What's Clear on Welfare and Taxes | Prosperity Pulse #13

Breaking Down Medicaid Cuts, State & Federal Spending, and the Fight for Texas School Choice.

Hello Friends!

Texas, my home state, could make significant strides this session with key policies to ensure a brighter future for the state. One of the most promising developments is the creation of the House DOGE (Delivery of Government Efficiency) Committee.

That’s just the start—school choice, property tax reform, and other vital policies are moving forward, all of which will make Texas an even better place to live and work. But there are major challenges of too much government spending, too little in tax relief, too much taxpayer money to the government school monopoly, and too little funding for ESAs.

I recently attended the Texas Policy Summit hosted by the Texas Public Policy Foundation. I heard thought-provoking discussions on topics such as regulating artificial intelligence, eliminating property taxes, passing universal school choice, and reining in spending.

A couple of highlights were hearing from Congressman (and my friend) Chip Roy (R-TX) and Secretary of Agriculture (and my former boss when I was at TPPF) Brooke Rollins, both of whom are champions for economic freedom.

This week, I also attended the inaugural Freedom Conservatism conference in Washington, D.C.

It was an energizing event with insightful conversations on the federal DOGE, spending restraint, tax cuts, and communicating freedom principles. The strong advocates for pro-growth policies and champions of human flourishing were truly inspiring.

Considering a subscription? Join for exclusive content and help us advance economic freedom and prosperity!

Highlights from This Month

1. Why We Need Welfare Reform

The House's reconciliation bill passed this week includes reductions to programs like Medicaid, bringing welfare reform into the spotlight. Despite the trillions of taxpayer dollars sent to the federal government to be spent on anti-poverty programs, many people remain in poverty. The issue isn’t a lack of funding but rather how welfare is structured. States can reshape safety nets to support those in need without fostering dependence. I explain more at AIER’s The Daily Economy.

2. Policies that Promote Prosperity

What is the proper role of government? A truly free society requires the government to be sufficiently restrained, allowing individuals, families, and communities to thrive without interference. I highlight the work of some of the most brilliant economic minds as support in my piece at EconLib.

3. Tariffs and Taxes

If enacted, Trump’s tariffs would be one of the largest tax increases in modern history, marking the biggest tax hike since 1993. I discuss the impact of these tariffs on Canada, Mexico and more in my recent piece at InsideSource’s DC Journal.

I discuss the budget battles, proposed Trump tax cuts, and making the Tax Cuts and Jobs Act permanent with Joe on The Joe Pags Show.

4. Untangle Tech from Regulatory Restrictions

Years of government overreach under the Biden administration have stalled progress in the tech sector. The administration prioritized bureaucracy over consumer benefits, giving China and the EU a competitive edge. I explain how the Trump administration can help untangle this mess on X.

I thoroughly enjoyed discussing the future of technology and innovation with David McGarry of the Taxpayer Protection Alliance. Our conversation was based on my recent report.

5. Pass Texas School Choice the Right Way

The Texas House is promoting HB2 and HB3 as a package deal for education reform. However, as I argue in my new commentary, this so-called “Texas Two-Step” is a misstep. Check it out to find out why.

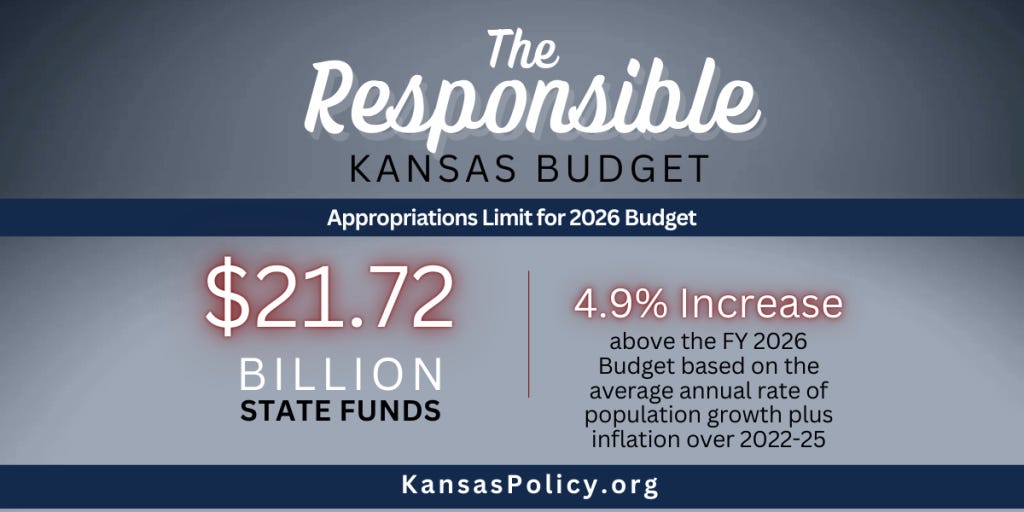

6. Tackling State Spending

Kansas' spending problem threatens its financial future. I urge lawmakers to address the problem head-on with a responsible budget at the Kansas Policy Institute.

Michigan has a similar opportunity to learn from states that have embraced sustainable budgeting and secured a stronger, more prosperous future. See my latest piece at the Mackinac Center for Public Policy for more information.

What I’m Learning

Federal Newswire: James Broughel offers a clear explanation of how regulatory audits can be an effective tool.

Forbes: Patrick Gleason’s thoughtful piece on the formation of state DOGEs across the country—an opportunity to address government spending issues.

RealClear Policy: The evidence speaks for itself: “States that embrace low taxes, minimize burdensome regulation, and foster individual freedom create environments where people and businesses thrive.”

Kite and Key: Why do politicians intentionally raise prices? Check out this great video!

Americans for Tax Reform: Don’t buy the myths about the Tax Cuts and Jobs Act. Let’s make these tax cuts permanent to let people prosper!

Economic Policy Innovation Center: An insightful paper on why it’s time to eliminate energy tax credits from the Inflation Reduction Act.

Texas Public Policy Foundation: A compelling video exploring the rising property taxes and escalating educational costs in Texas.

International Liberty: Dan Mitchell examines the real track record of pro-natalist policies and why they often fail.

Otherwise Objectionable: A new podcast from the Competitive Enterprise Institute delves into the misunderstood Section 230.

Books I’m Reading:

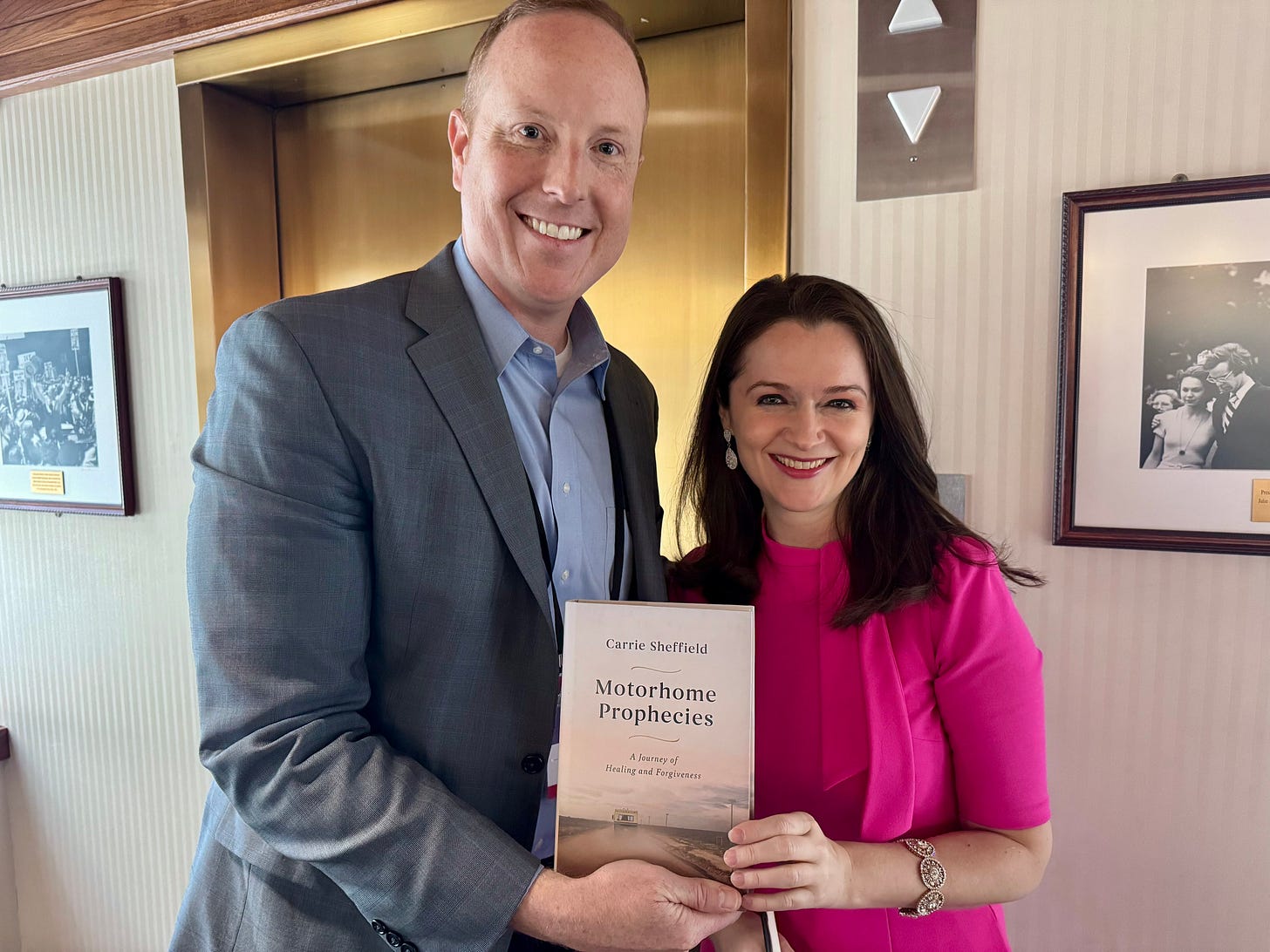

This week, I had the pleasure of meeting Carrie Sheffield, author of Motorhome Prophecies, at the Freedom Conservatism conference in DC. I’m currently reading her powerful memoir, which recounts her experience growing up as the daughter of a violent, mentally ill father who believed he was a modern-day Mormon prophet. Carrie shares her inspiring journey to healing and redemption. She will be a guest on my forthcoming Let People Prosper Show episode. Don’t miss it!

Let People Prosper Show Podcast

The Let People Prosper Show features deep discussions on hot topics:

Episode 133 (Thursday):

Education should empower parents and students, not protect bureaucratic systems. I sit down with Jenny Clark, founder of Love Your School, to discuss education savings accounts (ESAs), universal school choice, and the fight for parental rights. We discuss the good, bad, and the ugly of school choice programs across the country.

Episode 134 (Next Thursday):

Don’t miss next week’s episode with Grover Norquist, president of Americans for Tax Reform, as we explore tax reform at both the federal and state levels, the importance of sustainable budgeting, and why tariffs harm American businesses and consumers.Did you miss This Week’s Economy episode 100?

Quote of the Week

Bible Verse of the Week

Thanks for aiding my mission in promoting economic freedom and prosperity. I hope this edition of Prosperity Pulse keeps you informed, inspired, and ready for the week ahead. Please subscribe and share this newsletter with your family and friends.

Keep reading with a 7-day free trial

Subscribe to Let People Prosper to keep reading this post and get 7 days of free access to the full post archives.