Which States are Leading the Way? with Patrick Gleason | This Week's Economy Ep. 106

Let's unpack state legislative sessions with ATR's Patrick Gleason.

Hello Friends!

Significant policy changes could impact their economies as state legislative sessions wrap up. But how do states compare?

During this special episode of This Week’s Economy, I’m joined by Americans for Tax Reform’s Patrick Gleason to review the substantial tax, spending, and regulatory policies passed or discussed by states this year. These policies will significantly affect states' economic health, and those with the best policies will become more attractive as they foster more opportunity and growth.

You can catch the full episode on YouTube, Apple Podcast, or Spotify, and visit my website for more information.

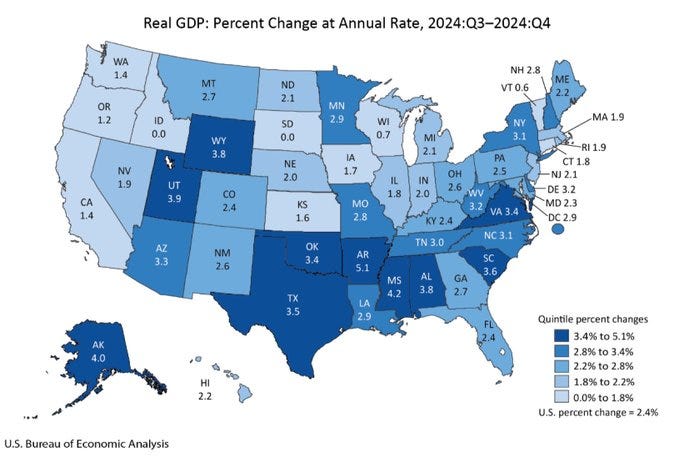

According to the latest BEA data on state GDP, southern states continue to lead the way in economic growth. Many of these states have implemented tax and regulatory reforms that help businesses and families thrive.

Migration patterns are another important data point to consider as people and businesses move to more economically favorable locations. States like California, New York, Illinois, Massachusetts, and New Jersey are experiencing the largest outflows of residents. One reason is the top personal income tax (PIT) rate.

1. REDUCING STATE SPENDING SPREES

In the News:

Kansas has an opportunity to pass a 2026 Responsible Budget as state appropriations have far outpaced population growth plus inflation since 2005, costing taxpayers an extra $56 billion over the past two decades. Over in Texas, the Senate unanimously passed a record-high $336 billion budget, a $71 billion increase (27%) from four years ago. We also see Iowa trying to increase its budget too fast. Sources: Kansas Policy Institute, KVUE ABC, and Iowans for Tax Relief

Our Take:

State Spending Problem: The real issue in most states is overspending, not under-taxation. Empirical research underscores the importance of spending restraint, as reducing government spending fosters better economic growth. As the great economist Milton Friedman frequently noted in some fashion, "The real problem is government spending." One of the easiest places to start with spending cuts is inefficiencies and corporate welfare.

What is Sustainable Budgeting? True sustainable budgeting involves limiting state government spending to a maximum rate of population growth plus inflation. This ensures that government spending remains affordable for the average taxpayer’s ability to pay for it. Don’t miss this overview for every state on the Americans for Tax Reform’s Sustainable Budget Project site.

Why It Matters: Sustainable budgeting is crucial to providing long-term tax relief. States must control spending to reduce income and property taxes and encourage economic growth. Though this may be an uphill battle, it’s essential for preserving liberty and creating more opportunities for people to prosper.

Related: Americans for Tax Reform’s Grover Norquist and I recently discussed sustainable budgeting on an episode of Let People Prosper.

2. SLASHING PROPERTY TAXES

In the News:

In red states nationwide, a growing movement is pushing to cut or even eliminate property taxes drastically. States like Texas, Montana, Wyoming, Florida, Illinois, Kansas, Iowa, and Pennsylvania are actively working on plans to limit or even abolish property taxes. Sources: Newsweek

Our Take:

Unjust Taxes: Property taxes are inherently unfair, forcing homeowners to perpetually "rent" from the government. They function like unrealized capital gains and wealth taxes, paid annually, which makes it harder for families to build wealth or pass on a legacy.

Easing the Homeowner's Burden: Eliminating or reducing property taxes would significantly ease the financial strain on families already grappling with rising homeownership costs. This would free up more of a family’s budget, giving first-time homebuyers and those looking to move the opportunity to purchase their dream homes—once deemed unaffordable.

Advancing the Movement: States that cut property taxes will become more attractive destinations, drawing larger populations and stimulating economic growth. This success will serve as a powerful example to other states, encouraging them to consider the benefits of such tax reductions. States currently considering these cuts should prioritize moving legislation across the finish line to reap the full benefits of tax reform and foster long-term prosperity. But the most important thing is spending less locally and imposing strict spending limits on them.

Related: On the last episode of This Week’s Economy, I explained how property taxes make you a permanent renter from the government.

3. CUTTING INCOME TAX

In the News:

Another nationwide movement to cut taxes, this time targeting income taxes, is gaining momentum. Montana is considering reductions to its individual income tax rate, while Georgia is expected to offer another state income tax rebate and further lower its income tax rates. Meanwhile, Kansas has already passed a bill to reduce income tax rates, and South Carolina may put their income taxes on a path to zero soon. Sources: Associated Press, Kansas Reflector, Fox News,

Our Take:

Another Positive Movement: It’s encouraging to see states taking serious steps to cut income taxes for families. With many Americans struggling under rising inflation, tax cuts will put more money in people's pockets, a positive move that helps individuals thrive and build a legacy for future generations.

A Path to Prosperity: Lowering income taxes makes states more competitive and attractive to potential residents. We're witnessing a growing trend of people moving to states with lower tax rates for greater financial freedom.

Coupled with Spending Cuts: To maximize the effectiveness of tax cuts, governments must focus on reducing unnecessary spending. Spend less, eliminate taxes, and foster a thriving environment where everyone benefits!

Related: Patrick Gleason recently wrote an excellent piece in Forbes detailing how South Carolina went from lagging in tax cuts to emerging as a leader.

4. REGULATORY REFORMS

In the News:

States are overhauling how regulations are reviewed through DOGE-like agencies and increasing transparency in the rulemaking process. Several states have also examined new regulations across critical technology, healthcare, and energy sectors. North Carolina is also moving forward with discussions on passing the REINS Act. Sources: Newsweek, State of Oklahoma House of Representatives, Capitol Weekly, Center Square, and West Virginia Watch

Our Take:

Opportunities through Reforms: Streamlining regulations offers a pathway to economic mobility by removing barriers like excessive occupational licenses and restrictive labor laws, which limit job opportunities, especially for marginalized communities. Reducing these barriers and lowering taxes can help families achieve financial independence.

State DOGE Movement: It’s encouraging to see many states follow the federal example by establishing their own Department of Government Efficiency (DOGE) departments. This presents a key opportunity to downsize a government that is often too big, inefficient, and costly. These efforts can highlight expensive regulations that limit opportunities for businesses and families.

Eliminate Regulations and Bad Policies: State agencies should periodically review outdated or redundant regulations and remove those that don’t work or serve a clear purpose. Texas should kill SB 6, which creates new mandates on large electricity users—like data centers and AI firms—while propping up unreliable energy sources with supply-side subsidies. Texas should remove barriers and let the market lead on reliability and innovation.

Related: In a previous episode of This Week’s Economy, I discussed Texas and other states creating their own DOGE committees.

Thanks for joining me in this episode of "This Week's Economy." For more insights, visit vanceginn.com and get even greater value with a paid subscription to my Substack newsletter at vanceginn.substack.com.

God bless you, and let people prosper!

Keep reading with a 7-day free trial

Subscribe to Let People Prosper to keep reading this post and get 7 days of free access to the full post archives.