30. Texas Legislative Session: Most Conservative Ever?

In this newsletter, I highlight how Texas could have a conservative session, the need for fiscal rules, the failures of Bidenomics, the improving COVID situation, and more ways to let people prosper.

Hello Friend!

Thanks again for reading! If you haven’t signed up for my newsletter yet, please subscribe here and share with others. My motto: Free-market capitalism best lets people prosper!

My family had a great time this past weekend at the Austin Aquarium, where we were almost swallowed by a great white shark!

I had the pleasure of co-authoring my first (of many to come) amicus brief with my TPPF colleagues that will hopefully help to fight back against the use of wasteful calculations of the social cost of carbon and their supposed costly implications.

The final days of the Texas Legislative Session are here. It’s a pleasure and an honor to be able to work with my TPPF colleagues to help preserve liberty and prosperity in Texas. And it’s also a pleasure to work alongside so many great members, staff, and others at the Texas Capitol and around the Austin area. The relational interactions with people here are refreshing compared with the transactional interactions people in D.C. This could end as a very conservative session.

These issues and more related to the economic and fiscal situations in Texas and D.C. along with more positive news about COVID-19 in Texas (and America) are highlighted below in the bullet points with more information at the links provided.

TEXAS ECONOMIC AND FISCAL SITUATION

Big News in Texas

The Texas jobs report for April indicates a slowing of positive job creation with only 1,700 jobs added in the private sector. Sound fiscal policy with spending restraint & tax relief is essential this session as the economy is open now & federal bonus payments soon end.

More people are leaving high tax, high spend blue states for lower tax, lower spend red states like Texas.

Texas Governor Greg Abbott recently noted that he will call the Legislature back this fall in a special session to deal with (at least) redistricting and determination of whether and how to allocate the ARPA funds sent by Congress. Here’s my thread on what that means and how it should (or should not) be allocated.

It was great to join the Alaska Policy Forum to discuss the need for a strong fiscal rule to limit government spending to less than pop+inf in their Responsible Alaska Budget to help let people prosper. Watch the discussion here.

Here’s one of the best overviews of the Texas blackout that I’ve read so far.

Testimony & Key Legislation Before the Texas Legislature

Scheduled to be on the House floor on May 25: SB 1336 would strengthen the state’s spending limit. This would be one of—if not the—biggest wins this session. Good piece supporting strong fiscal rules by Patrick Gleason at ATR.

Should be on the Senate floor soon: HB 1516 would provide an independent efficiency audit of TANF and it passed the House and moves over to the Senate.

Should be on the Senate floor soon: HB 1869 would add non-voter-approved debt under the election trigger for raising property taxes. Hopefully, it will be improved in the Senate, but this is a good bill for more taxpayer protection.

Should be on the Senate floor soon: HB 4242 would extend tax breaks for big businesses in Chapter 313 at the expense of property taxpayers statewide for two years, but it hopefully die as Chapter 313 will expire next year because these abatements fail basic math. Reminder: Crony corporatism is bad.

U.S. ECONOMIC AND FISCAL SITUATION

Tuesday: TPPF’s FY22 Responsible American Budget will be released.

The Republican Study Committee’s FY 22 budget has many great ideas!

Govt failure is tragic. Inflation and income inequality are created by only one thing: Government policy. Problems are made worse by increasing govt action to “do something” when govt should do nothing and roll back ongoing poor policies.

CBO’s analysis of President Biden’s spending plans shows they’re a disaster for America.

My co-authored commentary notes how Bidenomics fails basic economics and hurts those most who it is supposed to help. Let’s hope it changes soon…though I’m not holding my breath…are you?

All subsidies and tax breaks for energy companies at every level of government should end, including saying no to Biden’s “green bank.”

Americans on unemployment benefits remain 8X higher than pre-pandemic. With 8.1M job openings & many red states ending the new federal unemployment bonus while still offering state unemployment payments, the total should decline quickly as people return to work.

The huge cost of shutdowns: Economic well-being fell sharply for people without a high-school degree in 2020, while rising for more-educated groups.

Raising the child tax credit and providing it in monthly amounts is a bad move, especially without eliminating other safety net programs.

Should “common good” conservatism be the path forward? In my view, it seems too paternalistic which isn’t the path toward more liberty and prosperity.

Bidenomics is already failing us, in many ways and could get worse soon.

TEXAS OPEN, NOW OPEN AMERICA…

Here is a summary of the latest in the COVID-19 situation in Texas as of 5/23/2021. Given the evidence of the situation and questionable results of mandates and restrictions by governments at every level, it’s good that the state ended its restrictions on March 10, 2021 (two months ago) but it’s time to end all restrictions. More on TX DSHS data here. Here’s how different deaths compare across the U.S. in 2020.

A new study confirms that reopening Texas "100 percent" had no discernible impact on COVID-19 cases or deaths.

Closing Thoughts

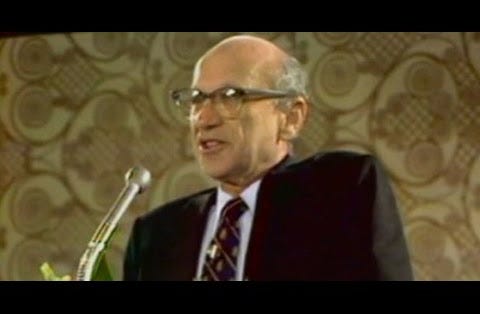

Here’s one of the best speeches that I’ve heard and it’s by Milton Friedman:

My prayers this week are focused on the following verse:

Thank you for reading this newsletter and sharing it with your network. I pray that we do not let things of this world separate us from the love of Christ. Many blessings to you and yours.

Vance Ginn, Ph.D. | www.vanceginn.com | #LetPeopleProsper