Legislative Wrap-Up, Family Time, and What's Next | Prosperity Pulse #20

A round-up of my recent commentaries on federal spending, American industry, the Texas legislative session, and more.

Hello Friends!

Whew! It’s been a busy Texas legislative session. Lately, I’ve been reflecting on the good, the bad, and the ugly, highlighting key takeaways for the future—chiefly, the urgent need to return to pro-growth policies that restrain spending and provide the tax relief Texans deserve.

After the session, I took some much-needed time off to relax and hang out with my family. It was refreshing, and now I’m back, recharged, and ready to continue advocating for policies that let people prosper!

One area I’m focusing on is ending government price controls on credit cards. Unfortunately, Congress and state legislatures are advancing bills to regulate swipe fees, which could significantly disrupt how Americans access credit. I recently spoke on this issue at the Tholos Foundation’s event in Washington, D.C., and visited with the Americans for Tax Reform team. I’ll continue pushing back on this misguided approach.

Next up, I’ll be heading to Coral Gables, Florida, for the James Madison Institute’s 2025 Tech and Innovation Summit, where I’ll be speaking on how law and markets can combat digital deception in the age of artificial intelligence. If you’ll be there, please let me know—I’d love to connect!

Lastly, if you’ve been considering subscribing, I’d be thrilled to have you join us. Your support helps advance the cause of economic freedom and lasting prosperity.

Highlights from This Month

1. News on Federal Spending and Taxes

The One Big, Beautiful Bill (BBB) is now headed to the Senate. While it includes some worthwhile provisions—such as extending the 2017 Trump tax cuts—I explain at The Pelican Institute why the bill ultimately falls short of delivering the fiscal discipline and pro-growth reform our country needs.

One especially problematic provision in the House version of the bill is the proposed increase in the state and local tax (SALT) deduction—from $10,000 to $40,000, with a phaseout starting at $500,000. In Forbes, Patrick Gleason quotes me on why restoring SALT is a misguided move that props up fiscally reckless states, shifting the burden to taxpayers.

The bill also proposes cuts to Medicaid, but lacks the structural reforms needed to protect vulnerable populations and improve access to care. Dr. Deane Waldman and I lay out meaningful reforms to protect patients in our piece for American Thinker.

Speaking of federal health care spending, the root cause of our health care crisis is federal control. In The Center Square, Dr. Deane and I explain why the solution is to return power to individuals—we, the Patients. The Empower Patients Initiative takes a crucial step in that direction. I’ll have more on a book I co-authored with him soon!

Kansas’ recent fiscal challenges offer a cautionary tale for federal policymakers. At Kansas Policy Institute, I explore how the state’s experience underscores the importance of pairing tax reforms with disciplined budgeting—a lesson federal lawmakers should heed as they consider the OBBB.

2. Should the Government Favor U.S. Manufacturing Jobs?

America’s manufacturing output is booming, but this masks two uncomfortable truths: manufacturing jobs are disappearing, and the wages for those jobs are not particularly high. In my commentary for The Daily Economy, I explain why this output alone doesn’t justify government favoritism aimed at reviving a labor model that’s in retreat.

National Review also highlighted this piece while exploring whether President Trump’s promise to "bring back" American manufacturing is even the right question.

3. Texas Let Down Taxpayers

The Texas Legislature’s 2026–27 budget reflects the spending habits of progressive states like California more than the limited government approach that made Texas an economic powerhouse. I break down the key issues with the budget here:

I joined KTRH for two conversations highlighting the major budget pitfalls—especially the problem of overspending.

Despite lawmakers' claims, the budget fails to deliver the meaningful property tax relief Texans promised. I shared my critiques with The Center Square and Yahoo News, outlining what real reform would look like.

I also had a great conversation with Chad Hasty, recapping the good and the bad from this year’s legislative session. Now that it’s over, the question is: What lessons can we take into the next one?

4. Price Controls Cause Harm

Congress and state lawmakers are advancing bills to regulate credit card swipe fees—quietly paving the way for a significant disruption in how Americans access credit. I discuss the problems with these proposals on Texans for Fiscal Responsibility and X.

What I’m Learning

State Policy Network: Great paper offering key policy recommendations to make ESA programs clearer, fairer, and more family-friendly.

Texas Comptroller: Texas is on the brink of an energy revolution, with small modular reactors (SMRs) at the forefront. SMRs could create 148,000 jobs and generate $50 billion in economic output over the next 25 years.

Austin American-Statesman: This deal amounts to corporate welfare, subsidizing private businesses while the government maintains control of water at the taxpayer's expense. It’s time to privatize water.

The Wall Street Journal: So far this year, the federal government has canceled 11,297 contracts across 60 agencies, saving $33 billion. But more cuts are still needed.

NetChoice: Europe’s online censorship rules should serve as a cautionary tale for the U.S. We must protect free speech and preserve internet freedom.

Texas Policy Research: A great resource for tracking who's running for office in Texas.

Forbes: A new report reveals that Americans are increasingly moving to low-tax states. Adam Millsap explains how this will impact state budgets.

American Institute for Economic Research: A helpful explainer by Thomas Savidge on how the federal government collects and spends your money.

NetChoice: A court will temporarily block Florida’s law requiring residents to surrender personal data to access lawful, protected speech online.

The Wall Street Journal: Full and permanent expensing stands out as the most pro-growth reform on the table, essential to restoring America’s industrial strength.

International Liberty: Congress should make the 2017 Trump tax cuts permanent, but this must be accompanied by real spending reform.

The Lion: New Hampshire becomes the 18th state to pass universal school choice, with Gov. Kelly Ayotte signing the expansion bill into law.

The Daily Economy: Republican officials must be cautious about weaponizing antitrust law in the same way progressives have.

Paragon Health Institute: The Congressional Budget Office’s letter to Democratic members on projected coverage losses under the OBBB is inaccurate.

: Neil Chilson explores the rise of “woke AI” and why conservatives have unique advantages in the emerging AI landscape.

Books I’m Reading:

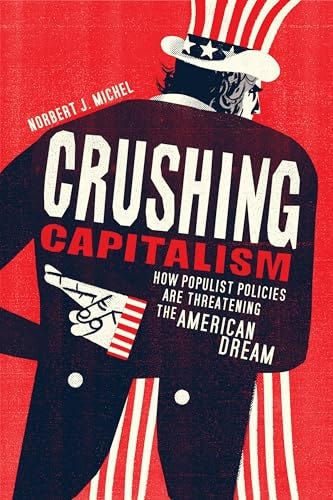

In preparation for my conversation with Norbert Michel on the Let People Prosper Show, I read his new book, Crushing Capitalism: How Populist Policies Are Threatening The American Dream. It’s an excellent read on misleading narratives around free markets and capitalism, and the case for nurturing the institutions that have enabled Americans to succeed.

You can never go wrong with a book by Thomas Sowell. I recently cracked open my copy of A Conflict of Visions on my family vacation, thanks to the No Due Date book club led by a great economist and friend, Pete Boettke.

Upcoming Events:

I’ll speak at the James Madison Institute’s 2025 Florida Tech & Innovation Summit on June 26. I’m on a panel with R Street’s Spence Purnell and Reason Foundation’s Richard Sill, where we will discuss truth in the age of AI.

Let People Prosper Show Podcast

The Let People Prosper Show features deep discussions on hot topics:

Episode 152 (Thursday):

Can 12-year-olds really grasp supply and demand, entrepreneurship, and the role of government in the economy? In this episode of the Let People Prosper Show, I talk with John Foster, a passionate advocate for teaching economics early and often. As a former leader in Junior Achievement and president of the Middle School MBA, Jon is on a mission to improve economic literacy where it matters most—before bad ideas take root. We discuss the gaps in today’s education system, how teachers can better engage students, and why real-world application is key to shaping informed citizens.

Episode 153 (Next Thursday):

Is capitalism truly crushing the middle class, or are misguided policies and harmful narratives to blame? Dr. Norbert Michel, Vice President and Director of the Cato Institute’s Center for Monetary and Fiscal Alternatives, and I delve into his new book, Crushing Capitalism: How Populist Policies Are Threatening The American Dream.Did you miss This Week’s Economy episode 115?

Quote of the Week

Bible Verse of the Week

Thanks for aiding my mission in promoting economic freedom and prosperity. I hope this edition of Prosperity Pulse keeps you informed, inspired, and ready for the week ahead. Please subscribe and share this newsletter with your family and friends.