26. Removing Obstacles to Prosperity: Eliminating Property Taxes

In this newsletter, I discuss the tribute to my late father, eliminating property taxes in Texas, rejecting federal funds to states, improving labor market in Texas, and more to let people prosper.

Hello Friend!

It was another fantastic week here. I hope it was a prosperous one for you. If you haven’t signed up for my complimentary newsletter yet, please subscribe and share with others.

My family received our (obligatory in Central Texas) bluebonnet family pictures today from our photographer. We’re all about making memories, and these pictures definitely capture our love and laughter, as noted in the one below. There’s never a dull moment with this crew, and we wouldn’t have it any other way!

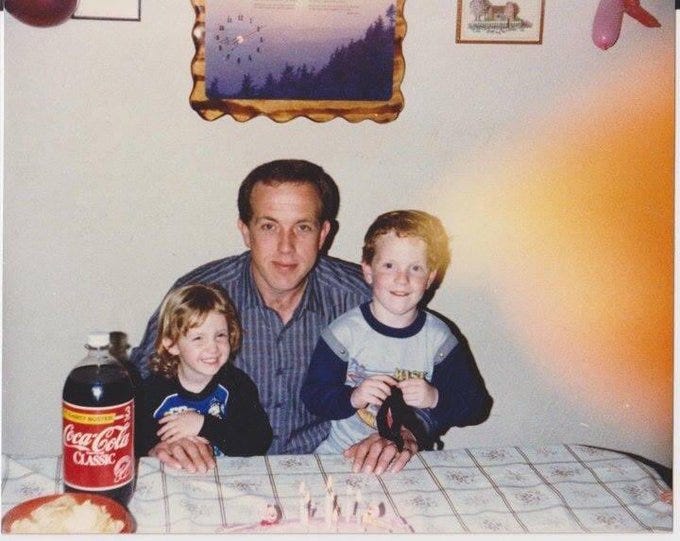

There was some sadness for me this week as I celebrated my dad, Harold Ginn, who passed away ten years ago on April 13, 2011, at the young age of 56 from SUDEP. He battled epilepsy for much of his life after a head injury from a wreck when he was in high school. I focused on his many lessons and memories during this trying week. Read my tribute to him that explains that day and his life’s ups and downs.

In other news, I’ll be presenting at this virtual, no-charge event by SMU’s Bridwell Institute. Register here.

Let’s get to the latest info to let people prosper!

TEXAS ECONOMIC AND FISCAL SITUATION

State-level Jobs Report Shows An Improving Texas Labor Market

My latest Ginn Economic Brief summarizes the report with key data on economic growth and job creation, and here’s more information.

Big News in Texas

Both Texas House and Senate versions of the state’s 2022-23 budget are looking good for taxpayers as they are both below TPPF’s Conservative Texas Budget, with the Texas House set to vote on theirs this Thursday. It would be great if there were tax cuts provided with the amounts below the CTB. Here is latest info:

My calculations exclude $6 billion in Texas Senate and House budgets as it goes to maintain last session’s property tax relief instead of growing government spending. And I exclude one-time federal funding for “COVID relief” efforts as these taxpayer funds shouldn’t go into the baseline budget thereby inflating the base for the next budget cycle and excessively growing government spending.

As I noted recently, there is good reason for Texas to reject all or at least some of these federal funds, and many Texans agree with rejecting these funds per the latest poll by WPA, with building a border wall and cutting taxes ranking high.

Texas Senate passed Sen. Hancock’s SB 1336 that would strengthen the state’s spending limit. I hope it will be heard soon in the House Appropriations Committee, which Approps Chair Rep. Bonnen is the sponsor of this bill, and then passed by the House. This would be a HUGE win this session.

Good piece here by TPPF’s newest economist EJ Antoni (great to have him onboard!) outlining problems with a recent “economic study” on the effects of the potential election law changes in Texas. In short, the study has major problems.

Testimony Before Texas Legislature

Testified for HB 59 by Rep. Murr to cut property taxes in half while improving the state’s fiscal system by restraining government spending and moving further toward a final sales and use tax. This could be a great opportunity for there to be some form of tax relief this session. Watch my full testimony starting at time 01:57:00 here.

Testified for SB 1138 by Sen. Hughes that would study safety net programs to provide more information about them, find ways to streamline them, and ultimately find better ways to use scarce taxpayer dollars to help those the program intends so they can quickly earn permanent self-sufficiency.

Testified for HB 701 by Rep. Walle that would streamline the recertification process for SNAP for those 60 & older or disabled without earned income. This is a good way to help the needy with currently appropriated taxpayer money instead of to bureaucracy.

U.S. ECONOMIC AND FISCAL SITUATION

Are Americans being paid to stay home with federally expanded UI? Yep. This may have been okay early in the pandemic, though shouldn't have locked down, but federal UI isn't necessary now with vaccines and improving the labor market, as noted by small businesses saying that they can’t find workers.

More than two dozen groups, including TPPF, joined a letter supporting the Maximizing America’s Prosperity (MAP) Act, which would set a limit on spending based on the growth in potential GDP. It’s not perfect as I’d rather it be based on pop+inf but it is certainly a step in the right direction as the status quo is fiscal insanity. I’ll release the Responsible American Budget soon!

More than 50 groups, including TPPF, sent a letter pushing back against President Biden and Congress who are trying to restrict tax relief by states.

TEXAS OPEN, NOW OPEN AMERICA

Here is a summary of the COVID-19 Situation in Texas as of 4/17/2021. More TX DSHS data here.

Here’s my latest piece on how lockdowns hurt kids’ future along with the effects that more severe shutdowns have had on their parents and thus the family.

Closing Thoughts

My prayers are focused on the following verse this week:

This quote by one of my favorite presidents hit home this week:

Thanks again for reading! Have a prosperous week! Many blessings to you and yours.

Vance Ginn, Ph.D. | www.vanceginn.com | #LetPeopleProsper