Backbreakers: How Trump, Powell, and Congress Stack the Pain on Americans

Debt, inflation, and tariffs are crushing Americans—and the political class is piling on.

Hello friends!

America’s working class is getting squeezed from both sides. On one end, the Federal Reserve is holding interest rates high to fight inflation it helped create. On the other hand, Washington politicians—from Trump to Congress—are playing economic games that raise prices, distort markets, and deepen instability. This isn’t just bad policy; it’s a full-blown assault on prosperity. In this piece, I break down the latest inflation data, the destructive role of tariffs, and how both parties are making life harder for everyday Americans. It’s time to stop pretending that prosperity can be engineered through government control—and start removing the burdens that weigh us down.

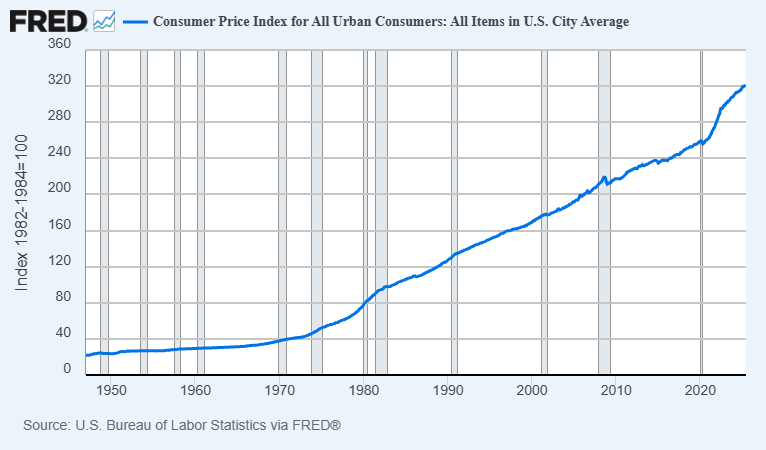

If you squint hard enough, the latest Consumer Price Index (CPI) data for June looks like progress. Prices rose 0.3% last month, and year-over-year inflation came in at 2.7%. That’s down from the COVID-era peak of 9.1% in 2022.

But what’s worse is that we’re pretending this is normal. Trump says his tariffs are just making America "competitive again." Powell says inflation is "moving in the right direction." Congress says there’s “room to invest in priorities.” But what they’re all doing is pushing the costs of their bad decisions onto you.

Behind the scenes, the forces driving inflation and economic dysfunction are as strong as ever. The Fed’s balance sheet remains bloated at $6.7 trillion—nearly 70% above its pre-COVID size—and continues to distort credit markets and asset prices.

Despite claims of “normalization,” Powell faces pressure from the White House to cut interest rates to juice growth before the election. That’s not economic prudence—it’s central banking by campaign season.

On top of that, Trump’s universal 10% tariff is already in place, with more targeted tariffs being layered on regularly—on EVs, steel, Chinese imports, and more. These are not just rhetorical negotiating chips. They’re taxes on American consumers, plain and simple. Prices rise, choices decline, and businesses are forced to scramble their supply chains at a higher cost.

Yes, tariffs aren’t inflation in the traditional sense. Inflation is caused by too much money chasing too few goods—something the Fed helped cause with its post-COVID $4.8 trillion monetary explosion. But tariffs do raise prices. They distort relative prices, redirect production inefficiently, and hurt working families most, because the pain falls hardest on the goods and inputs that matter most in everyday life.

Just look at the latest CPI report:

Food at home is up 0.3% in June or up 2.4% since last June

Food away from home is up 0.4% last month or 3.8% year-over-year

Electricity jumped 1.0% in June and is up 5.8% from a year ago

Beef prices rose 2.0% in a single month

Gasoline ticked up 1.0% in June, despite a full-year 8.3% decline

Nonalcoholic beverages rose 1.4% in June and 4.4% over the year

These categories are either directly imported or use imported inputs, precisely the types of goods hit hardest by tariffs.

Meanwhile, Congress hasn’t slowed its fiscal binge. Federal spending soared from $4.5 trillion in FY 2019 to $7 trillion in 2025, with no sign of restraint. Entitlements, subsidies, and debt service are now squeezing out productive investment, and the bill will continue to climb as spending remains too high even after the “One Big Beautiful Bill” and interest rates remain elevated.

What does all this mean? The average American isn’t experiencing recovery. They’re experiencing chronic economic whiplash.

Tariffs raise costs and kill efficiency.

Inflation erodes savings and purchasing power.

Deficits crowd out private growth.

Rate cuts (or hikes) driven by politics further distort everything.

This isn’t just bad policy—it’s coordinated dysfunction. As usual, the burden falls squarely on the backs of working Americans.

The irony is that many of these problems are self-inflicted. A better approach would be simple:

End the trade war and protectionism, and achieve zero tariffs and other barriers.

Cap government spending growth at a maximum rate of population growth plus inflation.

Use a rules-based monetary policy, such as a base money growth rule or the Taylor Rule.

Unleash innovation and lower costs by slashing regulations and red tape.

Until then, we’re stuck in a cycle where the same political class that caused the problem now pretends to be its solution, while Americans continue to foot the bill.

I disagree with some of your your prescriptions

1. Yes, remove tariffs and other impediments to international trade (ecppe maybe a few that we do not sihe to depend on China for)

2. A better spending rule is

a) fully fund social insurance expenditures -- Social Security, ACA, Medicare, Medicaid, unemployment insurance, SNAP -- with a consumption VAT

b) fund other public expenditures with a progressive consumption tax such that deficit does not exceed public investments. (no borrowing for consumption)

3. the Fed should not target interest rates or any other monetary policy instriment,including money supply. Rather it should target inflation or NGDP at levels that maximize real income growth.

4. Actively recruit high earning and high earning potential immigrants.