31. Special Edition: Responsible American Budget--Bringing Fiscal Sanity to DC (Updated)

In this newsletter, I highlight my latest research on the federal budget that constructs the Responsible American Budget to provide a tangible maximum goal for the budget to better let people prosper.

Hello Friend!

Thanks again for reading! If you haven’t signed up for my newsletter yet, please subscribe here and share with others. My motto: Free-market capitalism best lets people prosper!

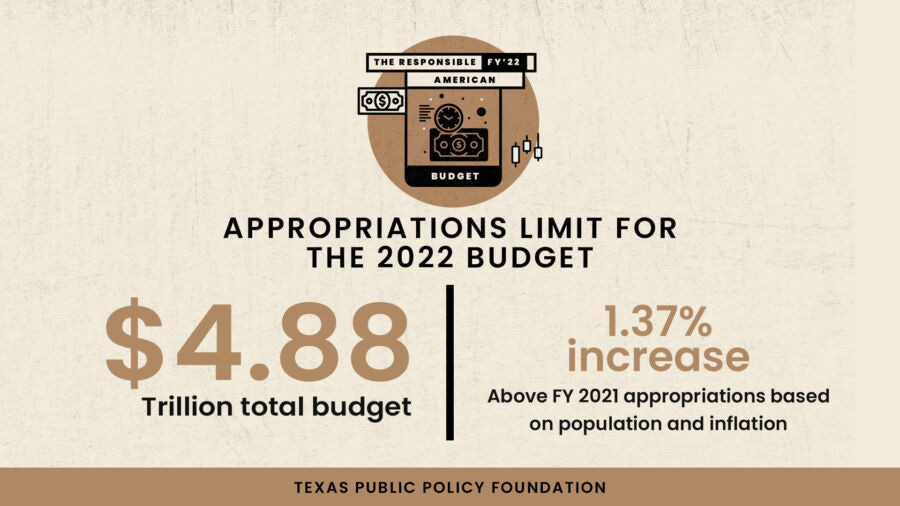

Let me introduce you to my latest research of the Responsible American Budget (RAB) that promotes a fiscal rule for limiting federal spending. This rule sets a maximum threshold on the federal budget so that spending is less than the average taxpayer’s ability to pay for it, as measured by population growth plus inflation, thereby helping get us closer to an institutional framework that best supports prosperity.

By using this approach, I provide a tangible maximum threshold that finally gives fiscal hawks like myself something to advocate for and be able to hold Congress and the president accountable. It’s an uphill battle to achieve the Responsible American Budget, but if not us, who? If not now, when? Let us start now!

During my time as the associate director for economic policy (essentially the chief economist) at the White House’s Office of Management and Budget during the Trump administration, I worked with our fantastic team that proposed nearly $5 trillion in savings over a decade in the president’s FY21 budget that would have helped balance the U.S. government’s budget in 15 years (Office of Management and Budget, 2020a). But Congress did not follow our proposals or the prior budgets of the Trump administration, which proposed historic savings each year because of no desire to rein in spending, disagreements on policy choices, lack of political will, or some combination of these.

Then the COVID‑19 pandemic happened, contributing to Congress passing legislation that led to appropriations outside of the normal federal budget process of more than $6 trillion over a decade during the Trump and Biden administrations. While some of these appropriations may have been necessary, they clearly made the fiscal path substantially worse.

Given past spending excesses by both political parties and the concerns about the future of our nation, we need a strong fiscal rule to tout as Americans while working toward a new law that helps to correct the lack of responsibility by our federal government. We will consider which fiscal rules tend to work best in other countries and in our system of federalism, which provides a laboratory of competition among states to support improvements of the institutional framework of governance.

While the optimal outcome would be a new law that limits federal spending based on the growth in population growth plus inflation, there may not be the political will to do so in the immediate future.

However, there is an opportunity for Americans to have a voice in the budget process by having a tangible maximum threshold for the federal budget. Armed with the same approach that has been helpful to the success of limiting spending in Texas through the Foundation’s Conservative Texas Budget, we can provide fiscal sanity in D.C. through what is called the Responsible American Budget.

Congress should consider doing what has worked well in other countries and in states like Texas and promote its own spending limit based on pop+inf each year—a maximum budget threshold referenced in this paper as the Responsible American Budget. Considering that high taxes and debt are always and everywhere a government spending phenomenon, this proposal is a valuable step toward limiting the footprint of government, allowing Americans more opportunities to flourish.

The time is now to restore fiscal responsibility in D.C. by using the RAB so that we benefit from an improved fiscal situation to better let people prosper. Unfortunately, the Biden administration looks to be heading the budget down a worse path, which would exceed $6 trillion or more than $1 trillion more than the RAB thereby further exacerbating the problems of excessive government spending and high deficits.

Here’s what many policymakers (e.g., U.S. Senator Mike Braun, U.S. Representative Chip Roy, Texas Representative Matt Schaefer, Texas Representative Tan Parker, The Honorable Jim DeMint), economists (e.g., Art Laffer, John Merrifield, Steve Moore, Jonathan Williams, Alex Salter, Orphe Divounguy), and thought leaders (e.g., Grover Norquist, Genevieve Collins, Matthew Dickerson, Bethany Marcum, Kendall Cotton, John Hendrickson, Manfred Wendt) are saying about the benefits of the RAB.

And reining in spending with the Responsible American Budget approach doesn’t mean that I’m not in favor of cutting the budget, which I am, but rather we must start to bend the cost curve of government with this maximum threshold (not a target) so that we can cut government spending and the intervention of government in our lives.

I’m thankful for this next step in my research process to finally attack the federal budget, which is in dire shape. Please let me know if you’d like to join in on this effort so I can add you to the coalition. Thank you for reading this special edition of the Let People Prosper newsletter and sharing it with your network. Many blessings to you and yours.

Vance Ginn, Ph.D. | www.vanceginn.com | #LetPeopleProsper