Texas Built Its Model on Economic Freedom

Overspending Now Puts It at Risk

Hello friends!

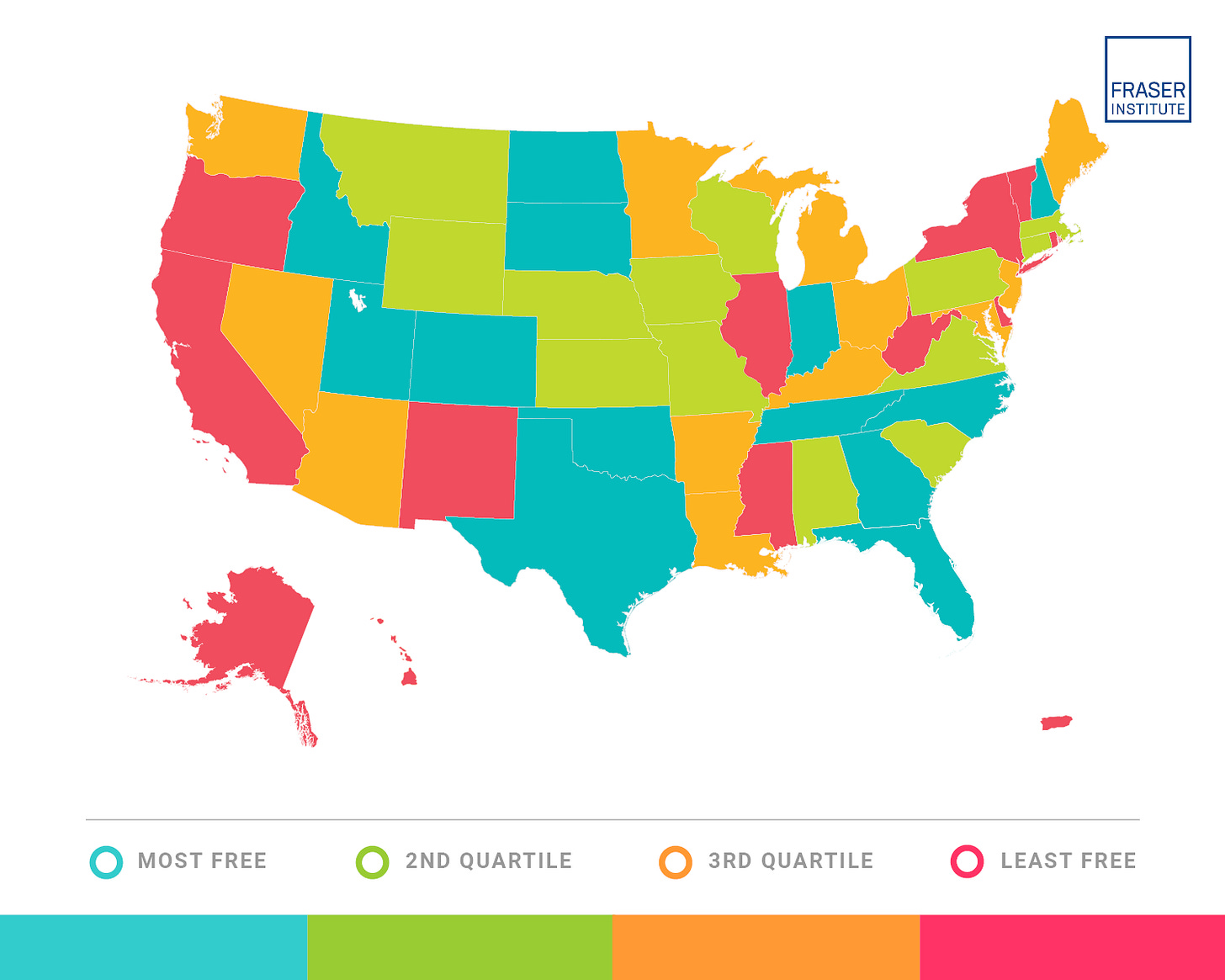

Texas ranks fourth nationally with an overall score of 8.15 in the Economic Freedom of North America report recently published by the Fraser Institute.

The ranking, based on 2023 data, places Texas firmly among the most economically free states in the country.

But the more important signal in the data is not where Texas ranks now. It is how the state has had excessive spending and high property taxes weigh on economic freedom today and in the coming years.

Texas’s economic success is visible first in the labor market.

According to the Bureau of Labor Statistics, Texas had one of the fastest job creation rates in 2023 (and thereafter). Employment growth has consistently exceeded the national average, while unemployment rates have generally remained below the U.S. rate.

When marginal tax rates on work are zero and labor markets are flexible, employers expand, and workers respond.

The economic output data tell the same story.

The Bureau of Economic Analysis shows that Texas’s real GDP growth was a leader in 2023, driven by private-sector expansion. Capital flows toward jurisdictions where expected after-tax returns are higher, and policy risk is lower. Texas has benefited from that reality for decades.

The EFNA index explains why.

Texas scores well on taxation and labor-market regulation, largely because it imposes no personal income tax and maintains comparatively flexible employment rules. Those institutional features reduce distortions on work, saving, and investment, raising long-run growth potential.

Yet the same EFNA data also reveal why Texas’s ranking has flattened rather than improved in recent years. The binding constraint today is not necessarily taxes or labor policy. It is government spending growth at the state and local levels.

Since at least the mid-2010s, state and local spending in Texas has grown substantially faster than population growth plus inflation, meaning government now consumes a larger share of personal income than it once did.

EFNA measures spending relative to income because this ratio determines how much private activity is crowded out. When the government expands faster than the economy and taxes rise to fund it, economic freedom declines.

Property taxes are the primary transmission mechanism.

Texas constitutionally bans income taxes, wealth taxes, and state property taxes, but relies heavily on sales taxes to fund state spending and local property taxes to finance local budgets.

Property-tax collections have risen faster than household incomes, raising effective tax rates even when statutory rates appear unchanged.

From an economic perspective, this is not neutral. Higher property taxes can raise the cost of housing and capital formation, reduce real wages over time, and slow investment, especially in high-tax metropolitan areas.

Public-sector employment growth reinforces the trend.

BLS data show government employment rising faster than private employment in recent years. EFNA penalizes this pattern because it signals higher future tax burdens or debt service.

Economic theory predicts the outcome: slower productivity growth and weaker private-sector dynamism.

Directionally, Texas has held its rank while peer states have closed the gap. That is an important distinction.

The EFNA report relies on 2023 data, which means recent policy changes about restraint are not yet reflected. What is reflected is the cumulative effect of spending decisions made over the past decade.

Rankings move slowly because institutions change slowly. That is a feature, not a flaw.

The Fraser Institute’s findings are consistent across time and geography. States with higher economic freedom exhibit higher income levels, stronger labor-force participation, faster job creation, and greater net in-migration.

Texas still benefits from those advantages. But the data now show that fiscal drift could erode the margin.

The lesson is not ideological. It is arithmetic. Economic freedom helped build the Texas Model. Preserving it now requires discipline.

If government spending growth continues to outpace population growth plus inflation, Texas’s comparative advantage will narrow, then disappear. Growth can mask that reality for a while. It cannot undo it.

Please subscribe and share! Let people prosper.

Vance Ginn, Ph.D.