24. Rising Above Rhetoric

In this newsletter, I discuss how the Texas Budget looks so far, the fiscal insanity in D.C., Biden's lack of a budget, Texas's latest jobs report, update on COVID, & more to let people prosper.

Hello Friend!

My apologies for the delay in this post of my newsletter. I had a long, extended weekend helping my mom move to her new place in Deer Park, Texas, where I also visited with family and friends. I enjoyed the opportunity to see them, play the drums while my brother-in-law played the guitar, and catch up, but it is always good to be home with my wife and boys. We had a blessed Easter with a fantastic church service of worship, miracles, and preaching. I am thankful and blessed beyond belief in so many ways, but the most important to me is to know that Jesus Christ is risen!

I hope you enjoyed your Easter and holiday weekend as well. Those times of rest and self-awareness are essential to keep up our daily routines and live life to its fullest.

Speaking of living life to its fullest, I thought you would like my April Fools tweet:

And don’t miss this podcast episode with Garrett Ballengee of the Cardinal Institute in West Virginia about the Texas Model and more!

I’ve revised my newsletter some below by including fewer full tweet posts and instead included links to them if you’d like more information. This will help to shorten my posts and hopefully give you a better reading experience. Please continue to provide feedback along the way. Let’s now start discussing ways to let people prosper!

TEXAS ECONOMIC AND FISCAL SITUATION

Texas Jobs Report: My latest Ginn Economic Brief highlights Texas’s labor market in February that was reported recently. The jobs picture soured that month due to increased pandemic-related restrictions by Governor Abbott’s previous EO as COVID-19 hospitalizations had increased resulting in many businesses across Texas being forced to remain at only 50% capacity. In other words, the economy was running at only half speed and likely less given the tens of thousands of businesses that have closed from the less consumer demand and more government restrictions, so I expected there to be a decline in net jobs. The unemployment rate of 6.9% remains about twice what it was in February 2020 before the pandemic, and private sector employment is x jobs below where it was then.

Texas State Budget: The Texas Senate Finance Committee passed the Committee Substitute for Senate Bill 1 (CSSB1), which is their version of the state’s 2022-23 budget, last week. Their latest version was $500 million less than their initially released version to $250.7 billion. Given TPPF’s Conservative Texas Budget (CTB) that’s a maximum threshold of $246.8 billion based on growth in population plus inflation of 5% over the last two fiscal years, CSSB1 is $2.1 billion below the CTB after excluding $6 billion toward maintaining property tax relief from the last session that doesn’t go to grow government. In short, the Senate’s version remains below the CTB, and the Senate will likely pass it with a wide margin this week. The budget will then head to the House where they will substitute their own version, which the House’s initial version was also below the CTB so let’s hope that’s the case with their substitute.

ARPA Money to Texas: Given Texas should receive about $40 billion from Biden’s latest $1.9 trillion ARPA bill, the question is what to do with it. While there is a strong case for rejecting some if not all of it, there is also the potential to use it to build the rest of the border wall for about $5 billion, as noted by TPPF’s Executive Director Dr. Kevin Roberts on the Washington Journal. Out of the $40 billion, local governments could receive $10 billion, which there is a strong case that they should use for property tax cuts or the state legislature could force them to do so to avoid wasteful spending on other programs that will likely be ongoing expenses. Out of the $30 billion to the state, $12 billion could be dedicated for education, $4 billion for infrastructure projects like water, sewage, and broadband projects, and the other roughly $17 billion could be used for other purposes. Although we are waiting to hear from Treasury Secretary Yellen on what all the $17 billion can be used for, it looks like it can’t be used for direct or indirect tax relief or to fund pensions, though I would include it on the list for Texas to fund the unemployment insurance trust fund loans to the federal government, cutting or eliminating the business margins tax, building the border wall, paying down state debt with high-interest rates, and funding other post-employment benefits with reform and letting the courts determine whether Texas has its sovereignty to do these things…which I believe it does and should.

More Testimony Before Texas Legislature: I testified for a number of bills last week. See this thread for details. Two key ones were SB 1336 that will strengthen the state’s spending limit and HB 1886 that will require a study of the state’s safety net programs to find ways to streamline them and reduce their costs to taxpayers.

What Loving Your Neighbor Means: Don’t miss this excellent piece by Texas Rep. Tan Parker at TPPF’s commentary website thecannononline.com that highlights the need to require a regularly scheduled efficiency audit of TANF to ensure scarce taxpayer dollars help those temporarily needing assistance to earn permanent self-sufficiency.

Work with Other States: The great folks at the Tax Education Foundation in Iowa have recently established their Conservative Iowa Budget and making great strides as we recently noted here.

U.S. ECONOMIC AND FISCAL SITUATION

“Infrastructure” plan: It was bad enough that we had to deal with a $1.9 trillion “COVID relief” bill (ARPA) passed by Democrats in Congress and signed into law by President Biden that had only about 10% going to actual vaccines and their distribution along with other things directly related to COVID relief thereby pushing us further into debt for very little gain. But now we have to deal with President Biden pushing a so-called “infrastructure” plan that is scored at around $2.5 trillion over 8 years but is closer to $3-4 trillion over the normal 10-year window. It has only about 5% toward actual infrastructure projects of roads and bridges that would support growth.

This is a terrible trend for saying one thing but the actual bill being much different, but such is the ways of socialist, progressive policies. They can talk a good game but the reality is much, much different. And really this “infrastructure” plan is nothing more than a green energy boondoggle with massive tax hikes and other poor policies that will harm growth and job creation, which is why I called it the American Anti-Jobs Plan in my recent NTD News interview.

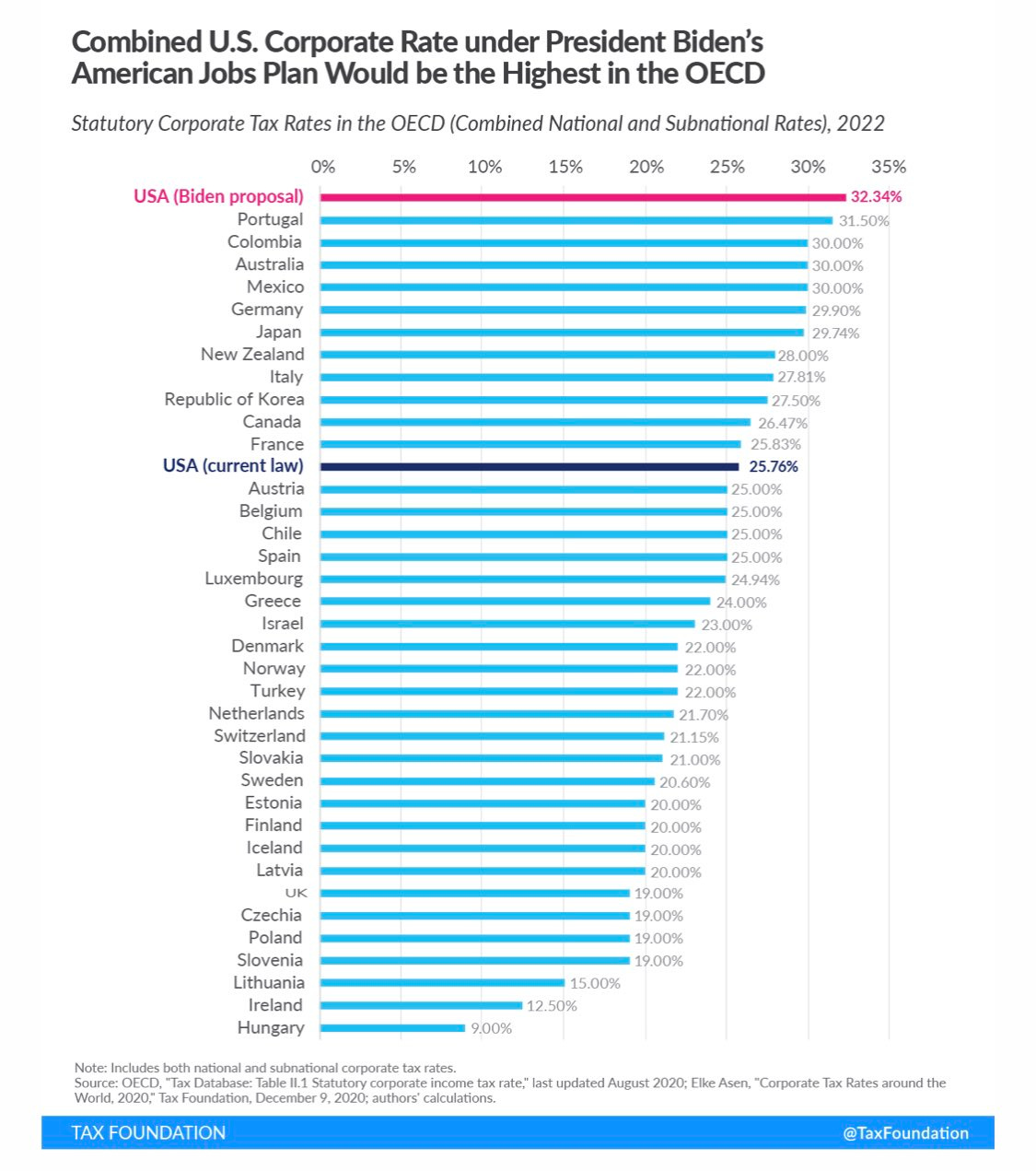

Making matters worse, Treasury Secretary Yellen is pushing for a minimum global corporate tax rate for multinational companies to essentially eliminate tax rate competition among developed countries as the Biden administration wants to raise the U.S. rate to 28%, which would bring the combined rate to the highest in the developed world.

Cutting the corporate income tax from 35% to 21% was one of the biggest achievements of the Trump presidency that resulted in huge gains to Americans and U.S. competitiveness. Raising this rate would be a mistake as it wouldn’t raise nearly as much tax receipts as Biden expects nor enough to cover his massive spending plans while hurting Americans through less purchasing power, lower wages, and fewer jobs, as the Tax Foundation notes there could be hundreds of thousands of job losses from raising it to 28%. We know that competition among state taxes works as many in New York are likely to start moving to Texas and elsewhere as they may soon have the highest personal income tax rate in the nation, so America must learn from these poor examples.

In fact, the best advice to President Biden and Congress is this: STOP SPENDING! We’ve got to get away from this idea that government can provide “stimulus” as the only thing it can stimulate is more government. The federal government has now authorized at least $6 trillion toward the pandemic. Compare that with the annual federal budget of $4.8 trillion, an economy of about $20 trillion, and how the $6 trillion is more than all countries except the U.S. and China, according to this ranking by IMF. More reason for the Responsible American Budget that I’ll release soon.

No Budget by President Biden: This would have been outrage by the media and the left during President Trump’s term, but President Biden has yet to release his budget, which is usually released in early February. Trump’s FY 21 budget, which I worked on during my time at the White House’s OMB and helped find $4.6 trillion in savings over a decade, was released late because of the COVID-19 pandemic, but there is silence about when Biden’s budget will be released. Will he release one? There’s some talk by Douglas Holtz-Eakin that it may include only discretionary spending. This is also much different than past budgets as they usually include a 10-year forecast of economic assumptions (which I worked on with my team at OMB) that determines the tax receipts forecast, expenditures, and deficits. Even with the $4.6 trillion in savings over a decade, the Trump budget still didn’t balance until after 15 years.

My guess is that given the Democrat bills during the pandemic under Trump and Biden and the additional bills that Biden is proposing that this fiscal path is substantially worse and one that the Biden administration doesn’t want to show. This is especially true given his socialist/progressive wishlist of expenditures that expand extractive institutions, slow economic growth, and further push the country toward bankruptcy. My guess is that the budget won’t balance for at least 20 years and the lost jobs, increased poverty, and expanded welfare state will mean that it could be much longer than that given what I’ve seen from past budgets.

Good U.S. Jobs Report for March: Here is my overview with more to come on this next week in my Ginn Economic Brief. There is no need for more spending by Congress and especially no tax hikes as Americans are starting to search for a job more. The key is for states to reopen, that is the best way to let people prosper now.

TEXAS OPEN, NOW OPEN AMERICA

Summary of COVID-19 Situation in Texas: TX DSHS Data Here

See my tweet with details along with Texas Governor Abbott’s overview here.

As of April 4, no Trauma Service Area (TSA) is on Texas Governor Abbott’s watch list, with the statewide rate of hospitalizations at 4.3%, ranging from 8.0% in TSA R (Galveston) to 0.1% in TSA K (San Angelo).

On March 10, 2021, Governor Abbott issued Executive Order GA-36, which ordered that on March 10 there are no longer restrictions on business operating capacity and no mask mandate. A county judge has the authority to restrict the business capacity of up to 50% only if the COVID-19 hospitalizations as a share of total hospital capacity in that TSA are above 15% for seven consecutive days, but cannot mandate wearing a mask.

EO GA-36 opening Texas is welcome news as the data have been showing substantial improvement in the COVID-19 situation, and freedom is the best way to deal with a pandemic while concentrating resources where they’re needed most without blanket restrictions that have hurt lives & livelihoods.

The next policy step is promoting and passing pro-growth policies so employers can expand their business, workers can return to work, and families can regain prosperity experienced before the pandemic. TPPF’s Responsible Recovery Agenda would help achieve this through less spending, taxing, and regulating.

Closing Thoughts

Let us focus on these Godly words this week as we celebrated Easter:

And finally, here’s a quote from one of my favorite economists Ludwig von Mises along with three key questions that we should be examining:

Thanks again for reading! If you haven’t signed up for my newsletter yet, please subscribe here at no charge and share with others. Many blessings to you and yours.

Vance Ginn, Ph.D. | www.vanceginn.com | #LetPeopleProsper