How Will the "One Big Beautiful Bill" Affect You? | This Week's Economy Ep. 120

My take on the bill’s impact, tariff fallout, AI panic, and what’s next in Texas policy.

Hello Friends!

My family recently returned to Texas after a week-long vacation in Colorado. It was heartbreaking to come home to news of the deadly flooding in Kerrville, which took so many lives. While our area was spared, the grief and devastation in nearby communities are deeply felt. My prayers are with the families who are mourning and those beginning the hard work of rebuilding.

Policy usually slows down in the summer, but this year is different. From the passage of the One Big Beautiful Bill to new tariff developments and a special legislative session starting in Texas next week, there’s a lot to catch up on.

In this week’s episode, I break it all down. You can watch the whole conversation on YouTube, Apple Podcast, or Spotify, and visit my website for more information.

1. OBBB Aftermath

In the News:

President Trump has signed the One Big Beautiful Bill (OBBB) after it passed the House just ahead of the Independence Day deadline. The bill extends key provisions of the 2017 Tax Cuts and Jobs Act. While it trims spending growth in programs like Medicaid and SNAP, it significantly increases funding for border security, defense, and energy production, adding trillions to the federal deficit. Source: CBS News

My Take:

An Honest Look: Let’s be clear—the One Big Beautiful Bill is good, but not great like what would be expected from a Republican trifecta. Yes, it makes much of the pro-growth 2017 tax cuts permanent. And yes, there are a few worthwhile reforms, such as permanent full expensing and closing certain Medicaid eligibility loopholes. But that alone doesn’t make the bill “beautiful”—and certainly not big in the way we need.

Bigger Government, Not Better Policy: The OBBB barely dents our spending crisis. What we got instead is a Frankenstein’s monster of populist giveaways, short-term tax tweaks, and fiscal illusions. It expands government from both ends: more military and border spending for the Right, more tax credits and special-interest carveouts for the Left. According to EPIC’s latest budget scorecard, we’re still running nearly $2 trillion annual deficits. That’s not a win—it’s a warning sign.

A Tax Code That Lifts Everyone: The fact that this was the best we got under GOP control should alarm anyone who cares about limited government. Republicans need to recall what made the original TCJA effective: lower, broad-based rates, full expensing, and a pro-growth agenda. Instead of drifting toward populism with tariffs, tax loopholes, and expanded “entitlements,” we should be pursuing real fiscal reform—less spending, real spending caps, a broader tax base focused on consumption, and renewed trust in markets and families over bureaucrats.

Related: Read my in-depth breakdown of the bill in a recent Substack post.

2. Tariffs and Market Health

In the News:

Treasury Secretary Scott Bessent announced that the U.S. will revert to steep, country-specific tariff rates in early August as the current pause expires. Following President Trump’s announcement of new tariffs on countries such as Japan, South Korea, and South Africa, the stock market suffered a decline. Sources: NBC News and CNN

My Take:

Tariffs Are Taxes: Congress—not the executive branch— should hold the power to levy taxes. These Trump-imposed tariff hikes are sowing economic uncertainty, and there’s no indication the administration plans to stop raising them without congressional intervention. If this continues unchecked, the fallout could rival or exceed the damage done by the Smoot-Hawley Tariff Act of 1930.

Uncertainty Has Consequences: This kind of instability wrecks confidence, delays investment, and rattles markets. We’ve seen it time and again—from trade and taxes to tariffs and public health. Governing by chaos is no way to run an economy.

We Need Direction: Leaders like Argentina’s Javier Milei are showing what’s possible: cutting government and restoring faith in free markets. Here in the U.S., we have the tools—what’s missing is the political will. America doesn’t need economic nationalism with hidden taxes. It needs a clear vision rooted in liberty, sound policy, stability, open markets, and limited government.

Related: Don’t miss my recent newsletter breaking down common misconceptions about tariffs and the tax cuts in the OBBB.

3. Upcoming Texas Special Session

In the News:

A special session of the Texas Legislature is set to begin on July 21st. Governor Abbott has released the final agenda, which includes items such as banning taxpayer-funded lobbying, providing property tax relief, imposing local spending limits, and others. Source: Office of the Texas Governor

My Take:

A Second Chance—to Do Good or Harm: While another opportunity to address these issues is welcome, there’s real concern that the Legislature could double down on the wrong priorities. That’s why we shouldn’t get too excited when a special session is called—because too often, it becomes a vehicle for making things worse, not better.

The Real Reason for the Session: This special session exists to address bills that the Governor vetoed. Abbott’s vetoes of SB 3 (a hemp product ban) and SB 974 (which would’ve allowed teachers to serve on appraisal boards—a clear conflict of interest) were the right calls. Both bills were textbook examples of government overreach driven by rent-seekers, rather than being grounded in sound economics or real policy needs. Limiting government overreach helps families, law enforcement, and local economies. It’s time to move beyond the outdated instinct to ban, punish, or control what isn’t understood.

Evaluating the Agenda: Now that Governor Abbott’s agenda is out, it’s clear that the session is likely to address real needs, such as local spending limits, a ban on taxpayer-funded lobbying, and property tax relief. However, other issues, such as regulating hemp products, allocating more funds toward flood emergencies, and other items that expand government, are questionable at best, but mostly represent bad policies. They can meet for only 30 days, so let’s see what happens.

Related: I broke down the good, the bad, and the ugly from the last legislative session in Episode 114 of This Week’s Economy. Catch it here.

4. Will AI Take Your Job?

In the News:

Recent waves of corporate layoffs have reignited concerns about the impact of artificial intelligence (AI) on the labor market. Ford CEO Jim Farley predicted that AI could eventually halve the number of white-collar jobs in the U.S. He’s not alone—Anthropic CEO Dario Amodei similarly warned that AI could eliminate 50% of entry-level white-collar jobs in just a few years. Sources: Yahoo! News and Vox

My Take:

From Disruption to Innovation: AI anxiety is nothing new. An IMF study stated last year that 40% of global jobs are exposed to AI. But history shows we tend to adapt to disruption—and often turn it into progress. AI, which is essentially advanced computing, presents an opportunity not just to replace tasks but to rethink how we work and create value.

Pause State AI Regulation: An explosion of state-level AI bills threatens to fracture innovation and undermine U.S. competitiveness. Unfortunately, a proposed federal moratorium on new state AI laws didn’t make it into the final One Big Beautiful Bill. Congress should revisit this. We don’t need 50 sets of conflicting rules slowing down the digital economy with red tape and political theater.

Labor in the Age of AI: For workers, especially those in high-skilled or entry-level white-collar roles, this shift is a signal to evolve, not panic. We should encourage re-skilling, up-skilling, and exploring new career paths, rather than restrictive policies. Free markets thrive when individuals are free to innovate, adapt, and grow without government-imposed barriers.

Related: I previously wrote about the benefits of a federal pause on new state AI laws while it was still included in the OBBB.

5. Misleading American Job Gains Data

In the News:

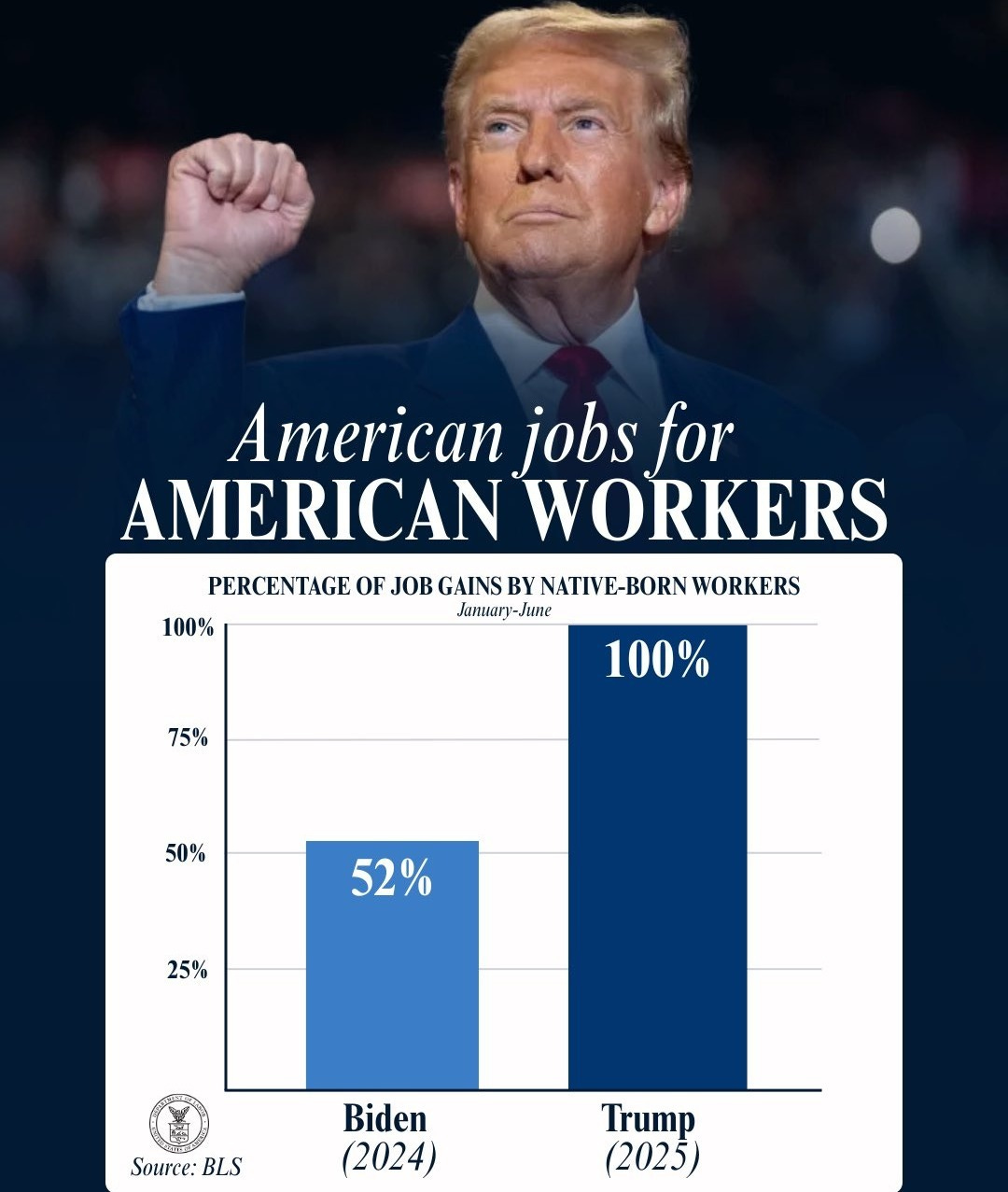

The Trump White House touted new figures from the Labor Department’s June jobs report that showed a significant shift in the workforce: the number of foreign-born workers fell by 348,000 from May and has dropped by more than 543,000 since January. In contrast, U.S.-born workers saw an increase of 830,000 in June alone, bringing the total gain since the start of the second Trump administration to over 2 million. Source: Fox News

My Take:

A Pointless Comparison: This is a misleading stat to celebrate. The vast majority of “foreign-born” workers are legal U.S. residents who were born in a country other than the United States. Surely the Trump administration knows this.

Immigration Makes Us Stronger: Why does the administration push these arguably xenophobic talking points? We should focus on getting work done, regardless of where someone was born. Smart immigration reform would help industries access the workers they need, easing labor shortages without putting extra strain on taxpayers.

A Better Path Forward: A market-based visa system could fix our broken immigration process. One idea: an auction model where employers bid for visas based on skills and economic need. This would help match willing workers with open jobs, ensuring meaningful contributions to our economy and reducing dependency on public resources.

Related: More on immigration reform in my piece for the TheWashington Times last year.

Thanks for joining me in this episode of "This Week's Economy." For more insights, visit vanceginn.com and get even greater value with a paid subscription to my Substack newsletter at vanceginn.substack.com.

God bless you, and let people prosper!

THANK YOU for being a paid subscriber!

Don’t miss this short video from the episode.

AI Innovation: Turning Disruption into Opportunity for You

Immiserate us with the deficits, year in year out. Everything else is tertiary.

Personally I am upset that not only was my marginal rate reduced but the deduction on SS income will also unfairly favor me. [The partial uncapping of SALT also favors me, but that just reduces the unfairness of 2017, taxing residents of some states more than others.]

The USG should not be borrowing to transfer income to people like me. Shame on every politician who voted for this monstrosity!