76. Free To Choose: Should have Chosen Economic Freedom to Avoid Recession

If there would have been more economic freedom and limited government, there would have been no reason for a recession nor high inflation. We must have that situation to let people prosper.

Hello Friend1,

I hope that you’ve had a terrific month of July. I’ve been busy this month with trips, TV interviews, conducting research, and spending time with family so haven’t posted in a couple of weeks. Thank you for reading, subscribing, and sharing. It’s an honor that you do so during your busy day. I have a lot to share based on the news that we are in a recession (even if President Biden and the progressive media don’t want to call it that yet) and what needs to be done to get us out of it.

I’ll also share ideas that I’ve had recently that will hopefully be of interest to you and provide more opportunities for conversation with me and others. Watch my latest interview on Fox Business by Neil Cavuto on the state of the economy.

I’m looking forward to speaking at the Young Americans for Liberty conference in Orlando, Florida this week.

We have a lot more to do to let people prosper, so let’s get to it!

BOOK TAKE

Today, July 31, would have been economist Milton Friedman’s 110th birthday. I’ve learned more from him since his death in 2006. He’s my favorite economist and philosopher primarily because of his ability to explain complex topics in a way most can understand and few could negate. But also the fact that few people did more to advance free markets and liberty in the last century than he did.

Given his birthday, I want to recommend that you read his book Free to Choose if you haven’t yet and watch his video series based on much of what’s in the book.

One of his key lessons about economics is that there are always tradeoffs in every decision in a world of scarcity. This supported a saying that he made famous: “There’s no such thing as a free lunch.”

Not only is there no such thing as a free lunch, but anything that is scarce isn’t free. More simply, nothing is free. We would be wise to remember this in our daily lives and from our demands for actions by the government. Ensuring that we have a principled foundation with this understanding provides essential assumptions in our analysis of human action, interaction, and public policies. Too often these days, populism, progressivism, and nationalism movements have the wrong solutions because they don’t have a principled foundation in liberty and free markets.

My guess is that most of us have similar foundations but we should teach others more before there are solutions for the government when the government is the problem.

Here’s an example:

Check out the book for yourself, as we need to learn from those like Friedman who noted how government failures are much more costly than any perceived market failure. Happy birthday, Friedman!

And someone else who you can learn a lot from is economist John B. Taylor who I recently interviewed and you can watch here:

HOT TAKE

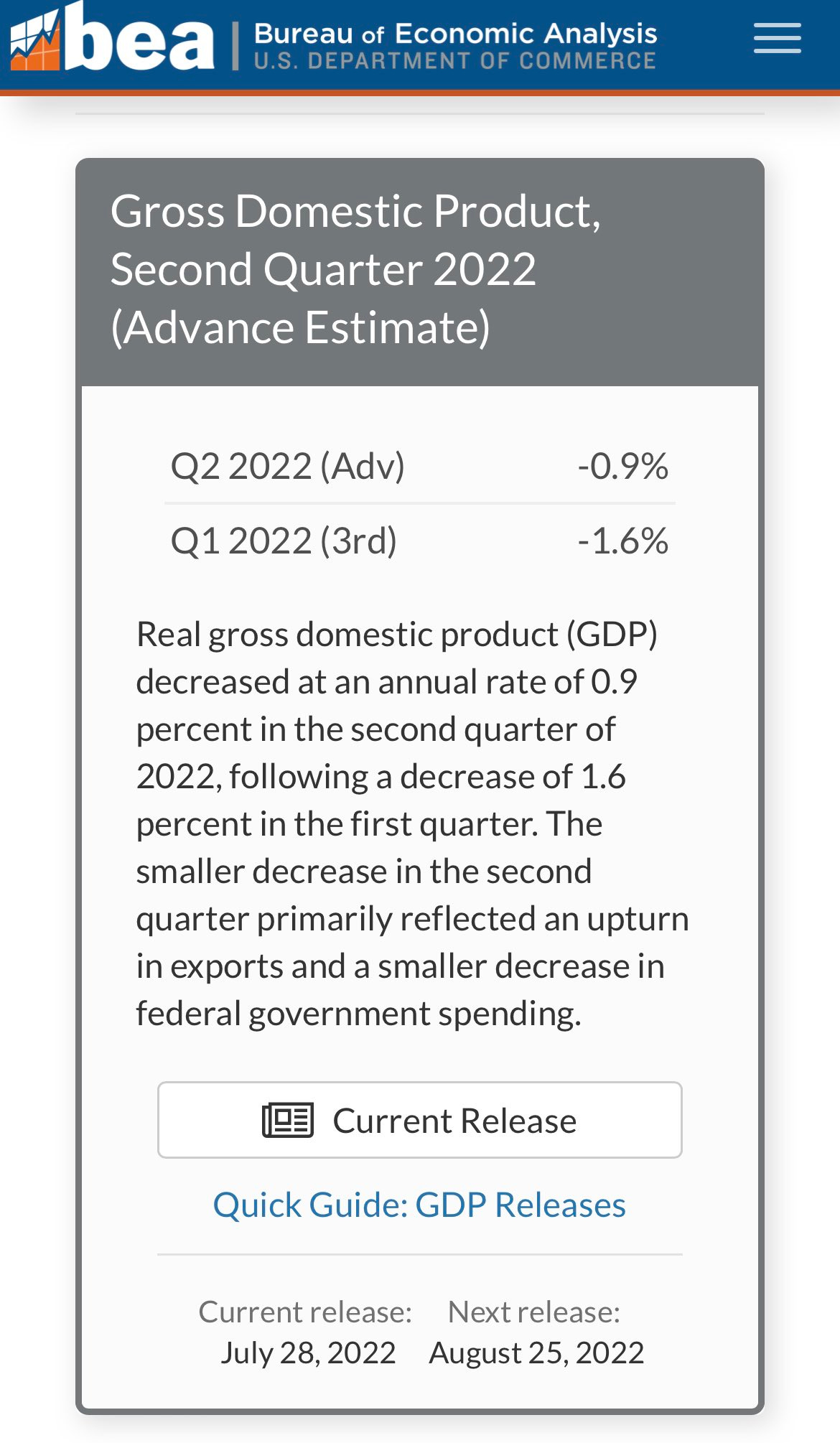

The U.S. economy is in a recession. I’ve been saying that this is where we were heading and that we were in one for a while.

I talked about this in a recent NTD News interview here:

This was an avoidable situation but was brought about because of bad policies. Here’s my take on it here:

Let me take you on a quick journey of how the economy, as noted as inflation-adjusted (real) gross domestic product (GDP), can be calculated.

The National Income and Product Account (NIPA) calculations provide an accounting identity for the Keynesian equation of GDP=C+I+G+NX.

y=C+I+G+NX

y: real GDP

C: consumption

I: investment

G: govt spending

NX: net exports

But G only redistributes, it doesn’t create. And I must be before C, as there is no consumption until after earning income through investing our time and resources.

Here is a way to think about this with the flow of funds.

But given that G is directly in the Keynesian equation and consumption and investment are in it while growth comes from savings and investment, the Keynesian calculation is flawed and not helpful other than providing a comparison over time.

Another equation to calculate real GDP is the equation of exchange.

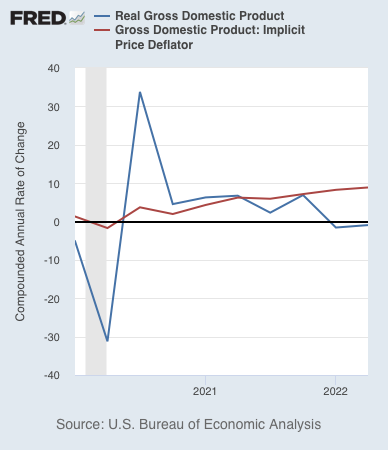

MV=Py is more helpful and notes why there was going to be and is persistent inflation and a recession.

y=M+V-P or P=M+V-y (percent changes)

M: money supply

V: velocity

P: prices

y: real GDP

The equation of exchange notes how too much money chasing too few goods is inflation!

This is the direct result of the Fed buying the government’s debt from excessive spending at a rapid pace, velocity declined and then stabilized, and then real GDP has been stifled by Biden’s regulations, Congress’ bad policies, and uncertainty in the tax code and regulations. This explains inflation and recession very well.

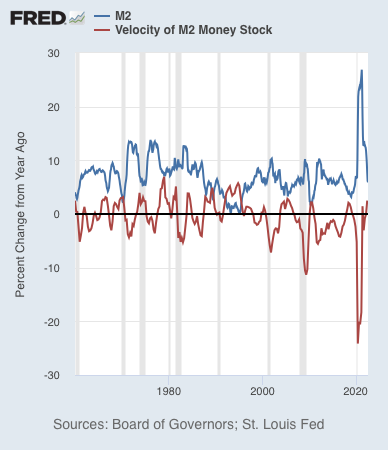

Here are charts to give you a better idea of how the equation of exchange looks over time and more recently. These are all in percent changes. One key measure of the money supply is M2. Increases in M2 typically move inversely to changes in the velocity of M2, which means that as the money supply increases people tend to want to use it at a slower rate and vice-versa. But that’s not always the case, like more recently.

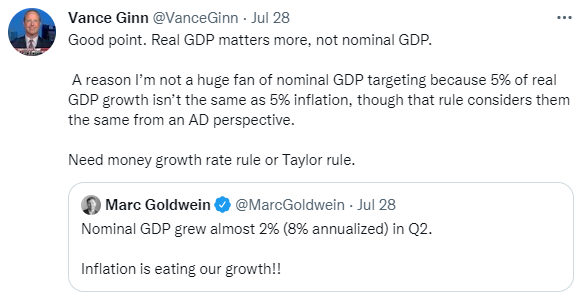

Given this analysis, I am in favor of a monetary rule (and fiscal rule). But I am less in favor of a nominal GDP rule, which would target some form of P*y, which means that nominal GDP could be all inflation (growth rate of P).

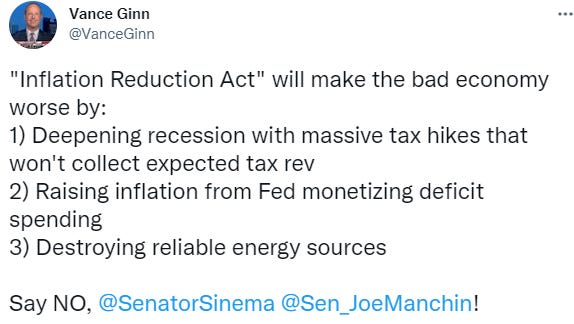

Some are arguing that the tax hikes in Congress’ latest “Inflation Reduction Act,” or what I’m calling the Inflation Raising Act, will reduce inflation. Jason Furman, a professor of the practice of economic policy at Harvard University and was chairman of the White House Council of Economic Advisers from 2013-17, noted in a recent WSJ article that the deficit reduction from raising taxes and spending on particular items, like healthcare, will reduce inflation.

While this makes some sense on the surface, as higher taxes should reduce demand and spending more on certain items could lead to lower prices somehow, but these are flawed assumptions. While there is some truth to these, I don’t follow the logic given the work by Alesina, Taylor, Romer, and others on how raising taxes is not a good option to close a deficit, especially during the current recession. It appears that some are falling victim to the arguments by the ideology of Modern Monetary Theory or a version of Keynesianism from an activist approach.

In my view, this Inflation Raising Act will not lower inflation or boost economic output because of the massive tax hikes and massive redistribution through government spending, as noted recently by the Penn-Wharton Budget Model.

Here are the key talking points for us to kill this bad bill to save America.

The only way to really control inflation is through monetary policy (quantitative tightening) as that’s where inflation is from (quantitative easing), see analysis above. While the other policies (pro-growth spending, taxing, and regulating relief) may slow the growth of some prices it doesn’t slow inflation. Of course, slowing the growth or cutting government spending would be ideal as it would reduce the deficit and give the Fed less opportunity to monetize it and excessively expand the money supply thereby creating higher inflation.

My view comes from a combination of Austrian and Chicago schools (with Public Choice and New Institutional schools) whereby I don’t think fiscal policy stimulates anything except more government and distorts the economy so government spending should only fund limited government and taxes should only fund enough to balance the budget, no social engineering. If that happened, the free market would thrive and people would prosper more. Maybe a pipe dream these days but that’s my foundation as tradeoffs and incentives are the starting point in evaluating policy.

Politically, it seems irresponsible for Sen. Joe Manchin (D-WV) to support the IRA given the green energy nonsensical spending in this bill as it will hurt the fossil fuel industry in his state when West Virginia is already losing jobs. Say no!

And the Joint Committee on Taxation finds that the IRA bill would raise taxes for everyone making over $30,000 per year, which is contrary to his promise not to raise taxes on those making less than $400,000 per year.

Inflation is soaring, as you’ve likely seen price increases at the grocery store, gas stations, rental places, and more. Here is my recent TV interview on the details of inflation as the consumer price index (CPI) inflation is up 9.1% y/y while the Fed’s preferred gauge of inflation is the personal consumption expenditures (PCE) price index which is up 6.8% y/y.

And Mark Perry at AEI recently updated his fantastic chart of price changes of key goods and services compared with overall inflation and average hourly wages since January 2020.

My quick take is that those items with more government intervention are those in red as their prices have increased faster than inflation. Those in blue are those with less government intervention and thus lower prices than inflation.

Some may argue that those items above inflation in red need government intervention. I don’t make the assumption that government is necessary for those markets as those are policy choices that are made. There’s no reason to believe the market won’t internalize those costs as necessary though it could take longer but be of higher quality and more affordable soon. I don’t agree that those items must have higher prices because the government doesn’t need to intervene. But it’s not just the regs for the “common good” that raises the price but also the regs on health insurance, the subsidies for Medicare and Medicaid, and other government interventions in the health care market not based on safety that drive up the price of health care because it’s not based on market prices but regulated prices that make it less affordable and lower quality for everyone than otherwise.

Similar outcomes in education and the other markets in the chart that have higher price increases than inflation compared with the ones below it. While there are many underlying factors, there is no legit reason that those goods and services above general inflation should have price increases that high if at all given a more unhampered market like those goods and services below general inflation. In other words, government intervention has burdened the marketplace by distorting prices and therefore innovation and productivity without a sound profit-loss mechanism from what would otherwise be lower without subsidies, taxes, and regulations in those markets. If they did, there would be lower prices in those markets, better quality goods and services, and better outcomes for things like healthcare, and general inflation would be lower had those prices been lower.

My research, education, and experiences provide my assumption that government failures from its intervening lead to worse outcomes than market failures (real or perceived as most are perceived market failures from government failures) so the market should be left alone with the government sticking to a limited approach as outlined in the U.S. Constitution of national defense to provide some order and safety, justice system to uphold contracts and adjudicate disputes, and few other public goods, like safety nets for the those who aren’t capable of working. Doing so would mean much less government spending, less taxing, and less regulation, so that civil society could help those in need and have more jobs and opportunities for people to prosper which would result in more resources to help each other, protect the environment, pay for quality healthcare services out of pocket, and get the quality education one desires at an affordable price. This is best done in an economic system of capitalism that we’ve had in the past but has been closer to socialism for many decades as government intervenes in the commanding heights of the economy and our daily lives.

Let’s hope that the classical liberal view will prevail soon! I’m not going to hold my breath though because too many people believe the government is the solution, God, angels, the father of the household, and more when it is really none of those things and is based more on winning votes and power and control. But I’ve gotta dream and keep learning and educating others.

TAKE ON ECONOMIES & POLICIES IN STATES

There is a need to lower property tax bills in Texas until they’re eliminated.

4-year universities should return to their start as a place of education.

Need a Responsible Austin Budget based on a pop+inf spending limit.

State and local governments must remove barriers to lower costs of living.

Kendall Cotton at Frontier Institute is doing big things! Glad to help with this.

Economic freedom is essential to let people prosper.

The Texas Model is great but there’s always room for improvement.

Recipe for more ways to let people prosper in Texas and beyond.

Government schools aren’t public schools.

TAKE ON ECONOMIES & POLICIES IN U.S.

Gas prices are down some but we’re still feeling the brunt of bad policies.

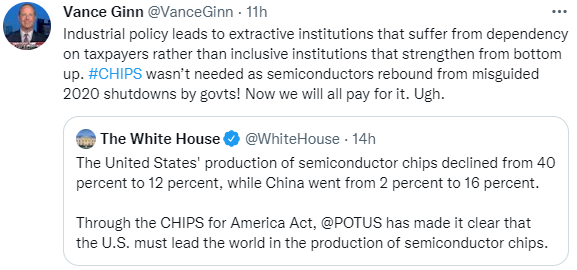

Congress, unfortunately, passed CHIPS Act, simply bad corporate welfare.

Nice piece in the WSJ on key ideas to slay inflation and boost economy.

This recession was avoidable if there had been a free-market-oriented approach.

We need a spending limit at the federal level ASAP.

Personal saving rate is dropping like its hot…tough situation for families.

Path forward to reduce depth and length of recession & solve inflation.

Don’t miss this co-authored piece on the dire economic situation.

Another reason the CHIPS Act wasn’t needed and we can’t afford it.

PERSONAL TAKE

We’re living our dreams in the Ginn house. Things have ups and downs but God is always good. Our baby girl will be four months old this week. Time flies! But that smile gets me every time.

RECOMMENDATION TAKE

Let me start by recommending the Economic Forces newsletter on Substack. I find it insightful regarding price theory and economic-related issues. Here’s is the About section: “Thanks for checking out Economic Forces, a weekly newsletter by Brian Albrecht and Josh Hendrickson. We are both professors of economics with a passion for we call “price theory,” a particular approach to economics that used to be taught at places like UCLA and Chicago. This newsletter is our attempt to work through and clarify points in price theory.”

Check it out for yourself and consider subscribing. Please consider sharing my newsletter in your newsletter and I’ll share yours—a mutually beneficial exchange.

CLOSING TAKE

For his birthday, here’s one of my favorite quotes of his on the roles of government.

I’m praying that we will never give up because God has our back every time.

Thank you for reading and sharing this newsletter. Many blessings to you and yours!

Why Let People Prosper: We believe an inclusive institutional framework with individual liberty, intact families, robust civil society, competitive capitalism, and a constitutional republic best supports abundant opportunities to mitigate poverty and let people prosper. This prosperity isn’t just material but spiritual, psychological, social, etc. that satisfies human desires. Given this understanding and my experience and research as a free-market economist, I provide trusted views on economies and policies. Please subscribe & share.