Not Business As Usual in Washington | This Week's Economy Ep. 98

Regulatory reduction, spending freezes, and a Texas budget crisis.

Hello Friends!

Even more executive orders are coming out of the White House this week. From cutting regulations to proposing a sovereign wealth fund, the announcements have been significant. One of the most anticipated is an order to dismantle the Department of Education. I hope this paves the way for a nationwide school choice movement, giving students and families more control over their education.

In this episode—and the show notes below—I break down the latest Trump executive orders, take a look at inflation, and analyze Texas’s proposed budget. Tune in on YouTube, Apple Podcast, or Spotify, and visit my website for more information.

1. INFLATION INDICATORS

In the News:

This week, the first inflation reports of 2025—the Consumer Price Index (CPI) and Producer Price Index (PPI)—will be released, providing fresh insight into price trends. Meanwhile, if they go into effect after 30 days, tariffs on Mexico and Canada are set to push up the cost of food and other goods. Sources: Reuters and PBS

My Take:

Anticipating Inflation Reports: Inflation remains high, and we can expect CPI and PPI data to reflect continued price increases.

Action Plan: The Federal Reserve must shrink its bloated $6.8 trillion balance sheet. Without this, inflation will persist. At the same time, Congress must rein in federal spending to curb the debt fueling the Fed’s excessive money printing.

White House Pressures: The White House should push Congress and the Fed to act. Encouraging free trade would also help mitigate rising costs, especially as Trump’s tariff threats put upward pressure on prices.

Related:

2. REGULATION AND SPENDING REFORM

In the News:

President Trump has issued a wave of executive orders (EOs) focused on government reform. One EO mandates aggressive regulatory rollback—requiring at least 10 old regulations to be eliminated for every new one enacted. Other orders attempt to freeze federal spending already approved by Congress. Additionally, the president has signed an EO directing the creation of a sovereign wealth fund, potentially to buy TikTok. Sources: PBS, Marketplace, Reuters, and Texans for Fiscal Responsibility

My Take:

Regulatory Reform: This executive order can potentially unlock opportunities for Americans. A 10-to-1 rule could push agencies to streamline processes, reduce bureaucratic red tape, and drive economic growth.

Federal Spending Freeze: Trump is right to prioritize spending restraint. However, executive orders attempting to freeze already approved spending face legal challenges and may be unconstitutional. Instead, the White House should pressure Congress to take ownership of spending reform.

Sovereign Wealth Fund: Using a sovereign wealth fund to buy TikTok is fundamentally flawed. The U.S. is already drowning in debt due to unchecked spending. Instead of seeking new ways to collect and allocate taxpayer dollars, the focus should be reducing government expenditures and curbing federal overreach. (Texas and other states shouldn’t have a sovereign wealth fund either).

Related:

3. TEXAS BUDGET CRISIS

In the News:

Despite strong economic growth, Texas is undermining its own success with reckless spending and misplaced priorities. Sources: Texans for Fiscal Responsibility and Austin American-Statesman

My Take:

Reckless Spending: The Texas Senate and House have proposed fiscally irresponsible budgets, with increases after the 32% in state funds last session. The Senate’s recommended new budget increases spending by $11.2 billion, while the House’s new budget jumps by $14 billion—on top of last session’s record 21% increase in all funds.

Misplaced Priorities: With a $24 billion surplus and $28 billion in the rainy day fund, property tax relief should be the top priority. Yet, only $6.5 billion is allocated for relief ($3.5B in new relief not in prior law), while billions of dollars are funneled into corporate welfare and politically-driven projects. Texans will continue facing higher property taxes without stricter limits on state and local government spending.

What Needs to Change: Lawmakers should cut spending by 15% or, at minimum, freeze it. More substantial spending limits are essential, corporate welfare must be eliminated, and tax relief should take precedence. Education funding should follow students rather than institutions as Texas hopefully passes universal school choice. The latest school choice bill is SB 2 in Texas, and it passed the Senate 19-12 last week, with Senator Robert Nichols being the only Republican to vote against it. (More below)

Related:

4. END DEPARTMENT OF EDUCATION

In the News:

The Trump administration is preparing an executive order to dismantle the Department of Education. Source: CNN

My Take:

Dissolve the Department of Education: Our government-run schools are failing. Meaningful reform starts with eliminating the Department of Education and returning control to those closer to the communities they serve.

Return Education to the States: Trump has previously intended to shift education policy to the states. This would give local governments more authority over how tax dollars are spent and allow for policies that better reflect the needs of their communities.

Expand School Choice: Research consistently shows that school choice improves educational outcomes. Of 18 major studies on school choice, 12 found positive effects, including improvements in public schools due to increased competition. Already, more than 10 states have adopted universal or near-universal Education Savings Accounts—more should follow. Texas could be next with Senate Bill 2, passed last week in the Texas Senate, and is an emergency item by Governor Greg Abbott. It needs some improvement, but it is the best school choice bill in Texas so far.

Related:

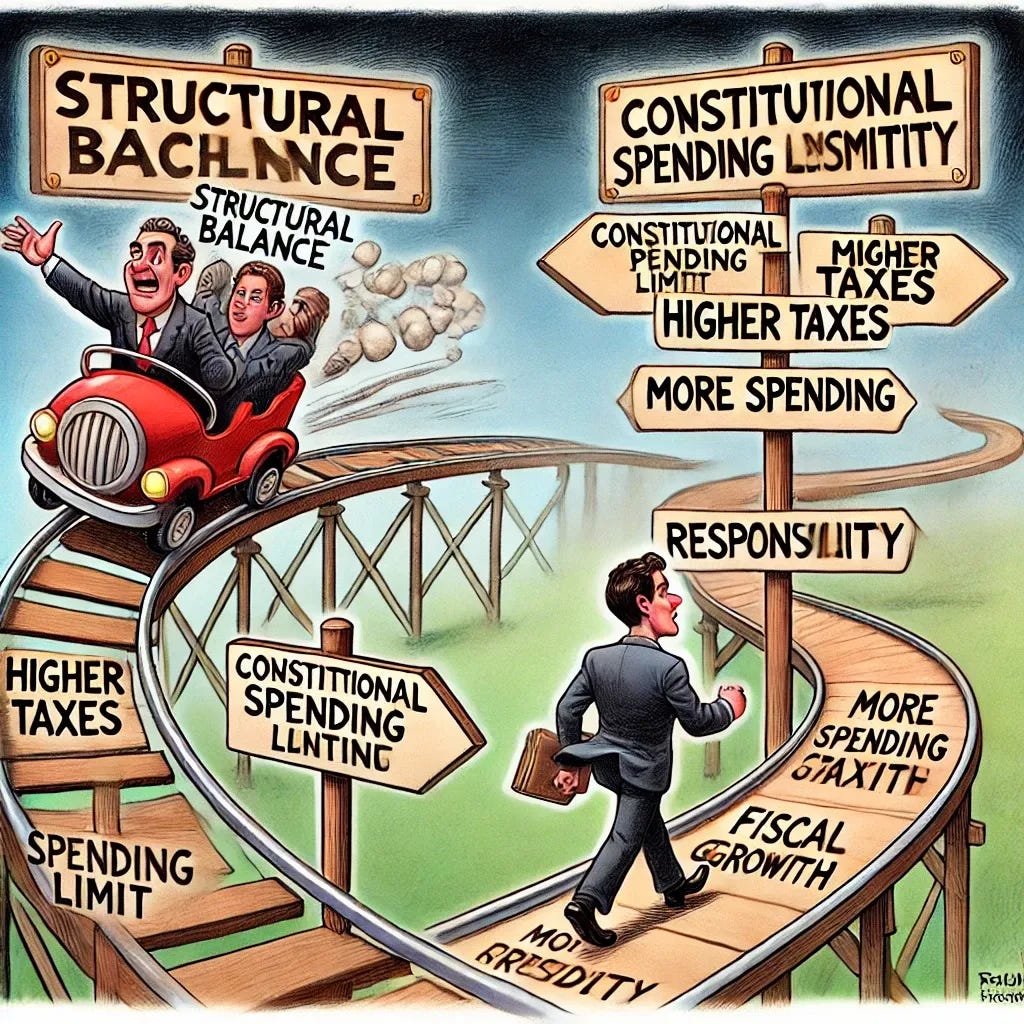

5. WHY SPENDING LIMITS BEAT STRUCTURAL BALANCE

In the News:

A growing debate among fiscal conservatives is how best to rein in government spending—through strict constitutional spending limits or structural balance rules. While structural balance aims to smooth government spending over time, critics argue that it encourages more spending rather than limiting government growth. True fiscal conservatism means keeping government spending in check, so it only grows at a rate taxpayers can afford. Source: National Review

My Take:

Strict Spending Limits vs. Structural Balance: Structural balance allows for flexibility in budgeting but can encourage overspending and tax hikes to maintain services as a share of GDP. In contrast, a constitutional spending limit ties growth to population plus inflation, ensuring affordability for taxpayers.

Private Sector Growth Over Government Expansion: The economy grows when individuals and businesses control their money, not when the government reallocates it through spending. A spending limit prioritizes fiscal discipline, while a structural balance risks higher spending and more government control over economic activity.

Political Incentives Matter: Budget smoothing may work for families and businesses because they manage their own money, but politicians have no personal financial stake in government spending. Without strict limits, policymakers face constant pressure to overspend and increase taxes, harming economic prosperity.

Related:

➡️ Read more: Budgeting for Prosperity: Spending Limits or Structural Balance?

➡️ Join the debate: Kurt Couchman’s Thread on Structural Balance

Thanks for joining me in this episode of "This Week's Economy." For more insights, visit vanceginn.com and get even greater value with a paid subscription to my Substack newsletter at vanceginn.substack.com.

God bless you, and let people prosper!

Keep reading with a 7-day free trial

Subscribe to Let People Prosper to keep reading this post and get 7 days of free access to the full post archives.