking about the economy and efforts to limit spending and reduce property taxes in Texas. Please send emails about your take on my newsletter and other thoughts as I’ve received more lately and I enjoy them.

Finally, check out my updated personal website. I’ve added some of my TV interviews, speeches, and other videos that you might find of interest in the “Shows” tab.

CLOSING TAKE

You should read Frederic Bastiat, especially for takes on seen versus unseen.

I’m praying that we will find God’s calling for our lives and flourish in it.

Thank you for reading and sharing this newsletter. Many blessings to you and yours!

Why Let People Prosper: We believe an inclusive institutional framework with individual liberty, intact families, robust civil society, competitive capitalism, and a constitutional republic best supports abundant opportunities to mitigate poverty and let people prosper. This prosperity isn’t just material but spiritual, psychological, social, etc. that satisfies human desires. Given this understanding and my experience and research as a free-market economist, I provide trusted views on economies and policies. Please subscribe & share.

Thanks, Vance! Excellent piece. Very valuable. Coolidge is one of my favorites, as well.