Is Texas Losing Its Conservatism? | This Week's Economy Ep. 114

Wrapping up the 89th TexLeg session and examining key U.S. economic health indicators.

Hello Friends!

Today marks the conclusion of the 89th Regular Session of the Texas Legislature, and what a session it's been. Once renowned for its commitment to pro-freedom and pro-growth policies, Texas now grapples with decisions that challenge its conservative principles. This session has strayed from the fiscal conservatism Texans expect, from expanding corporate handouts to unprecedented spending. The people of Texas deserve better. It's time to return to the pro-growth policies that have enabled the state to thrive and lead the nation.

On the federal front, the passage of the “One Big, Beautiful Bill” in the House reveals a similar mix of commendable and concerning developments. How can we reconcile the benefits of tax cuts with the drawbacks of increased government spending?

In this episode, I delve into these significant legislative moves and assess their impact on the nation's economic health. Let's examine both the positive and negative aspects to gain a clear understanding of where things stand. Watch the full episode on YouTube, Apple Podcast, or Spotify, and visit my website for more information.

1. OBBB Pros and Cons

In the News:

The House passed the “One Big, Beautiful Bill” (OBBB), which now moves to the Senate for a vote. The legislation includes an extension of the 2017 Tax Cuts and Jobs Act and tax reductions on tips, overtime pay, and Social Security payments. It also introduces restrictions on Medicaid and SNAP, raises the state and local tax (SALT) deduction cap to $40,000, allocates more funding for border security, rolls back several Biden-era clean energy initiatives, and raises the debt ceiling by $4 trillion. Sources: CBS News and CNBC

My Take:

A Step in the Right Direction: The OBBB is a step forward in critical areas. Extending the expiring pro-growth tax provisions from the Tax Cuts and Jobs Act is a win for hardworking Americans. It’s also good to see a rollback of costly and ineffective clean energy subsidies and some reforms to government programs like Medicaid and SNAP.

Room for Improvement: Despite these positives, the bill still spends too much and misses opportunities for deeper reforms. It includes too many targeted tax carveouts—classic examples of government picking winners and losers. Broad-based tax relief would be far more effective in fostering long-term economic growth for families, workers, and businesses. Moreover, the bill fails to deliver substantive reform to Medicaid, contributing to unsustainable government spending.

The Path to Prosperity: If we want Americans to truly prosper, we must pursue faster economic growth and tighter fiscal discipline. Runaway government spending is helping fuel the Fed’s inflation creation. Instead of raising the debt ceiling again, Washington should focus on cutting spending, reforming “entitlements,” and providing broad, pro-growth tax cuts to promote growth.

Related: In a recent episode of This Week’s Economy, I discussed many of the proposals in the OBBB.

2. Good, Bad, and Ugly of Texas Session

In the News:

With the Texas Legislature adjourning sine die today, it’s time to reflect on what lawmakers accomplished—and what they failed to deliver. From modest wins to major disappointments, how did Texas measure up this session? Source: Fox 7

My Take:

The Good: Texas finally made a long-overdue move toward education freedom. Lawmakers approved the state’s first school choice program—Education Savings Accounts (ESAs). But while this is a historic step in the right direction, Texans were promised universal school choice, whereby every student who wants one can receive it. Instead, they got an ESA pilot program serving less than 1.5% of Texas schoolchildren—little more than a political concession in return for an $8.5 billion increase in funding to government-run schools.

The Bad: The Legislature doubled down on corporate welfare for Hollywood stars and contractors through taxpayer money in the general fund and constitutional funds. Lawmakers failed to deliver meaningful reforms to Medicaid as enrollment continues to surge past 4 million. Lawmakers were unable to provide substantial property tax relief. They passed several misguided regulations, such as the age-verification mandate for app usage by minors and a ban on hemp/THC, signaling a concerning drift toward government overreach.

The Ugly: In the most egregious move, Texas passed the largest budget in its history. This should raise red flags for a state that claims to champion fiscal conservatism. Had lawmakers held spending growth to the rate of population growth plus inflation over the past decade, Texans would have saved $51 billion in excessive government growth and the taxes that fund it. This missed opportunity is especially frustrating given the advantages Texas had this session: a booming economy, a record $24 billion budget surplus, and $28 billion stashed in the Rainy Day Fund.

Related: Texas had every opportunity to lead the nation with bold, conservative reforms. Instead, it chose the path of big spending.

3. Market Health Update

In the News:

Moody’s recent downgrade of the U.S. credit rating sent ripple effects through financial markets. Bond prices have fallen, driving the yield on 30-year Treasury bonds above 5%—an 18-month high. Stocks are slipping, and the dollar has declined by roughly 0.8%. Analysts caution that rising yields could curb investor optimism following the recent pause in tariff escalations. Sources: Reuters and The Guardian

My Take:

Overspending Is the Root Cause: Moody’s downgrade reflects what many of us have warned about for years: Washington’s addiction to overspending is finally catching up with us. The downgrade was driven by concerns over ballooning federal debt—and rightly so. Across all levels of government, spending continues to grow far faster than the ability of American families to pay for it. The result? Higher taxes, more debt, and persistent inflation that eat away at paychecks and erode opportunity.

The Clock Is Ticking: This fiscal recklessness cannot go on forever. At some point, and it looks to be soon, global investors and foreign governments may decide U.S. debt is too risky. If demand for government bonds weakens significantly, we could face a full-blown debt crisis, with consequences that ripple far beyond Wall Street.

The Way Out Is Clear: There’s only one sustainable path forward: stronger economic growth and fiscal discipline. Lawmakers must implement real budget constraints—starting with cutting spending now and capping changes later with a cap on annual spending growth tied to population growth plus inflation. This keeps the government from outpacing the ability of the average taxpayer to fund it. When the economy grows faster than the government, prosperity follows. But the American dream becomes harder to reach if we keep piling on debt and spending unchecked.

Related: Earlier this month, I discussed some of the recent impacts of tariffs on the stock market—just one example of how policy decisions can ripple through the economy. It's another key area we must consider when evaluating the broader effects of government action.

4. Where Trump’s Trade War Stands

In the News:

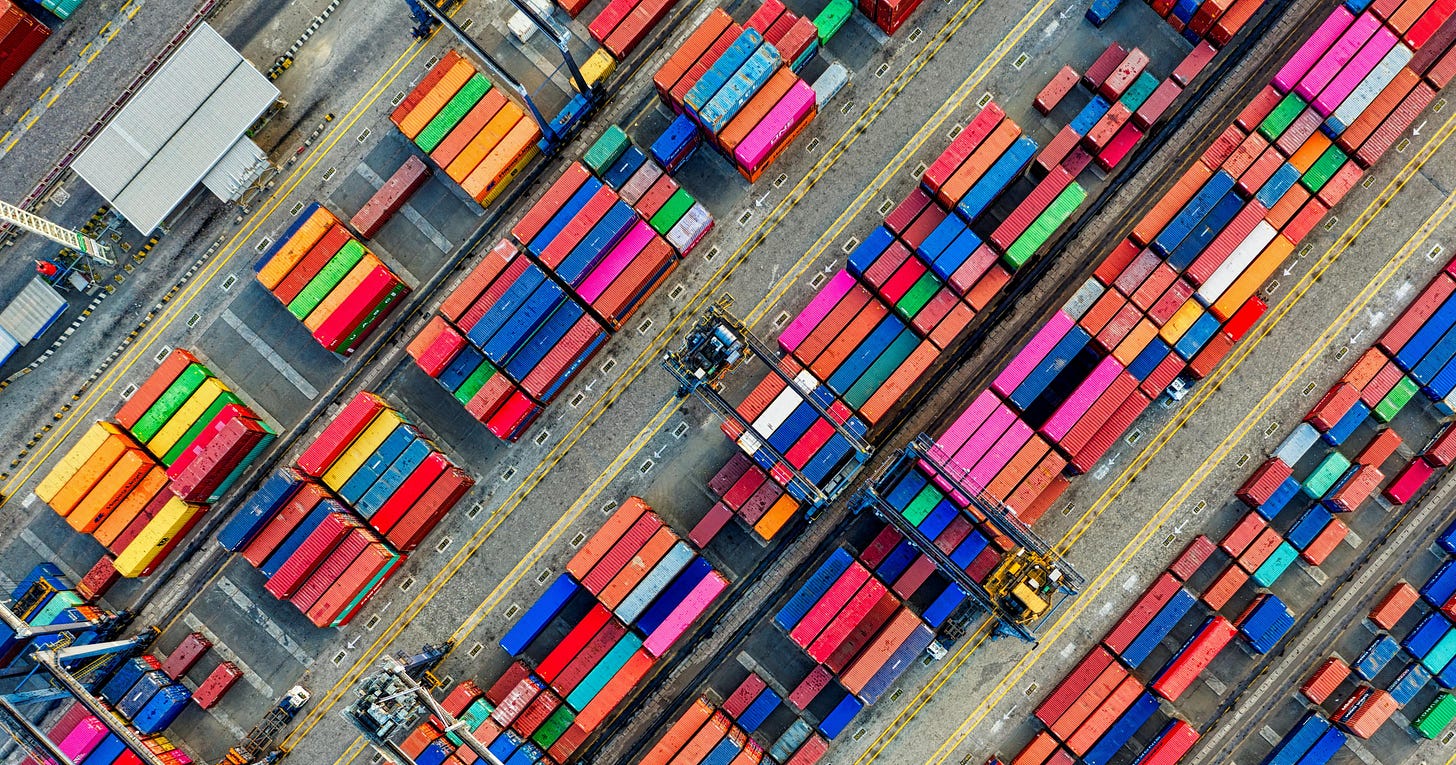

Just weeks after signaling a pause in tariff escalation, President Trump is again ramping up trade threats—this time proposing a 50% tariff on goods from the European Union and a 25% tariff on foreign-made iPhones. Some businesses are exploring legally questionable ways to sidestep these costs. Sources: Wall Street Journal and CNBC

My Take:

Who Really Pays the Price? Any hope for relief from tariffs' economic damage has been short-lived. These renewed threats highlight a recurring failure to recognize who truly bears the cost of tariffs: hardworking Americans. From families facing higher prices at the store to businesses squeezed by rising input costs and passing that on through lower pay, fewer jobs, and lower returns on stocks, tariffs hit the people they claim to protect.

Tariffs Are Not Tax Cuts: Tariffs are taxes on American consumers and businesses, plain and simple. Labeling them a “necessary defense” doesn’t change their effects: higher prices, supply chain disruptions, distorted markets, and less economic freedom. While some businesses benefit from politically granted exemptions, others scramble for workarounds—hardly a level playing field.

What Real Defense Looks Like: If we want to truly defend American workers and strengthen our economy, the path is clear: low taxes, limited regulation, and free trade. Protectionist policies like tariffs only shrink opportunities, hurt competitiveness, and chip away at prosperity. We must advance policy that empowers people to prosper.

Related: Tariffs are taxes that put Americans last. I outlined the economic consequences for Iowans for Tax Relief earlier this spring.

5. Housing Keeps Taking Hits

In the News:

Spring typically marks the peak of the real estate selling season—but this year, first-time homebuyers are shifting their focus to smaller homes in response to high prices, elevated mortgage rates, and limited inventory. Builders are also adjusting, turning to smaller builds to contain rising costs. Source: Wall Street Journal

My Take:

Increase Supply, Reduce Costs: High interest rates, labor shortages, and skyrocketing material costs make homeownership increasingly out of reach for working families. But the answer isn't more government intervention—it’s a return to pro-growth policies that allow builders to build. That means lowering taxes, streamlining permitting, reforming zoning laws, and ensuring access to a skilled workforce.

What Can Be Done? To make housing more affordable and expand access to homeownership, policymakers must remove government-imposed barriers and empower the private sector. Whether at the federal level—through the Trump administration and Congress—or at the state or local level, leadership must focus on restoring affordability and opportunity in the housing market.

Major Areas for Reform: The path forward starts with reducing government spending, eliminating tariffs, rolling back burdensome regulations, reforming zoning and permitting, cutting taxes, and supporting infrastructure and labor necessary to fuel the construction industry. By tackling these issues head-on, we can start making the American dream of homeownership more attainable for hardworking families.

Related: Check out my recent episode on housing costs and explore my pro-growth policy guide tailored to the construction industry.

Thanks for joining me in this episode of "This Week's Economy." For more insights, visit vanceginn.com and get even greater value with a paid subscription to my Substack newsletter at vanceginn.substack.com.

God bless you, and let people prosper!

Keep reading with a 7-day free trial

Subscribe to Let People Prosper to keep reading this post and get 7 days of free access to the full post archives.